. Ethereumi hind has been a joy to watch since the start of 2024, climbing by more than 30% in less than two months. The latest on-chain revelation suggests that ETH investors are approaching the market with more confidence, as the cryptocurrency’s price rally seems to be far from over.

2.4 miljardi dollari väärtuses ETH lehtede vahetus: CryptoQuant

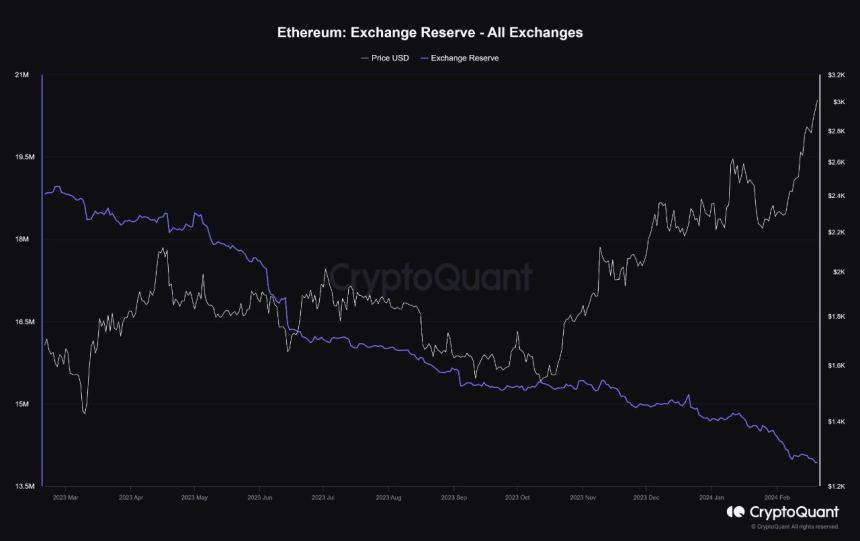

A pseudonymous analyst on CryptoQuant’s Quicktake revealed that significant amounts of the Ethereum token have been making their way out of exchanges in the last few weeks. This observation is based on the “Exchange Reserve” metric, which tracks the amount of ETH tokens in the wallets of all centralized exchanges.

Kui selle mõõdiku väärtus suureneb, tähendab see, et investorid teevad tsentraliseeritud börsidele rohkem hoiuseid kui vara (antud juhul eetri) väljavõtmist. Samal ajal tähendab mõõdiku langus, et rohkem varasid voolab välja kui nendele platvormidele siseneb.

Aasta andmetel Krüptokvant, more than 800,000 ETH (equivalent to approximately $2.4 billion) has flowed out of cryptocurrency exchanges since the turn of the year. Typically, the movement of significant amounts of cryptocurrencies out of these platforms suggests a rise in investor confidence.

Ethereum's exchange reserve | Source: Krüptokvant

As the CryptoQuant Quicktake author noted, this reduction in Ether’s exchange reserve balance could be a bullish catalyst for the altcoin’s price. A sustained decline in the ETH’s supply on exchanges could trigger a supply crunch, potentially driving the Ethereum price higher.

Selle kirjutamise seisuga on Ethereumi hind umbes 2,920 dollarit, mis kajastab 1.8% langust viimase päeva jooksul. Sellegipoolest on "altcoinide kuningas" iganädalase ajakava osas endiselt rohelises, viimase nädala jooksul on hinnahüpe peaaegu 5%.

Ethereumi hinnatõus seoses Dencuni versiooniuuenduse ootusega: halltoonid

Hiljutises aruandes Grayscale has offered commentary on Ethereum’s positive price performance so far in 2024. The asset management firm tied ETH’s bullish trajectory to the upcoming Dencun upgrade of the Ethereum network.

William Ogden Moore, Grayscale’s research analyst, wrote in aruande:

Usume, et hiljutine hinnanäitaja peegeldab turu ootusi sellele uuendusele, kuna Ethereum (26% aasta algusest) on alates 3. jaanuarist 1 edestanud laiemat nutikate lepingute platvormide sektorit (kasv 2024% aasta algusest).

. Dencun upgrade, which is less than a month away, will aim to enhance Ethereum in terms of scalability and cost-effectiveness. It is also expected to help the network compete with “faster chains in the Smart Contract Platforms Crypto Sector, such as Solana.”

Another narrative that may be propelling the price of ETH is the approval of Ethereum spot exchange-traded funds (ETFs) in the United States. Interestingly, Grayscale is amongst the asset managers looking to debut an Ether spot ETF.

Ethereum price at $2,923 on the daily timeframe | Source: ETHUSDT chart on TradingView

Esiletõstetud pilt Unsplashilt, diagramm TradingView'st

Kohustustest loobumine: artikkel on mõeldud ainult hariduslikel eesmärkidel. See ei esinda NewsBTC arvamust selle kohta, kas investeeringuid osta, müüa või hoida ning loomulikult kaasneb investeerimisega riske. Enne mis tahes investeerimisotsuse tegemist soovitame teil ise uurida. Kasutage sellel veebisaidil esitatud teavet täielikult omal vastutusel.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoData.Network Vertikaalne generatiivne Ai. Jõustage ennast. Juurdepääs siia.

