- The recent significant increase of a total of 20 bps in the 2-year JGB yield since the start of the year has come in line with the highly anticipated rosy results of the annual wage negotiations in Japan.

- In the past week, the JPY crosses have come under downside pressure as the carry trade strategy loses its appeal.

- Watch the 168.75 key short-term resistance on the CHF/JPY.

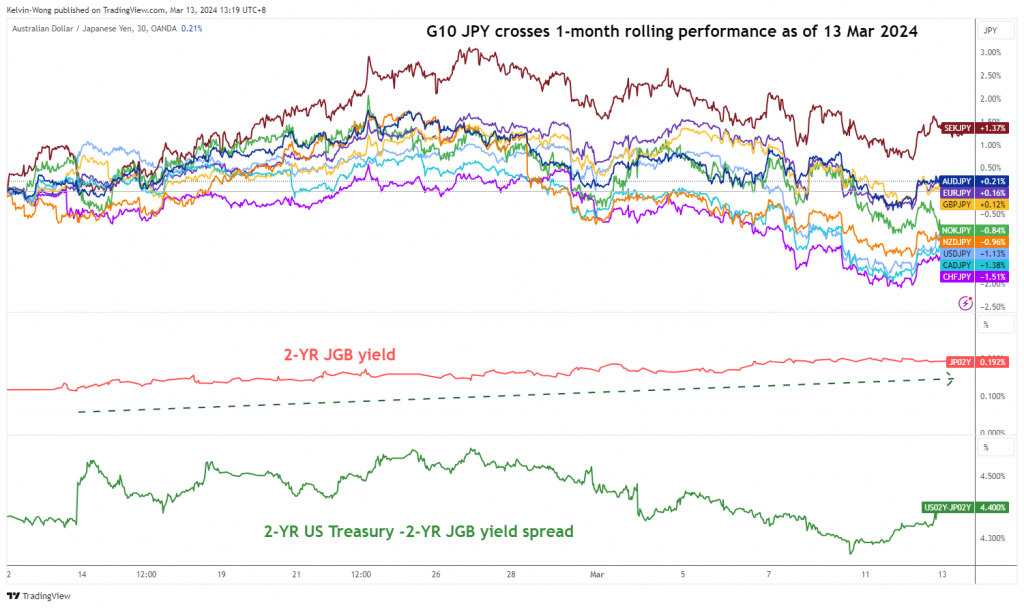

The JPY crosses have continued to face downside pressure in the recent week ahead of key related risk events such as the release of the preliminary FY 2024/2025 wage negotiation results in Japan by the latest labour union federation, Rengo on this Friday, 15 March (see Fig1).

Expectations have been optimistic as the consensus forecast is pegged at an average pay rise of 3.85% for FY 2024/2025 (above last year’s annualized gain of 3.58%), and if It turns out as expected, it will be the largest wage increase in Japan since 1993.

JPY crosses under downside pressure as carry trade strategy loses appeal

Joonis 1: G-1 JPY ristide jooksev näitaja kolme kuu jooksul 10. märtsil 13 (Allikas: TradingView, klõpsake diagrammi suurendamiseks)

. CHF / JPY is the worst performer among the JPY crosses as it shed -1.50% based on a one-month rolling performance basis as of today, 13 March in line with the rosy anticipated outcome of the Japanese employee’s wage negotiation results.

The primary driver of JPY strength has been the rising 2-year Japanese Government Bond (JGB) yield as it rose by a whopping 20 basis points (bps) from close to 0% at the start of January to 0.20% on 11 March as market participants have started to price in a more hawkish Bank of Japan (BoJ) going forward to either scrapped off its short-term negative interest rates policy next Tuesday, 19 March or on the 26 April monetary policy meeting.

