SEC og DOJ rejste begge anklager mod det kontroversielle kryptovalutaprojekt SafeMoon og relaterede personer den 1. november.

US Securities and Exchange Commission (SEC) påstod det the company and its members carried out a fraudulent scheme by selling the SafeMoon (SFM) cryptocurrency. The regulator also described SFM as a security asset in its claims today.

SEC navngav to virksomheder - SafeMoon LLC og SafeMoon US LLC - samt grundlægger Kyle Nagy, CEO John Karony og CTO Thomas Smith i sin klage.

Nagy fortalte angiveligt brugerne, at deres midler var sikkert låst, hvis de blev holdt i SafeMoons likviditetspulje og ikke kunne trækkes ud af nogen. SEC sagde dog, at "store dele" af midlerne i denne pulje i virkeligheden blev låst op.

The SEC said that SafeMoon and its individual members later withdrew more than $200 million of crypto from the project and “wiped out” billions of dollars of their cryptocurrency’s market cap. The defendants allegedly misappropriated investor funds for their own personal use and purchased luxury vehicles, travel, property, and more.

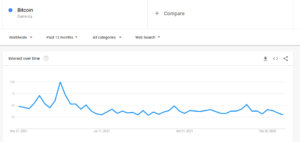

SEC bemærkede også, at SFM's pris "steg i vejret" med mere end 55,000 % i ugerne før den 20. april 2021, men faldt med 50 %, da detaljerne om de ulåste puljemidler blev tydelige. Efter dette hævder SEC, at Karony og Smith brugte uretmæssigt tilegnede aktiver til at hæve priserne og manipulere markedet, herunder gennem vaskehandel.

DOJ indgiver parallelle strafferetlige anklager

The U.S. Attorney’s Office for the Eastern District of New York — part of the Department of Justice (DOJ) — uforseglet parallel criminal charges against the three executives.

Kontoret hævdede, at Smith, Karony og Nagy begik svig med værdipapirer, sammensværgelse for at begå svig og hvidvaskning af penge. Den hævdede, at de tre personer løj om, hvorvidt puljemidler var låst, og uretmæssigt tilegnede sig millioner af dollars.

However, the Attorney’s Office described the SFM token as considerably more valuable during the relevant period. Whereas the SEC said that SFM reached a market cap above $5.7 billion, the Attorney’s Office said that SFM reached a market cap above $8 billion. The office also described how Binance’s BNB-token was used throughout the fraud.

IRS-agent Thomas M. Fattorusso udtalte, at på trods af den komplekse karakter af svindelsagen, "er slutresultatet enkelt - tyveri."

Attorney's Office tilføjede, at Karony og Smith begge er blevet anholdt i USA, mens Nagy fortsat er på fri fod. Alle er uskyldige, indtil det modsatte er bevist.

It does not appear that either case is related to a hack that occurred against SafeMoon in April 2023. Although that attack affected nearly $9 million of liquidity pool funds, the exploiter behind the incident returned most of the stolen funds.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoData.Network Vertical Generative Ai. Styrk dig selv. Adgang her.

- PlatoAiStream. Web3 intelligens. Viden forstærket. Adgang her.

- PlatoESG. Kulstof, CleanTech, Energi, Miljø, Solenergi, Affaldshåndtering. Adgang her.

- PlatoHealth. Bioteknologiske og kliniske forsøgs intelligens. Adgang her.

- Kilde: https://cryptoslate.com/safemoon-and-executives-charged-by-sec-doj-in-alleged-200m-fraud/

- :er

- :ikke

- $ 9 millioner

- 000

- 1

- 20

- 2021

- 7

- a

- Om

- over

- tilføjet

- påvirket

- Efter

- mod

- Agent

- Alle

- påståede

- angiveligt

- også

- Skønt

- ,

- nogen

- vises

- april

- ER

- anholdt

- AS

- aktiv

- Aktiver

- At

- angribe

- BE

- blev

- været

- bag

- Billion

- milliarder

- både

- men

- by

- kasket

- gennemføres

- tilfælde

- Boligtype

- Direktør

- opladet

- afgifter

- hævdede

- fordringer

- klar

- Kommissionen

- begå

- engageret

- Virksomheder

- selskab

- klage

- komplekse

- Conspiracy

- kontroversielle

- kunne

- Criminal

- krypto

- cryptocurrency

- CTO

- tiltalte

- Afdeling

- justitsministeriet

- Justitsministeriet (DoJ)

- beskrevet

- Trods

- detaljer

- distrikt

- gør

- DoJ

- dollars

- droppet

- i løbet af

- østlige

- enten

- ende

- udveksling

- ledere

- indgivet

- Filer

- Til

- grundlægger

- bedrageri

- svig

- svigagtig

- fra

- fonde

- skyldig

- hack

- Have

- Held

- Hvordan

- Men

- HTTPS

- if

- in

- hændelse

- Herunder

- individuel

- enkeltpersoner

- uskyldig

- investor

- investormidler

- IT

- ITS

- John

- John Karoni

- jpg

- Retfærdighed

- Kyle

- stor

- senere

- hvidvaskning

- Likviditet

- likviditetspulje

- LLC

- låst

- Luksus Boliger

- Marked

- Market Cap

- Medlemmer

- million

- millioner

- penge

- Hvidvaskning af penge

- mere

- mest

- Som hedder

- Natur

- næsten

- Ny

- New York

- bemærkede

- november

- forekom

- of

- Office

- on

- ud

- egen

- Parallel

- del

- periode

- personale

- plato

- Platon Data Intelligence

- PlatoData

- pool

- pris

- Priser

- Forud

- projekt

- ejendom

- gennemprøvet

- købt

- rejse

- nået

- Reality

- regulator

- relaterede

- relevant

- resterne

- resultere

- s

- sikkert

- Safemoon

- Said

- Ordningen

- SEK

- Værdipapirer

- Securities and Exchange Commission

- værdipapirsvig

- sikkerhed

- Salg

- erklærede

- Stater

- stjålet

- stjålne midler

- TAG

- end

- at

- deres

- de

- denne

- tre

- Gennem

- hele

- til

- i dag

- token

- fortalt

- Trading

- rejse

- to

- os

- U.S.A. ADVOKATS KONTOR

- amerikanske værdipapirer

- US Securities and Exchange Commission

- Forenet

- Forenede Stater

- ulåst

- indtil

- us

- brug

- anvendte

- brugere

- Værdifuld

- Køretøjer

- var

- vaskehandel

- uger

- GODT

- var

- ud fra følgende betragtninger

- hvorvidt

- mens

- Tråd

- Wire Fraud

- york

- zephyrnet