Bitcoin is a historic opportunity for retail and individual investors to access assets and economic wealth before major financial institutions.

Allpool on väljavõte Bitcoin Magazine Pro hiljutisest väljaandest, Bitcoin Magazine'i esmaklassilise turgude uudiskirjast. Et olla esimeste seas, kes saab need ülevaated ja muud ketisisesed bitcoini turuanalüüsid otse teie postkasti, Telli nüüd.

Jaemüük omab 14% pakkumisest

One of the most common Bitcoin fear, uncertainty and doubt (FUD) critiques is that the majority of supply is heavily concentrated in the hands of the few. Like every financial system or asset class that exists today, there is some truth to that type of distribution but it’s almost always exaggerated in Bitcoin’s case.

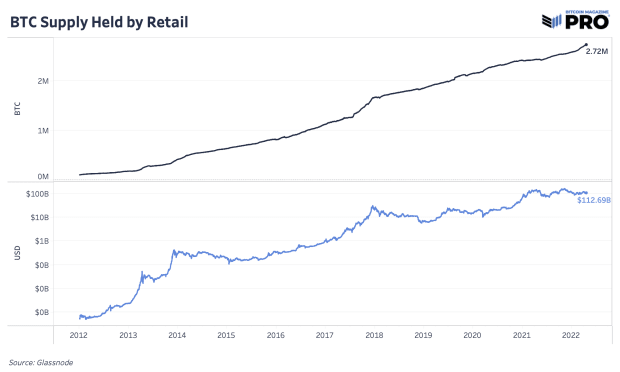

Bitcoin’s share of supply held by estimated retail individuals has been taking more share of the network every year. It’s one of the only assets in the world where anyone with an internet connection and a smartphone can obtain, having incredibly low adoption friction for the common individual.

Paljud kriitikud viitavad aadressitabelile nagu see ja nimetage seda tõeks. Tõde on see, et tarnejaotuse jälgimine aadresside vahel on uskumatult nüansirikas ja see on peamine põhjus, miks Glassnode on kasutanud heuristika ja klasterdamisalgoritmide komplekt et hinnata võrgus olevaid olemeid, mitte aadresse.

Glassnode leidis oma aastataguses analüüsis järgmist:

“We can derive that around 2% of network entities control 71.5% of all Bitcoin. Note that this figure is substantially different from the often propagated ‘2% control 95% of the supply.’”

And that 71.5% was an upper bound, i.e., a high estimate of the supply distribution concentration. There are many reasons why the retail share is likely larger because of bitcoin with custodians, supply on exchanges, lost coins, and a conservative methodology to identify entities.

When digging into the entities supply distribution data today, we find a clear trend of retail (entities holding less than 10 BTC) increasing their share of circulating supply from 1.51% in 2012 to 13.90% in 2022 on average. The largest share growth of supply comes from entities holding 1-10 BTC and 0.1 – 1 BTC.

Lõpetuseks

The data contributes to the case that Bitcoin is a money designed for and accessible to the common global individual. Although institutions and institutional capital flowing into the network is likely the next major price catalyst and will impact supply share, we continue to see the network share of retail rise as anyone in the world can acquire and store bitcoin themselves.

See on esimene omataoline juhtumiuuring, kus jaemüüjatel ja üksikisikutel on üks kord juurdepääs varadele ja majanduslikule rikkusele enne institutsioone.

- 10

- 2022

- juurdepääs

- omandama

- üle

- aadress

- aadressid

- Vastuvõtmine

- Materjal: BPA ja flataatide vaba plastik

- Kuigi

- vahel

- summa

- analüüs

- keegi

- ümber

- eelis

- vara

- keskmine

- Bitcoin

- BTC

- helistama

- kapital

- juhtumiuuring

- Katalüsaator

- klass

- Mündid

- ühine

- kontsentratsioon

- ühendus

- jätkama

- pidev

- kontrollida

- andmed

- kavandatud

- erinev

- jagatud

- jaotus

- Majanduslik

- väljaanne

- üksuste

- hinnata

- Hinnanguliselt

- Vahetused

- Joonis

- finants-

- Finants institutsioonid

- esimene

- avastatud

- Klaasisõlm

- Globaalne

- Kasvama

- Kasv

- võttes

- Suur

- omamine

- omab

- HTTPS

- identifitseerima

- mõju

- kasvav

- eraldi

- teadmisi

- Institutsionaalne

- institutsioonid

- Internet

- Investorid

- IT

- Võti

- suurem

- suurim

- Tõenäoliselt

- peamine

- Enamus

- Turg

- Turuanalüüs

- turud

- raha

- rohkem

- kõige

- võrk

- Uudiskiri

- Ahelas

- Võimalus

- Muu

- preemia

- hind

- Pro

- põhjustel

- saama

- jaemüük

- Jaeinvestorid

- Jaga

- nutikas telefon

- mõned

- salvestada

- Uuring

- varustama

- süsteem

- võtmine

- maailm

- täna

- Jälgimine

- väärtus

- Jõukus

- maailm

- aasta