A multi-jurisdictional Keskpanga digitaalne valuuta (CBDC) pilot has been marked “successful” by the Bank for International Settlements (BIS) after a month-long test phase that facilitated $22 million worth of real-value cross-border transactions.

The central banks of Hong Kong, Thailand, China and the United Arab Emirates (UAE) took part in the pilot program along with 20 commercial banks from those regions.

More than $12 million worth of value was issued onto the test platform, which facilitated 164 foreign exchange transactions and piiriülesed maksed between the participating firms totaling over $22 million worth of value according to a Tuesday LinkedIn pärast from the BIS.

Daniel Eidan an advisor and solution architect at the BIS ütles the pilot focused on hulgimüügi CBDC cross-border payments and the role the central banks have on the platform, adding “we will likely consider more commercial aspects in the future stages of our work.”

The platform, known as “mBridge” short for Multiple CBDC (mCBDC) Bridge is a part of Project Inthanon-LionRock, a hajutatud pearaamatu tehnoloogia (DLT) CBDC cross-border payment project launched initially in Sept. 2019 involving the Thai and Hong Kong central banks.

With the first pilot of the platform now completed the project has moved into its third and final stage before a minimum version of the product with only the platform’s core functionality is put to market.

A fully-functional CBDC cross payments platform will only be ready after revisions are made taking into account the feedback from the minimum version, according to a Sept. 2021 BIS report.

Seotud: Venemaa kavatseb kasutada CBDC-d rahvusvahelisteks arveldusteks Hiinaga: aruanne

The BIS added that a detailed progress report on mBridge will be released in October which will discuss technical design, legal, policy and regulatory considerations along with a future roadmap of mBridge.

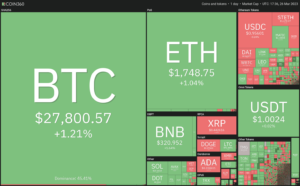

A June report by the BIS revealed around 90% of central banks are investigating the adoption of CBDCs. Currently, 11 CBDCs have launched, 15 are in a pilot stage and 26 are in development according to the CBDC tracker from think tank Atlantic Council.

- kuni

- Bitcoin

- blockchain

- plokiahela vastavus

- blockchain konverents

- CBDCA

- cbdc piloot

- Keskpank

- keskpanga digitaalne valuuta

- Hiina

- coinbase

- coingenius

- Cointelegraph

- üksmeel

- piiriülesed maksed

- krüptokonverents

- krüpto mineerimine

- cryptocurrency

- Detsentraliseeritud

- Defi

- Digitaalsed varad

- jaotatud pearaamatu tehnoloogia

- DLT

- ethereum

- Hong Kong

- masinõpe

- mbridge

- mcbdc

- mitte vahetatav märk

- Platon

- plato ai

- Platoni andmete intelligentsus

- Platvormplokk

- PlatoData

- platogaming

- hulknurk

- tõend osaluse kohta

- Tai

- AÜE

- W3

- sephyrnet