- PlatoAiStream. Web3 luure. Täiustatud teadmised. Juurdepääs siia.

- PlatoESG. Süsinik, CleanTech, Energia, Keskkond päikeseenergia, Jäätmekäitluse. Juurdepääs siia.

- PlatoTervis. Biotehnoloogia ja kliiniliste uuringute luureandmed. Juurdepääs siia.

- Allikas: https://www.newsbtc.com/news/ethereum/800000-eth-flow-out-of-centralized-exchanges-in-2024-bullish-sign-for-ethereum-price/

- :on

- :on

- :mitte

- $ UP

- 000

- 1

- 1.

- 2024

- 26%

- 31

- 800

- 9

- a

- soovitatav

- eesmärk

- Materjal: BPA ja flataatide vaba plastik

- peaaegu

- Ka

- hulgas

- summa

- summad

- an

- analüütik

- ja

- ennetamine

- mistahes

- läheneb

- heakskiit

- umbes

- OLEME

- ümber

- artikkel

- AS

- eelis

- varahaldus

- vara

- At

- autor

- ära

- Saldo

- põhineb

- BE

- olnud

- enne

- Uskuma

- Miljard

- laiem

- Bullish

- ostma

- by

- juhul

- Katalüsaator

- tsentraliseeritud

- Tsentraliseeritud vahetused

- ketid

- Joonis

- Ronimine

- kommentaar

- võistlema

- Läbi viima

- usaldus

- leping

- lepingulised platvormid

- võiks

- prõks

- krüpto

- krüptosektor

- cryptocurrencies

- cryptocurrency

- Krüptovaluutavahetused

- krüptokvant

- iga päev

- andmed

- päev

- debüüt

- otsused

- Väheneb

- hoiused

- ei

- sõidu

- kaks

- haridus-

- suurendama

- Sisse

- täielikult

- Samaväärne

- ETF-id

- ETH

- Eeter

- ethereum

- ethereumi võrk

- Ethereumi hind

- Ethereumi omad

- ETHUSDT

- vahetamine

- börsil kaubeldavad

- börsil kaubeldavad fondid

- Vahetused

- oodatav

- kaugele

- vähe

- Firma

- voog

- Voolav

- eest

- Alates

- raha

- Halltoonid

- Green

- Olema

- aitama

- rohkem

- hoidma

- HTTPS

- pilt

- in

- Tõstab

- info

- sisse

- investeerimine

- investeering

- Investeeringud

- investor

- Investorid

- IT

- Jaanuar

- rõõm

- jpg

- hüppama

- viimane

- hiljemalt

- vähem

- otsin

- Tegemine

- juhtimine

- Juhid

- Turg

- max laiuse

- mai..

- vahendid

- Vahepeal

- meetriline

- kuu

- kuu

- rohkem

- liikumine

- NARRATIIVNE

- võrk

- Sellegipoolest

- UudisedBTC

- märkida

- tähelepanek

- of

- pakutud

- on

- Ahelas

- ainult

- Arvamused

- or

- välja

- edestanud

- üle

- enda

- minevik

- jõudlus

- Platvormid

- Platon

- Platoni andmete intelligentsus

- PlatoData

- positiivne

- potentsiaalselt

- hind

- hinnaralli

- hinnatõus

- liikumapanemiseks

- tingimusel

- eesmärkidel

- ralli

- hiljuti

- vähendamine

- peegeldav

- peegeldab

- aru

- esindama

- teadustöö

- Reserv

- ilmutus

- Tõusma

- Oht

- riskide

- s

- Skaalautuvus

- sektor

- tundub

- müüma

- kirjutama

- märkimisväärne

- alates

- nutikas

- arukas leping

- Nutikad lepinguplatvormid

- So

- nii kaugel

- Solana

- allikas

- Kaubandus-

- seisab

- algus

- Ühendriigid

- Veel

- selline

- Soovitab

- varustama

- tingimused

- kui

- et

- .

- Nädalaleht

- oma

- Need

- see

- seotud

- ajakava

- et

- sümboolne

- märgid

- Lood

- TradingView

- trajektoor

- vallandada

- Pöörake

- kaks

- tüüpiliselt

- Ühendatud

- Ühendriigid

- Unsplash

- tulemas

- upgrade

- kasutama

- väärtus

- Rahakotid

- Watch

- Tee..

- veebisait

- nädal

- iga nädal

- nädalat

- kas

- mis

- will

- koos

- Väljamakseid

- väärt

- kirjutamine

- kirjutas

- aasta

- sa

- Sinu

- sephyrnet