Bitcoin and Ether dropped on Monday afternoon in Asia on the first trading day of May, after concerns about the U.S. banking system resurfaced following news of U.S. regulators approving the sale of First Republic Bank’s assets to JPMorgan. Most other top 10 non-stablecoin cryptocurrencies also fell, except Binance’s BNB, with Solana and Litecoin the biggest losers of the day. Most Asian equity markets were closed on Monday for the May 1 holiday.

Se relateret artikel: Weekly Market Wrap: Bitcoin flirter med US$30,000, Ether genvinder US$1,900

Crypto

Bitcoin faldt 2.2% til US$28,640 på 24 timer til klokken 4 i Hong Kong, ifølge CoinMarketCap data. The world’s largest cryptocurrency by market capitalization gained 4.37% in the last seven days, and rose as high as US$31,005 in the last month.

Ether lost 2.83% to US$1,850, but traded 0.34% higher on the week. The world’s second-biggest cryptocurrency rose as much as US$2,137 in the last one month.

Solana’s SOL was the day’s biggest loser, dropping 4.72% in 24 hours to US$22.33. Litecoin lost 3.42% to US$87.59 – the second-biggest loser in 24 hours – although it gained 0.5% on the week.

BNB, the native token of world’s largest crypto exchange Binance, was the only gainer, rising 3.71% to US$333, and strengthened 1.39% on the week. Binance on Monday introduceret Sui blockchain’s SUI token to its Launchpool, which allows Binance users to stake their BNB and TrueUSD (TUSD) to farm the recently launched SUI.

The total crypto market capitalization dropped 1.95% to US$1.18 trillion, while the total crypto market volume gained 66.78% to US$39.78 billion.

NFT

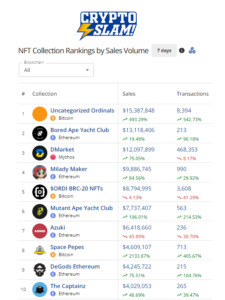

Forkast 500 NFT indekset faldt 0.04 % til 3,741.30 point på dagen og faldt 0.66 % på ugen. Indekset er et proxy-mål for ydeevnen på det globale NFT-marked og inkluderer 500 kvalificerede smarte kontrakter på en given dag. Det administreres af CryptoSlam, et søsterselskab til Forkast.News under Forkast Labs-paraplyen.

Bored Ape Yacht Club (BAYC), one of the biggest NFT collections by market capitalization, saw a surge in sales volume in the past 24 hours, jumping 6.24% to US$832,882 million, after dropping 59.41% in the last seven days, according to CryptoSlam data.

Aktier

U.S. stock futures traded mixed on Monday at 5:45 p.m. in Hong Kong. The S&P 500 Futures inched up 0.01%, the Dow Jones Industrial Average gained 0.03% and the tech-heavy Nasdaq Composite Index dropped 0.02%.

Many Asian equity markets were closed on Monday. Japan’s Nikkei 225 gained 0.92% and ended Monday on a 8.5-month high, driven by strong Japanese corporate earnings reports and a weak yen. The country’s forbrugertillidsindeks increased to 35.4 in April from 33.9 in March, the highest since January 2022, according to Tradingeconomics.

Global banking industry concerns resurfaced with nyheder of JPMorgan Chase acquiring most assets of First Republic Bank in a deal arranged by the U.S. Federal Deposit Insurance Corporation, a government agency for deposit insurance supply to depositors in American commercial and savings banks. The share price of U.S.-based First Republic Bank plunged 43.20% on Friday after the lender rapporteret a 40.8% drop in deposits, or around US$100 billion, since the start of the year.

The banking sector has now witnessed three major failures including Silicon Valley Bank , Signaturbank that were also taken over by the FDIC.

The U.S. Federal Reserve’s next move on interest rates is on May 3. Over the past year, the central bank has consistently raised rates to bring inflation down to its target range of 2%. U.S. interest rates are currently between 4.75% to 5%, the highest since June 2006.

“It is highly anticipated that the Fed may hike the interest rates by 25 basis points,” said Dhruvil Shah, vice-president of technology at Liminal, a wallet infrastructure and custody solutions platform. This will increase interest rates to around 5% to 5.25%, a level not seen since 2007.

Den Europæiske Centralbank er efter sigende expected to increase interest rates on Thursday but analysts are divided on the quantum of the hike.

Se relateret artikel: Coinbase siger, at SECs juridiske trusler straffer gennemsigtighed og underminerer den offentlige notering

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoAiStream. Web3 Data Intelligence. Viden forstærket. Adgang her.

