Bitcoin's (BTC) price has been trading above $22,500 for 12 days. Of course, this situation can change even if Federal Reserve chair Jerome Powell issues positive statements about the economy in today’s post-FOMC presser.

Even if the decision matches the market consensus, the post-meeting statement should be investors’ primary area of focus. Specific areas to focus on would be clues for the next meeting in March.

Troubling news for the largest stablecoin Tether (USDT) could also cause a meaningful impact after a Celsius konkursgransker rapport showed that “Tether’s exposure eventually grew to over $2 billion” in September 2021. However, it is unclear if iFinex — Tether’s issuer — suffered any losses. iFinex chief technology officer Paolo Ardoino denied exposure to Celsius and suggested that the examiner had “mixed up” prepositions in the report.

Is a strong correction in stock market ahead?

Legendary portfolio manager Michael Burry, known for being one of the most vocal critics of the subprime mortgage crisis from 2007 to 2008, posted a short note on Twitter on Feb. 1, suggesting that investors “sell.”

While the message lacks a supporting thesis, one could conclude that Burry expects a meaningful correction in traditional markets. Considering the 40-day correlation between Bitcoin and the S&P 500 index at 75%, the odds of a BTC price retrace become evident.

Consequently, this week’s Feb. 3, $1 billion BTC options expiry can go either way because bears can still flip the tables as the tide currently favors the bulls.

Bitcoin-bjørne blev fanget helt på vagt

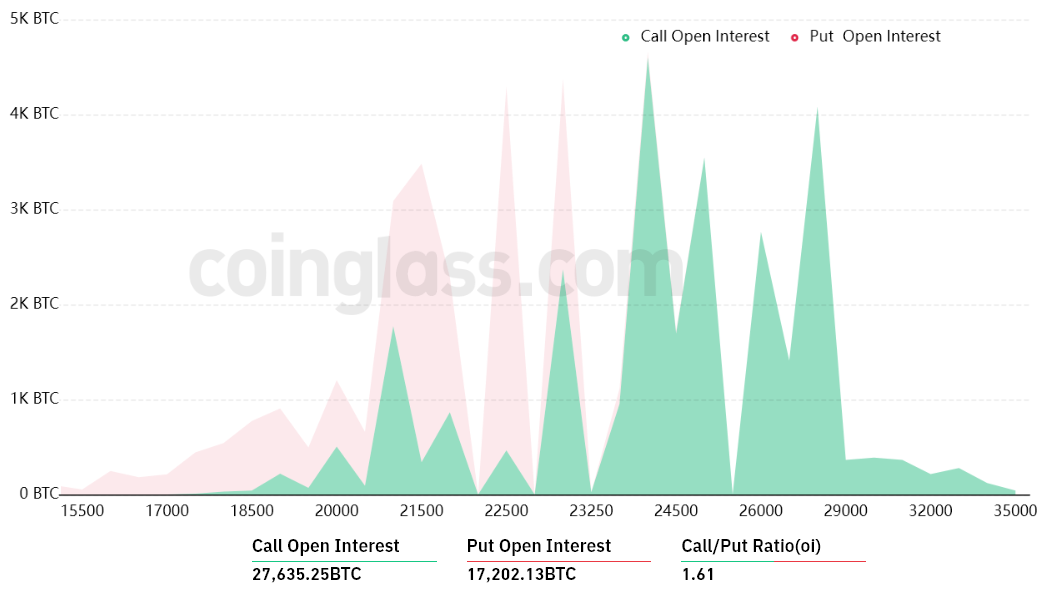

The open interest for the Feb. 3 options expiry is $1 billion, but the actual figure will be lower since bears were caught by surprise after the 9.6% rally between Jan. 20 and Jan. 21.

The 1.61 call-to-put ratio reflects the imbalance between the $640 million call (buy) open interest and the $400 million put (sell) options.

If Bitcoin price remains above $23,000 at 8:00 am UTC on Feb. 3, less than $7 million worth of these put (sell) options will be available. This difference occurs because the right to sell Bitcoin at $22,000 or $23,000 is useless if BTC trades above that level on expiry.

Relateret: Retail giant Pick n Pay to accept Bitcoin in 1,628 stores across South Africa

$23,000 Bitcoin ville give tyre en fortjeneste på $180 millioner

Below are the three most likely scenarios based on the current price action. The number of options contracts available on Feb.3 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Mellem $ 21,000 og $ 22,000: 2,700 opkald vs. 10,700 puts. Nettoresultatet favoriserer put-(bear)-instrumenterne med $165 millioner.

- Mellem $ 22,000 og $ 23,000: 4,400 opkald vs. 4,200 puts. Nettoresultatet er balanceret mellem call- og put-optioner.

- Mellem $ 23,000 og $ 24,000: 7,800 opkald vs. 100 puts. Nettoresultatet favoriserer opkaldsinstrumenterne med $180 millioner.

- Mellem $ 24,000 og $ 25,000: 12,400 opkald vs. 0 puts. Bulls udvider deres gevinster til $300 millioner.

