See on meie sõbra kirjutatud iganädalane õpetus kõige mõjuvamate võimaluste kohta saagikasvatuses DeFi isa, The Defianti nõustaja ja portfelli tugiteenuste juht aadressil Neljanda revolutsiooni pealinn (4RC).

Protokolli taust: Crypto markets have always struggled to manage overinflated token prices thanks to an abundance of ways to go long and go short. The resulting volatility can be detrimental to attracting new participants whether retail or institutional.

Despite the viral uprising against hedge funds shorting the stock market (ie GameStop saga), the truth is every market needs a counter-balance to buying pressure, including the DeFi markets. In case you’re unfamiliar with how shorting works, it’s when you borrow an asset to sell now and then buy it back later at a lower price. Just like in traditional global markets, we need new permissionless and trustless DeFi products to short tokens and help mitigate unrelenting upward pressure on the markets.

Avage lühike positsioon

Umbes kaks nädalat tagasi, beetafinantseerimine launched as a new protocol on Ethereum for permissionless lending, borrowing, and short-selling. What’s most novel about Beta is the ability to open a short position more easily, in less time, and eventually with any token. To open a short position in DeFi would normally require quite a bit of work, if you check out the diagram below:

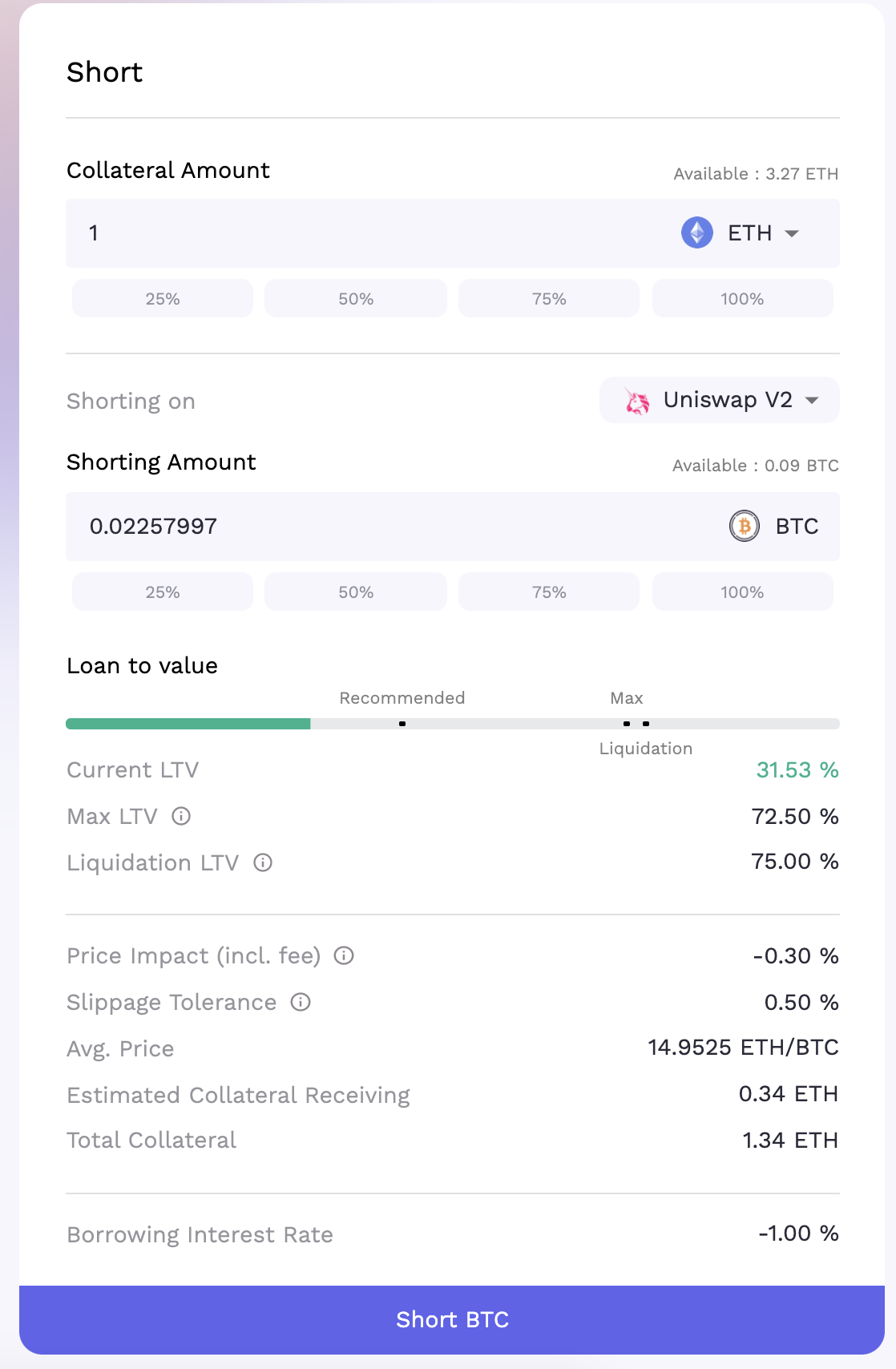

Compare this very manual process with what Beta automates in a few clicks below in my example, showing how to deposit ETH collateral to short WBTC against the price of ETH:

A few other key takeaways on Beta Finance:

- This is the first project incubated by the Alpha Finance Launchpad DeFi incubator program.

- ALPHA stakers who back Alpha Finance products such as Alfa Homora, will earn a retro distribution of the BETA token, once generated in the coming weeks or months.

- There are about 6,800 ALPHA token holders according to Etherscan who may be incentivized to support BETA as an incubated project of Alpha.

- The Beta team has announced that a BETA retroactive distribution will reward anyone who lends, borrows, or shorts since the Beta app went live on August 18th.

