The New Zealand dollar has had a busy week, which is not surprising given the turmoil which has gripped the markets. NZD/USD has extended its losses on Thursday and is trading at 0.6162, down 0.40%.

New Zealand GDP declines

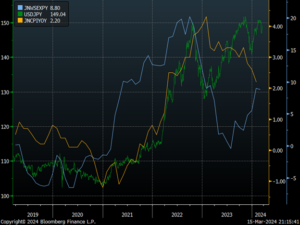

The markets were braced for a soft GDP report for Q4, but the decline was sharper than expected. GDP slowed to 2.2% y/y, down from 6.4% in Q3 and shy of the estimate of 3.3%. On a monthly basis, GDP fell 0.6%, following a gain of 2.0% in Q3 and shy of the estimate of -0.2%. The Reserve Bank of New Zealand had projected 0.7% growth, and the miss could mean the central bank will ease up on the pace of rate hikes.

The economy is showing weakness across the board, including manufacturing, consumer spending and trade. The RBNZ had projected that the economy would tip into a recession in the second quarter of 2023, but the contraction in Q4 may signal that the economy is already in recession. The forecast for Q1 of 2023 is gloomy, exacerbated by the severe flooding in January and February.

Given this bleak backdrop, the central bank may have to back its tightening plans. The markets had priced in the RBNZ hiking the cash rate by another 75 basis points to 5.50% by the third quarter, but this has fallen to 5.10%. The RBNZ meets next on April 5 and the market is 50/50 on whether the next hike will be 25 or 50 basis points.

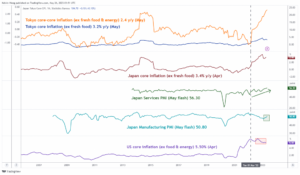

In the US, today’s data was a mixed bag. Unemployment claims fell to 192,000, down from 212,000 and lower than the forecast of 205,000. This points to a resilient US labour market, a key pillar of support for the Fed’s hawkish rate stance. Manufacturing has been struggling and the Philly Fed Manufacturing Index ticked higher to -23.2, compared to -24.3 prior and well below the forecast of 14.5 points. This release follows the Empire State Manufacturing Index, which tumbled to -24.6, down from -5.8 and below the forecast of -8.0 points.

.

NZD / USD Teknisk

- NZD/USD tester support ved 0.6149. Nedenfor er der support på 0.6071

- 0.6212 og 0.6290 er de næste modstandslinjer

Denne artikel er kun til generel information. Det er ikke investeringsrådgivning eller en løsning at købe eller sælge værdipapirer. Udtalelser er forfatterne; ikke nødvendigvis OANDA Corporation eller nogen af dets tilknyttede selskaber, datterselskaber, officerer eller direktører. Levereret handel er højrisiko og ikke egnet for alle. Du kan miste alle dine deponerede midler.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- Platoblokkæde. Web3 Metaverse Intelligence. Viden forstærket. Adgang her.

- Kilde: https://www.marketpulse.com/20230316/new-zealand-dollar-extends-losses-as-gdp-contracts/kfisher

- :er

- $OP

- 000

- 2%

- 2012

- 2023

- 75 basispoint

- 8

- a

- over

- tværs

- rådgivning

- søsterselskaber

- Alle

- Alpha

- allerede

- analyse

- analytiker

- ,

- En anden

- april

- ER

- artikel

- AS

- At

- forfatter

- forfattere

- tilbage

- bagtæppe

- taske

- Bank

- baseret

- grundlag

- BE

- jf. nedenstående

- board

- Boks

- bred

- købe

- by

- Kontanter

- central

- Centralbank

- fordringer

- KOM

- Råvarer

- sammenlignet

- forbruger

- sammentrækning

- kontrakter

- bidragsyder

- VIRKSOMHED

- kunne

- Dækker

- dagligt

- data

- Afvis

- deponeret

- direktører

- Dollar

- ned

- økonomi

- Empire

- Aktier

- skøn

- forventet

- erfarne

- Fallen

- februar

- Fed

- finansielle

- Finansielt marked

- Fokus

- efter

- følger

- Til

- Forecast

- forex

- fra

- fundamental

- fonde

- Gevinst

- BNP

- Generelt

- given

- Vækst

- Have

- høgeagtig

- Høj

- højere

- stærkt

- Hike

- Hikes

- HTTPS

- in

- Herunder

- indeks

- oplysninger

- investere

- investering

- israel

- IT

- ITS

- januar

- jpg

- Nøgle

- Arbejdskraft

- taber

- tab

- større

- Produktion

- Marked

- MarketPulse

- Markeder

- max-bredde

- opfylder

- blandet

- månedligt

- nødvendigvis

- Ny

- New Zealand

- næste

- NZD / USD

- of

- officerer

- on

- online

- Udtalelser

- Tempo

- Philly Fed Manufacturing Index

- Søjle

- planer

- plato

- Platon Data Intelligence

- PlatoData

- punkter

- Indlæg

- Forud

- fremskrevet

- publikationer

- offentliggjort

- formål

- Q1

- Q3

- Kvarter

- rækkevidde

- Sats

- renteforhøjelser

- RBNZ

- recession

- frigive

- indberette

- Reserve

- reservebank

- Reserve Bank of New Zealand

- elastisk

- Modstand

- Risiko

- Anden

- andet kvartal

- Værdipapirer

- søger

- Søger Alpha

- sælger

- flere

- svær

- deling

- Signal

- siden

- Soft

- løsninger

- udgifterne

- Tilstand

- Kæmper

- egnede

- support

- overraskende

- Test

- at

- Tredje

- stramning

- tip

- til

- nutidens

- handle

- Trading

- arbejdsløshed

- us

- Svaghed

- uge

- GODT

- hvorvidt

- som

- vilje

- med

- Arbejde

- ville

- Du

- Din

- Sjælland

- zephyrnet