Bearish “Ascending Wedge” detected in CHF/JPY

Joonis 2: CHF/JPY peamised ja keskmise tähtajaga trendid seisuga 13. märts 2024 (Allikas: TradingView, klõpsake diagrammi suurendamiseks)

The major uptrend phase of CHF/JPY in place since the 13 January 2024 low of 137.44 is likely in jeopardy through the recent appearance of an impending bearish “Ascending Wedge” configuration that has taken shape from the 3 October 2023 low (see Fig 2).

The formation of the “Ascending Wedge” suggests a potential major bullish trend exhaustion condition as the magnitude of its upper boundary that connects its “higher highs” is lesser than the slope of its “lower lows” (lower boundary).

In addition, the daily RSI momentum indicator has flashed a bearish divergence condition.

Oscillating within a minor descending channel

Joonis 3: CHF/JPY lühiajaline trend seisuga 13. märts 2024 (Allikas: TradingView, klõpsake diagrammi suurendamiseks)

In the shorter term as seen on its hourly chart, the price actions of CHF/JPY have started to oscillate within a minor descending channel in place since 29 February 2024 high of 171.50.

If the 168.75 short-term pivotal resistance is not surpassed to the upside, it may see further potential weakness to expose the next intermediate support at 166.55 (close to the lower boundary of the “Ascending Wedge) in the first step (see Fig 3).

On the other hand, a clearance above 168.75 negates the bearish tone for the next near-term resistance to come in at 169.50 (also the downward-sloping 20-day moving average).

Sisu on mõeldud ainult üldiseks teabeks. See ei ole investeerimisnõustamine ega lahendus väärtpaberite ostmiseks või müümiseks. Arvamused on autorid; mitte tingimata OANDA Business Information & Services, Inc. või selle sidus-, tütarettevõtete, ametnike või direktorite oma. Kui soovite OANDA Business Information & Services, Inc. toodetud auhinnatud Forexi, kaupade ja globaalsete indeksite analüüsi- ja uudistesaitide teenuses MarketPulse leiduvat sisu reprodutseerida või levitada, avage palun RSS-voog või võtke meiega ühendust aadressil info@marketpulse.com. Külastus https://www.marketpulse.com/ et saada rohkem teavet maailmaturgude löögi kohta. © 2023 OANDA Business Information & Services Inc.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoData.Network Vertikaalne generatiivne Ai. Jõustage ennast. Juurdepääs siia.

- PlatoAiStream. Web3 luure. Täiustatud teadmised. Juurdepääs siia.

- PlatoESG. Süsinik, CleanTech, Energia, Keskkond päikeseenergia, Jäätmekäitluse. Juurdepääs siia.

- PlatoTervis. Biotehnoloogia ja kliiniliste uuringute luureandmed. Juurdepääs siia.

- Allikas: https://www.marketpulse.com/forex/chf-jpy-technical-potential-major-bullish-trend-exhaustion/kwong

- :on

- :on

- :mitte

- 1

- 11

- 13

- 15 aastat

- 15%

- 19

- 20

- 2023

- 2024

- 26%

- 29

- 50

- 7

- 700

- 75

- a

- MEIST

- üle

- juurdepääs

- meetmete

- lisamine

- nõuanne

- tütarettevõtete

- eespool

- Ka

- vahel

- an

- analüüsid

- analüüs

- ja

- aastane

- aastateks

- Oodatud

- mistahes

- kaebus

- Aprill

- OLEME

- ümber

- AS

- At

- autor

- autorid

- avatar

- keskmine

- auhind

- Pank

- Jaapani pank

- Jaapani Pank (BoJ)

