REKLAAM

The BTC fund outflows are slowing down as the amount of money that is leaving is less than the previous record of $141 million however investors started exiting their Ether funds as we can see in today’s bitcoini viimased uudised.

Overall, the BTC fund outflow slowed down last week but the net redemptions from BTC-focused funds decreased and investors are seemingly souring on ether. Overall, the digital asset funds experienced a new outflow of $21 million during the week until 11 of June which is down from $94 million pulled out of the funds a week ago according to a report by CoinShares.

The decline in outflows could be a sign of a bearish sentiment peaking. Investors are pulling money from BTC funds in the past few weeks as the price of the biggest crypto by market cap traded below $40K from the all-time high of $65,000. Funds focused on altcoins like ether and XRP were favored over the past month as investors diversified from BTC funds. The latest data suggests that the trend could be starting to shift and Ether had the biggest outflows on record since 2015 last week up to $12.7 million.

REKLAAM

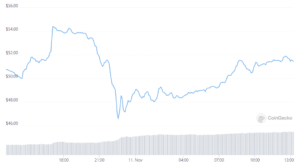

In the meantime, outflows in BTC funds totaled $10 million a week ago which is less than the previous record week of $141 million, as the Coinshares report shows:

“Trading activity in bitcoin investment products rose by 43% compared to the previous week.”

XRP funds saw a minor outflow that totaled $2.8 million a week ago after a six-week run on inflows that totaled $21 million. Flow data suggests mixed opinions among investors as the sentiment weakened over the past month.

As recently reported, institutional BTC investors are in the spotlight now as the upcoming major cashout date is sparking new waves of fresh volatility. Twitter commentator Loomdart shifted the attention to the buyers and sellers of the grayscale Bitcoin trust as the number one cryptocurrency hovers near $40K. the giant in the institutional BTC space GBTC has over $24 billion in assets under management but it is not available constantly. The trust operates with periodic closures and this year it coincided with the buy-in price trading at the discount spot price. The negative GBTC premium formed a major talking point in its own right as the invested funds are locked up for a set period of time and then released which allows investors to cash out at certain times depending on when they are purchased.

- 000

- 11

- 7

- Altcoiinid

- vahel

- eelis

- vara

- ebaviisakas

- suurim

- Miljard

- Bitcoin

- BTC

- Raha

- CoinShares

- pidev

- krüpto

- Crypto News

- cryptocurrency

- andmed

- digitaalne

- Digitaalne vara

- Allahindlus

- Drop

- Juhtkiri

- Eeter

- voog

- tasuta

- värske

- fond

- raha

- GBTC

- Halltoonid

- Suur

- HTTPS

- Institutsionaalne

- investeering

- Investorid

- IT

- hiljemalt

- Uudised

- Tase

- peamine

- juhtimine

- Turg

- Turupiirkond

- miljon

- segatud

- raha

- Lähedal

- neto

- uudised

- pakkuma

- Arvamused

- Poliitika

- preemia

- hind

- Toodet

- tõmmates

- aru

- jooks

- Sellers

- tunne

- komplekt

- suunata

- Aeglustub

- Ruum

- Kaubandus-

- prožektor

- standardite

- alustatud

- rääkimine

- aeg

- Kauplemine

- Usalda

- puperdama

- us

- Lenduvus

- lained

- veebisait

- nädal

- xrp

- aasta