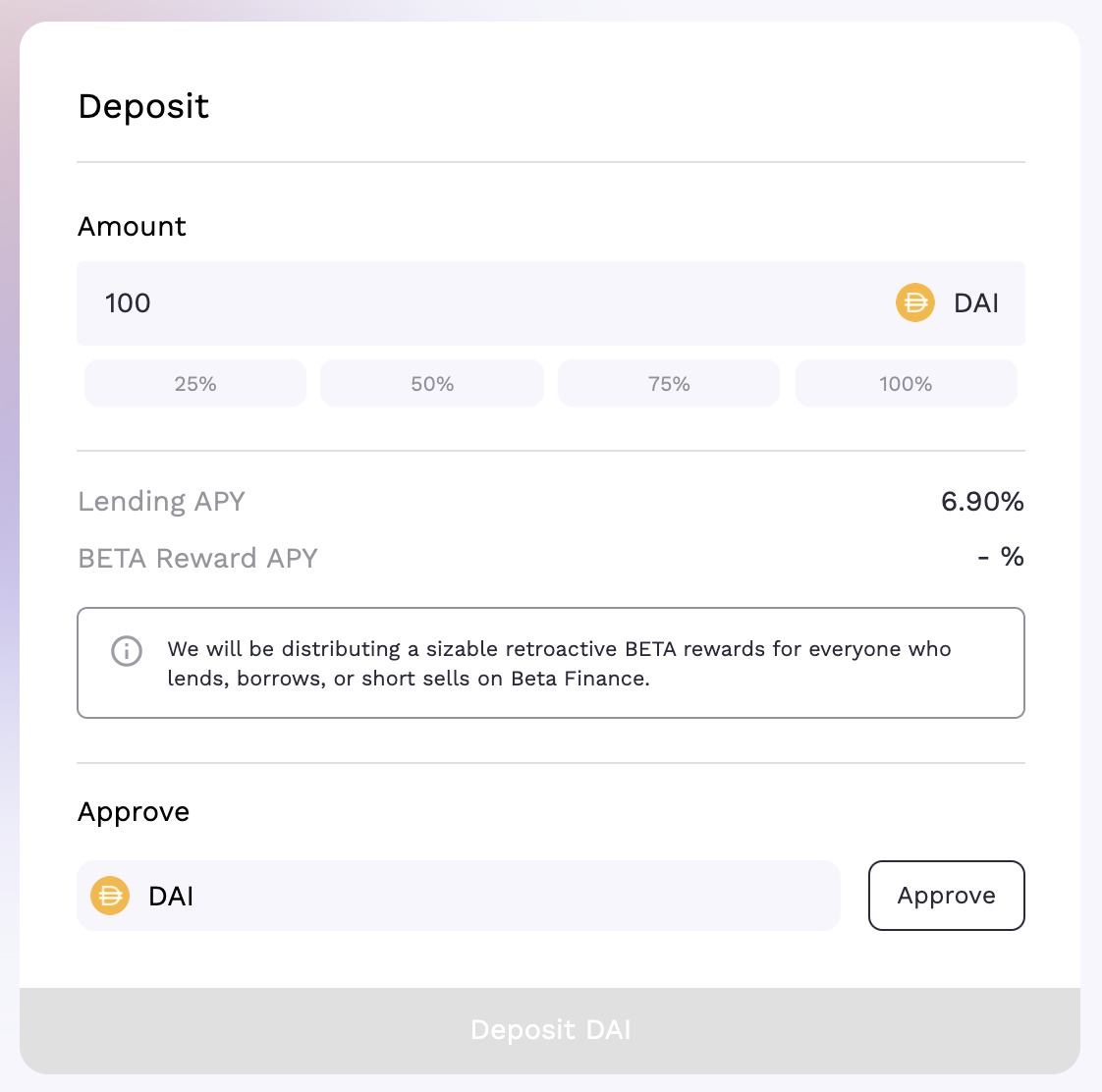

Võimalus: Today, I will capitalize on this future retroactive distribution of BETA by using Beta Finance to lend,borrow, or short-sell, prior to the BETA token generation. Since BETA is not a live token as of August 27th, there’s no APY to report on and one can only speculate on how much BETA I might earn. It is possible to earn lending interest on one of the 16 “verified markets.” For example, the DAI lending rate is as high as 6.9% APY.

Aeg lõpetada: 5 minutit, kui maksate soovitatud FAST gaasihinna või kõrgemat hinda gasnow.org.

Preemiaprogrammi eeldatav pikkus: There’s no definitive token generation date and hence no end to this mining for a future retroactive BETA distribution.

Gas + Protocol Fees: Based on gas prices between 65-100 Gwei on Ethereum, it should cost $100-$200 to participate. The greater amount of work, under the hood, required by smart contracts in Beta Finance means that even a single click/transaction can be expensive on Ethereum. In the future, users can look forward to Beta deploying liquidity to BSC and Ethereum L2s, which should allow for cheaper transactions.

Tasud: If one chooses to borrow or short a token on Beta, they will pay a borrowing rate like on any money market.

Riskid: As always, this is not financial advice and you should do your own research. The following are risks when participating in this opportunity.

- Smart contract risk Beta Finance, SushiSwap, and Uniswap v2 and v3

