On-chain information reveals the Bitcoin funding charge remains to be at a comparatively excessive optimistic worth, suggesting that the crypto would possibly see extra decline within the close to time period.

Bitcoin-finansieringsraten har været på en positiv værdi i løbet af de sidste par dage

Som identificeret af en analytiker i en CryptoQuant indlæg, the present funding charge means that the value is in a brand new decline proper now.

Den "finansieringsrate” is an indicator that measures the periodic price that merchants within the Bitcoin futures market should pay one another.

When the worth of this metric is above zero, it means lengthy merchants are presently paying a premium to the brief merchants to maintain their positions. Such values point out {that a} bullish sentiment is extra dominant available in the market in the meanwhile.

Relateret læsning | On-Chain Data: Bitcoin Whales med 10k+ BTC er vokset

On the opposite hand, detrimental values of the indicator indicate the bulk sentiment is bearish proper now as shorts are paying longs presently.

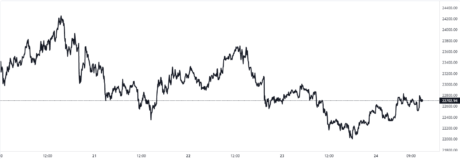

Now, here’s a chart that reveals the pattern within the Bitcoin funding charges during the last six months:

The worth of the metric appears to have been optimistic up to now week | Source: kryptokvant

As you’ll be able to see within the above graph, each time the Bitcoin funding charge has reached a comparatively excessive optimistic worth throughout the previous couple of months, the value of the crypto has usually noticed a decline not too lengthy after. Similarly, detrimental spikes have resulted within the worth of BTC seeing some uptrend.

Here’s what’s happening right here: excessive optimistic values imply longs are piling up available in the market. So, a major sufficient sudden decline can liquidate quite a lot of these, which might find yourself driving the value additional down, and thus liquidating much more lengthy positions. Such an occasion the place liquidations cascade collectively is named a “presse” (or on this case, an extended squeeze).

Relateret læsning | Bitcoin NUPL viser gennemsnitlig indehaver tilbage i overskud, men hvor længe?

A number of days again, when the value of the crypto was above $23k, the funding charge once more made a optimistic peak and the value subsequently went down. However, the present worth of the indicator nonetheless appears to be like to be fairly optimistic, which can imply the decline remains to be ongoing.

BTC-pris

På tidspunktet for skrivning, Bitcoins pris flyder rundt om $22.7k, en stigning på 6 % inden for de sidste syv dage. I løbet af den foregående måned er kryptoen steget 8% i værdi.

Under -diagrammet viser mønsteret inden for møntens værdi i løbet af de sidste 5 dage.

Looks like the worth of the crypto has been sliding down over the previous couple of days | Source: BTCUSD på TradingView

Udvalgt billede fra Brent Jones på Unsplash.com, diagrammer fra TradingView.com, CryptoQuant.com

- Bitcoin

- Bitcoin-upload

- blockchain

- overholdelse af blockchain

- blockchain konference

- coinbase

- coingenius

- Konsensus

- kryptokonference

- krypto minedrift

- cryptocurrency

- decentral

- Defi

- Digitale aktiver

- ethereum

- Seneste nyt om kryptovaluta

- machine learning

- ikke fungibelt symbol

- plato

- platon ai

- Platon Data Intelligence

- PlatoData

- platogaming

- Polygon

- bevis for indsatsen

- W3

- zephyrnet