Hash ribbons, an indicator with a proven track record of spotting opportunistic entry points for bitcoin, has flashed a buy signal suggesting now is a prime period to purchase the peer-to-peer currency.

Knowing when is the best time to make an investment is the desire of many but the accomplishment of few. Indeed, investment strategies such as dollar-cost averaging (DCA) have emerged to remove the guesswork from the equation and enable a more stress-free investing experience. Notwithstanding, many still look for opportunities to make a significant allocation that promises outsized returns. While there’s no single indication of when such a time is here, strategies exist to aid spotting these periods –– and, in the Bitcoin world, hash ribbons is one of them.

Hash bånd, publicly available on TradingView, is an indicator made up of two simple moving averages (SMAs) of bitcoin’s hash rate: the 30-day and the 60-day SMA. A downward cross of the short-term MA on the long-term MA marks the beginning of a capitulation period, whereas an upward cross spots its end. Buying bitcoin at the end of a miner capitulation period often produces outsized returns for investors as the worst is believed to be over and the market is beginning a recovery.

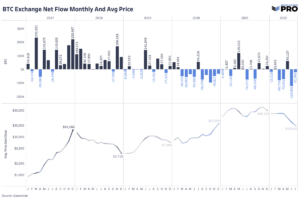

The hash ribbons indicator signaled “buy” on Friday as BTC dropped by more than 7%. Bitcoin is up over 4% since. (Bitcoin price chart/TradingView)

"Der er en god sandsynlighed for, at bunden er i," sagde Charles Edwards, opfinder af hashbånd og grundlægger af Capriole investeringer, a quantitative crypto fund whose objective is to outperform bitcoin. “Looking at Bitcoin, we have the strongest signal for a major accumulation zone possible: a hash ribbon buy, and the timing of this signal makes it even more valuable.”

Det seneste købssignal for hashbånd kommer i anden halvdel af denne halveringscyklus – den fireårige periode mellem halveringer. (Halveringen er den begivenhed, hvorigennem protokollen "halverer" blokbelønningen.) Edwards forklarer, at sent-cyklus hashbåndssignaler har været "de mest pålidelige og effektive i fortiden." Et hashbåndskøb betyder dog ikke, at prisen øjeblikkeligt stiger.

"Det er værd at bemærke, at 15% downdraw på et hashbåndssignal ikke ville være ud over det sædvanlige," tilføjede Edwards. "Timing bunde er aldrig let. Hovedformålet for os som investorer er at identificere regioner med høj sandsynlighed og handle på disse – uanset om de ender med at være den absolutte bund eller ej.”

"Vi tror, vi er i en af de højsandsynlige regioner i dag," sagde han.

In the previous Bitcoin bear market, following the 2017 blow-off top, hash ribbons flagged a buy opportunity as BTC was trading at around $3,600 on Jan. 10, 2019. Over the following year, bitcoin’s price increased by 127% to $8,200 after having scored returns of 233% in the first six months.

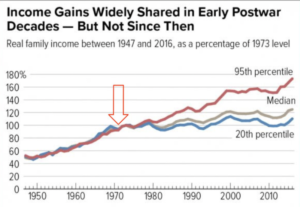

På trods af de attesterede tidligere afkast på at handle på hashbånds købssignaler, udgør den nuværende makroøkonomiske baggrund nogle udfordringer, da en bredere risiko-off-stemning fortsat er knyttet til de globale markeder. Men Edwards hævder, at der har været et modargument for at handle på indikatoren, hver gang den har blinket med et signal.

"Der har været seks 'live' hashbånd-signaler, siden strategien blev offentliggjort for tre år siden," sagde han. "Næsten alle har haft skepsis eller gode teoretiske modargumenter, der tyder på, at denne gang er anderledes, men indtil videre har ingen af disse modpunkter været gyldige."

The truth is that returns are never guaranteed, and investors themselves should decide whether and when to buy bitcoin according to their individual conditions. Furthermore, as highlighted by Edwards, the global high-inflation period the world is currently experiencing is “definitely” a good counterpoint to hash ribbons’ signal.

“Such periods only happen about every half century,” he said. “So it’s hard to assess how Bitcoin will behave and how such Bitcoin specific strategies will perform. No doubt there will be an impact.”

- Bitcoin

- Bitcoin Magazine

- Bitcoin Price

- blockchain

- overholdelse af blockchain

- blockchain konference

- coinbase

- coingenius

- Konsensus

- kryptokonference

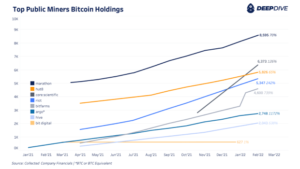

- krypto minedrift

- cryptocurrency

- Dca

- decentral

- Defi

- Digitale aktiver

- ethereum

- Feature

- hash rate

- Hash bånd

- machine learning

- Markeder

- ikke fungibelt symbol

- plato

- platon ai

- Platon Data Intelligence

- PlatoData

- platogaming

- Polygon

- bevis for indsatsen

- Signal

- W3

- zephyrnet