- Udmøntning af fremtiden med Adryenn Ashley. Adgang her.

- Kilde: https://forkast.news/bitcoin-ether-fall-amid-banking-sector-concern/

- :har

- :er

- :ikke

- ][s

- $OP

- 000

- 1

- 10

- 2%

- 2022

- 24

- 30

- 500

- 66

- 7

- 8

- 9

- 95 %

- a

- Om

- Ifølge

- erhverve

- Efter

- agentur

- tillader

- også

- Skønt

- amerikansk

- Midt

- Analytikere

- ,

- Forventet

- ABE

- april

- ER

- omkring

- anbragt

- artikel

- AS

- asia

- asiatisk

- asiatiske aktiemarkeder

- Aktiver

- At

- gennemsnit

- Bank

- Bank

- bankindustri

- banksektoren

- banksystem

- Banker

- grundlag

- bayc

- mellem

- Største

- Billion

- binance

- Bitcoin

- bnb

- bringe

- men

- by

- kapitalisering

- central

- Centralbank

- chase

- lukket

- klub

- CNN

- CO

- Mønter

- samlinger

- kommerciel

- selskab

- Bekymringer

- tillid

- kontrakter

- Corporate

- VIRKSOMHED

- lands

- krypto

- Kryptomønter

- krypto udveksling

- Crypto Exchange Binance

- Crypto Market

- volumen på kryptomarkedet

- cryptocurrencies

- cryptocurrency

- cryptos

- CryptoSlam

- For øjeblikket

- Custody

- data

- dag

- Dage

- deal

- depositum

- INDSIKRINGSFORSIKRING

- indskydere

- indskud

- digital

- Divided

- dow

- Dow Jones

- Dow Jones Industrial Average

- ned

- drevet

- Drop

- droppet

- Dropper

- Indtjening

- berettiget

- egenkapital

- Aktiemarkeder

- Ether

- europæisk

- Europæiske Centralbank

- Undtagen

- udveksling

- forventet

- Fall

- gård

- tillid

- Fed

- Federal

- Federal Deposit Insurance Corporation

- Federal Reserve's

- Fornavn

- efter

- Til

- Forkast

- Fredag

- fra

- Futures

- given

- Global

- Regering

- graf

- Høj

- højere

- højeste

- stærkt

- Hike

- Ferie

- Hong

- Hong Kong

- HOURS

- HTTPS

- in

- omfatter

- Herunder

- Forøg

- øget

- indeks

- indekser

- industrielle

- industrien

- inflation

- Infrastruktur

- forsikring

- interesse

- Renter

- IT

- ITS

- januar

- Japans

- japansk

- jpg

- JPMorgan

- jpmorgan chase

- juni

- Kong

- Labs

- største

- Største krypto

- Efternavn

- lanceret

- Politikker

- långiver

- Niveau

- notering

- Litecoin

- Tabere

- tabte

- større

- lykkedes

- Marts

- Marked

- Markedsbogstaver

- markedsomslag

- Markeder

- max-bredde

- Kan..

- måle

- foranstaltninger

- million

- blandet

- Mandag

- Måned

- mest

- bevæge sig

- meget

- Nasdaq

- indfødte

- Indfødt token

- nyheder

- næste

- NFT

- NFT -samlinger

- nft marked

- ikke-stabil mønt

- nu

- of

- on

- ONE

- kun

- or

- Andet

- i løbet af

- forbi

- ydeevne

- perron

- plato

- Platon Data Intelligence

- PlatoData

- kastet

- punkter

- pris

- proxy

- offentlige

- offentlig notering

- Quantum

- hævet

- rækkevidde

- priser

- for nylig

- Regulators

- relaterede

- fornyet

- Rapporter

- Republikken

- stigende

- ROSE

- s

- S & P

- S & P 500

- Said

- salg

- salg

- Omsætning

- Besparelser

- siger

- sektor

- set

- syv

- Del

- siden

- søster

- Smart

- Smarte kontrakter

- SOL

- Solana

- Løsninger

- spil

- starte

- bestand

- stærk

- sui

- forsyne

- bølge

- systemet

- Tablet

- mål

- Teknologier

- at

- Fed

- deres

- de

- denne

- trusler

- tre

- til

- token

- top

- Top 10

- I alt

- handles

- Trading

- Gennemsigtighed

- trillion

- trueusd

- TUSD

- os

- paraply

- under

- Underminere

- brugere

- Dal

- via

- bind

- tegnebog

- var

- uge

- var

- som

- mens

- vilje

- med

- vidne

- Verdens

- wrap

- Yacht

- Yacht Club

- år

- Yen

- zephyrnet