- põhineb

- alus

- BE

- ebaviisakas

- Jäme suhtes

- lööma

- olnud

- alla

- kahju

- võlakiri

- piir

- Kast

- Bullish

- äri

- ostma

- by

- viima

- Kanal

- Joonis

- luba

- klõps

- lähedal

- COM

- kombinatsioon

- Tulema

- Tarbekaubad

- seisund

- läbi

- konfiguratsioon

- ühendamine

- ühendab

- üksmeel

- kontakt

- sisu

- jätkas

- kursused

- iga päev

- tuvastatud

- Direktorid

- Lahknemine

- miinus

- juht

- kumbki

- Elliott

- suurendada

- sündmused

- vahetamine

- oodatav

- kogemus

- ekspert

- nägu

- Veebruar

- Föderatsioon

- viigipuu

- finants-

- leidma

- esimene

- voog

- eest

- Ennustus

- välis-

- välisvaluuta

- forex

- moodustamine

- edasi

- avastatud

- Reede

- Alates

- fond

- põhiline

- edasi

- FY

- kasu

- Üldine

- Globaalne

- globaalsed turud

- läheb

- Valitsus

- käsi

- Olema

- Hawkish

- Suur

- kõrgelt

- HTTPS

- if

- eelseisev

- in

- Inc

- Suurendama

- Indikaator

- Indeksid

- info

- huvi

- Intressimäärad

- investeering

- IT

- ITS

- Jaanuar

- Jaapan

- jaapani

- JAAPANI VALITSUS

- JGB

- JPY

- Kelvin

- Võti

- Labour

- suurim

- viimane

- hiljemalt

- vähem

- taset

- nagu

- Tõenäoliselt

- joon

- Kaotab

- Madal

- vähendada

- Makro

- peamine

- mar

- Märts

- Turg

- turuväljavaated

- turu uuring

- MarketPulse

- turud

- max laiuse

- mai..

- koosolekul

- alaealine

- Impulss

- Rahaline

- Rahapoliitika

- rohkem

- liikuv

- libisev keskmine

- tingimata

- negatiivne

- negatiivsed intressimäärad

- läbirääkimised

- uudised

- järgmine

- arvukad

- oktoober

- of

- maha

- ametnikud

- on

- üks kuu

- ainult

- Arvamused

- Optimistlik

- or

- Muu

- välja

- Tulemus

- väljavaade

- üle

- osalejad

- kirglik

- minevik

- Maksma

- seotud

- jõudlus

- etendused

- esineja

- perspektiivid

- faas

- foto

- Keskses

- Koht

- Platon

- Platoni andmete intelligentsus

- PlatoData

- palun

- võrra

- poliitika

- positsioneerimine

- Postitusi

- potentsiaal

- esialgne

- surve

- hind

- esmane

- Toodetud

- pakkudes

- eesmärkidel

- Rates

- hiljuti

- seotud

- vabastama

- teadustöö

- Vastupidavus

- Tulemused

- jaemüük

- Ümberpööramine

- Tõusma

- tõusev

- Oht

- Rolling

- ROSE

- Roosiline

- RSI

- rss

- Väärtpaberite

- vaata

- nähtud

- müüma

- vanem

- teenus

- Teenused

- kuju

- jagamine

- kuur

- lühiajaline

- märkimisväärne

- alates

- Singapur

- site

- Kalle

- lahendus

- allikas

- spetsialiseerunud

- algus

- alustatud

- Samm

- varu

- Aktsiaturgudel

- Strateeg

- Strateegia

- tugevus

- selline

- Soovitab

- toetama

- ületas

- võtnud

- Tehniline

- Tehniline analüüs

- kümme

- termin

- kui

- et

- .

- see

- tuhandeid

- Läbi

- et

- täna

- TONE

- Summa

- kaubelda

- Ettevõtjad

- Kauplemine

- TradingView

- koolitus

- Trend

- Trends

- Teisipäev

- lülitub

- all

- liit

- ainulaadne

- Upside

- tõusutendents

- us

- kasutamine

- v1

- visiit

- palk

- Wave

- nõrkus

- nädal

- Nädal ees

- Hästi

- will

- võit

- koos

- jooksul

- wong

- halvim

- halvim esineja

- oleks

- aasta

- aastat

- saak

- sa

- sephyrnet