Dette grove estimat tager højde for de call-optioner, der bruges i bullish-væddemål, og put-optionerne udelukkende i neutral-til-bearish handler. Alligevel ser denne oversimplificering bort fra mere komplekse investeringsstrategier.

For eksempel kunne en erhvervsdrivende have solgt en købsoption, og effektivt opnå negativ eksponering for Bitcoin over en bestemt pris, men desværre er der ingen nem måde at estimere denne effekt på.

In essence, Bitcoin bears need to push the price below $22,000 on Feb. 3 to flip the tables and secure a $165 million profit. But, for now, bulls are well positioned to profit from the BTC weekly options expiry and use the proceeds to further defend the $23,000 support.

De synspunkter, tanker og meninger, der udtrykkes her, er forfatterne alene og afspejler ikke nødvendigvis Cointelegraphs synspunkter og meninger.

Denne artikel indeholder ikke investeringsrådgivning eller anbefalinger. Enhver investerings- og handelsbevægelse indebærer risiko, og læsere bør foretage deres egen forskning, når de træffer en beslutning.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- Platoblokkæde. Web3 Metaverse Intelligence. Viden forstærket. Adgang her.

- Kilde: https://cointelegraph.com/news/bitcoin-bulls-plan-to-flip-23k-to-support-by-aiming-to-win-this-week-s-1b-options-expiry

- $ 1 milliarder

- $ 400 Million

- 000

- 1

- 10

- 100

- 2021

- 7

- 9

- a

- Om

- over

- Acceptere

- tværs

- Handling

- rådgivning

- Efter

- forude

- sigter

- alene

- ,

- Ardoino

- OMRÅDE

- områder

- artikel

- til rådighed

- Konkurs

- baseret

- Husk

- Bears

- fordi

- bliver

- være

- jf. nedenstående

- Væddemål

- mellem

- Billion

- Bitcoin

- Bitcoin bjørne

- bitcoin tyre

- Bitcoin Price

- BTC

- btc pris

- tyr

- Bullish

- Bulls

- købe

- ringe

- Opkald

- fanget

- Årsag

- Celsius

- Formand

- lave om

- chef

- Chief Technology Officer

- Cointelegraph

- komplekse

- konkluderer

- Adfærd

- Konsensus

- Overvejer

- anser

- kontrakter

- Korrelation

- kunne

- Kursus

- krise

- Kritikere

- rå

- Nuværende

- For øjeblikket

- Dage

- beslutning

- Afhængigt

- forskel

- hver

- økonomi

- effekt

- effektivt

- enten

- helt

- Essensen

- skøn

- Endog

- til sidst

- Hver

- eksaminator

- eksempel

- udelukkende

- forventer

- udløbet

- Eksponering

- udtrykt

- udvide

- favoriserer

- Federal

- Federal Reserve

- Figur

- Flip

- Fokus

- fra

- yderligere

- vinder

- gevinster

- kæmpe

- Giv

- Go

- link.

- Men

- HTTPS

- ubalance

- KIMOs Succeshistorier

- in

- indeks

- instrumenter

- interesse

- investering

- Investorer

- Udsteder

- spørgsmål

- IT

- Jan

- jerome powell

- kendt

- største

- Niveau

- Sandsynlig

- tab

- Making

- leder

- Marts

- Marked

- Markeder

- meningsfuld

- møde

- besked

- Michael

- Michael burry

- million

- mere

- Pant

- mest

- bevæge sig

- nødvendigvis

- Behov

- negativ

- negativ eksponering

- netto

- nyheder

- næste

- nummer

- Odds

- Officer

- ONE

- åbent

- åben interesse

- Udtalelser

- Option

- Indstillinger

- egen

- Paul

- Betal

- pick

- Vælg N Pay

- fly

- plato

- Platon Data Intelligence

- PlatoData

- portefølje

- porteføljeforvalter

- positionerede

- positiv

- indsendt

- Powell

- pris

- PRIS ACTION

- primære

- udbytte

- Profit

- Skub ud

- sætte

- sætter

- rally

- forholdet

- læsere

- anbefalinger

- afspejler

- afspejler

- resterne

- indberette

- repræsentere

- forskning

- Reserve

- resultere

- Risiko

- S & P

- S & P 500

- scenarier

- sikker

- sælger

- sælge bitcoin

- september

- Kort

- bør

- side

- siden

- Situationen

- So

- solgt

- Kilde

- Syd

- specifikke

- stablecoin

- Statement

- udsagn

- Stadig

- bestand

- aktiemarkedet

- forhandler

- strategier

- stærk

- support

- Støtte

- overraskelse

- Teknologier

- Tether

- deres

- teoretisk

- denne uge

- tre

- Tide

- til

- nutidens

- erhvervsdrivende

- handler

- Trading

- traditionelle

- traditionelle markeder

- brug

- UTC

- visninger

- uge

- ugentlig

- vilje

- vinde

- værd

- ville

- ville give

- zephyrnet