- Oracle'i rike

- Likviidsuskriis

- Süsteemne risk DeFi-s

- Seotud varad, nagu stabiilsed mündid, võivad sidumise tühistada

Õpetus:

- Esiteks lähen ma juurde Beta Finance app and connect my Ethereum wallet.

- Given my interest in earning this future BETA token, I might choose to lend, borrow, or short-sell based on my risk profile and assets in my wallet. The most complex and powerful example using Beta could be short-selling WBTC against the price of ETH, by depositing ETH collateral. Earlier in this tutorial I showed a screenshot of how I might do this being careful to use the Beta app UI to choose an LTV well below the liquidation threshold of 72.5%.

- However, for the sake of simplicity, I’ll first show how I can just lend stablecoins or ETH to potentially earn lending interest on Beta while also earning the future BETA token.

- Kohta list of verified markets, I find an asset like DAI that I would like to lend.

- Click Hoius.

- Specify how much to lend

- I follow the prompts to Heaks kiitma ja siis Hoius

- And I’m done! I’m now earning interest and the future BETA token.

- Alternatively, I can choose to short WBTC/USD by depositing / collateralizing DAI, USDC, or USDT or short WBTC/ETH by depositing ETH.

- I search for an asset I want to short like WBTC siin ja kliki Lühike.

- Then I choose whether to short with any of these collateral: DAI, USDC, USDT, or ETH and specify how much to deposit.

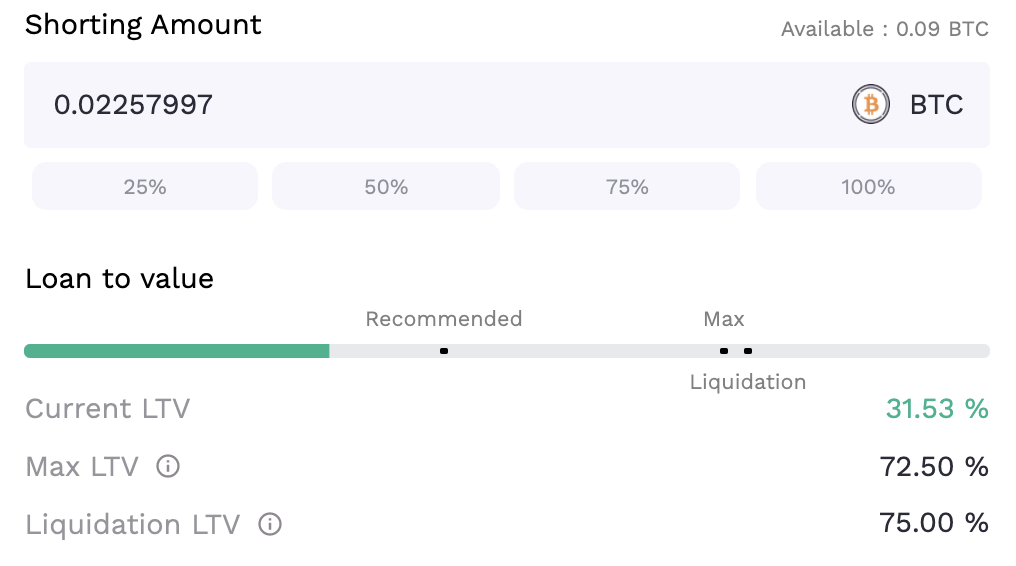

- I then use the controls under Shorting Amount to decide how large of a short position in WBTC I want, keeping in mind that Maksimaalne LTV is 72.5% and I will get liquidated 75%. I can use the options to short with 25%, 50%, 75%, 100% based on whatever size of position gets me to 72.5%.

- I prefer to keep it conservative using 25% of the shorting capacity available to me, getting me to 31.53% LTV in this example.

- Lastly, I click Short BTC and follow the prompts on MetaMask with a single transaction ringing me up for 0.1-0.12 ETH in gas fees.

- I’m done! Now, I can track my interest earned lending DAI or manage/track my open borrowing/short-selling position and LTV here on the,en positsioonid tab.

Autori kohta: DeFi isa on DeFi superkasutaja, koolitaja ja investor. Tema ja ta meeskond kell 4RC (Fourth Revolution Capital) investeerib meeskondadesse, kes loovad järgmise suurepärase protokolli või rakenduse DeFi, NFT-de ja Web3 jaoks. Saate tellida tema YouTube'i kanali aadressil defidad.com ja jälgi teda Twitteris.

Kaebused: All opinions expressed by DeFi Dad are solely his own and do not reflect the opinion of 4RC or The Defiant. DeFi Dad disclosed 4RC stakes ALPHA and hence will earn a share of the retroactive distribution of BETA tokens, in case he has any bias writing about Beta Finance. This is not an endorsement or recommendation to buy the future BETA token. This post is for informational purposes only and should not be relied upon as a basis for investment decisions. Please do not follow any opinion as a specific strategy.

Source: https://thedefiant.io/defi-dad-shorting-tokens-beta/

- nõuanne

- nõuandja

- Materjal: BPA ja flataatide vaba plastik

- teatas

- app

- taotlus

- eelis

- vara

- AUGUST

- beeta

- Natuke

- Laenamine

- Ehitus

- ostma

- Ostmine

- Võimsus

- kapital

- tulevad

- leping

- lepingud

- krüpto

- Krüpto turud

- DAI

- Defi

- ETH

- ethereum

- põllumajandus

- KIIRE

- Tasud

- rahastama

- finants-

- esimene

- järgima

- edasi

- raha

- tulevik

- GAS

- gaasitasud

- Globaalne

- suur

- juhataja

- riskifondid

- siin

- Suur

- Kuidas

- Kuidas

- HTTPS

- Kaasa arvatud

- inkubaator

- Institutsionaalne

- huvi

- investeering

- investor

- IT

- pidamine

- Võti

- suur

- laenud

- Likvideerimine

- Likviidsus

- Pikk

- Turg

- turud

- MetaMask

- Kaevandamine

- raha

- kuu

- NFT-d

- avatud

- Arvamus

- Arvamused

- Võimalused

- Võimalus

- Valikud

- Muu

- Maksma

- portfell

- surve

- hind

- Toodet

- profiil

- Programm

- projekt

- aru

- teadustöö

- jaemüük

- Hüved

- Oht

- Otsing

- müüma

- Jaga

- Lühike

- Lühikeseks müük

- Pikkus

- lühikesed püksid

- SUURUS

- nutikas

- Tarkvaralepingud

- Stabiilkiinid

- varu

- aktsiaturg

- Strateegia

- toetama

- aeg

- sümboolne

- märgid

- jälgida

- tehing

- Tehingud

- ui

- Lahutage

- USDC

- USDT

- Kasutajad

- Lenduvus

- rahakott

- wBTC

- Web3

- iga nädal

- WHO

- Töö

- töötab

- kirjutamine

- saak

- youtube