See on meie sõbra kirjutatud iganädalane õpetus kõige mõjuvamate võimaluste kohta saagikasvatuses DeFi isa, The Defianti nõustaja ning turundus- ja portfellitoe juht aadressil Neljanda revolutsiooni pealinn.

Disclaimer: All opinions expressed by DeFi Dad are solely his own opinion and do not reflect the opinion of 4RC or The Defiant. DeFi Dad disclosed he is in the Orion Saver stablecoin farm. He wishes to disclose this as he could benefit from future upside in an ORION token once it’s generated. This post is for informational purposes only and should not be relied upon as a basis for investment decisions. Please do not follow any opinion as a specific strategy.

Protokolli taust: kutsutakse uus DeFi protokoll Orioni raha aims to build a cross-chain stablecoin bank for saving and lending. What’s clever about Orion is that it’s bridging demand from two different DeFi communities: the Anchor Rate available on Terra blockchain and the outsized amount of stablecoin liquidity and demand to earn yield on Ethereum. If you’re unfamiliar with the Anchor Rate, think of it as the target APY that Anchor protocol seeks to pay out to depositors of UST. This Anchor Rate isn’t fixed, but is designed to be stable, currently about 19.55% APY.

If you have a reliable source to earn a stable 19-20% yield on stablecoins on one blockchain (Terra) and a larger pool of stablecoin lenders on Ethereum, what happens when you bring the two together? Orion Money addresses this by allowing stablecoin lenders to remain on Ethereum, while lending one of many stablecoins such as DAI, USDC, and UST to earn with the Anchor Rate.

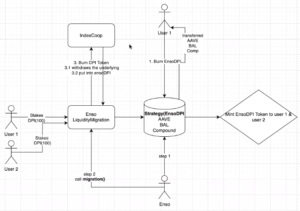

Siin on, kuidas see toimib:

- Orion users deposit ERC20 stablecoins on Ethereum (USDT, USDC, DAI, wrapped UST, FRAX, BUSD).

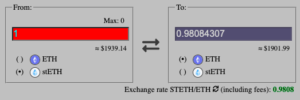

- Under the hood, Orion Money swaps the stablecoins for wrapped UST using curve.fi/ust and then bridges the wrapped UST to native UST on Terra. There are some higher gas fees to pay and potential slippage to impact anyone’s deposits/withdrawals.

- Lastly, the UST is used to earn the Anchor UST rate, currently at 19.55% APY.

I’m not sure there’s a better example today of cross-chain DeFi than this. Someone depositing stablecoins on Ethereum benefits from yield earned on Terra. Also, like most blue chip DeFi protocols on Ethereum, there’s cover already available at 2.6% APR for Orion deposits, thanks to KindlustusAce, or at least there was cover until it sold out recently.

Keep in mind, this is simply the first phase of a rollout to support lending stablecoins on Orion Money. Here’s a few milestones ahead:

- In September, the team will facilitate an IDO prior to token generation of ORION.

- Eventually after ORION is created, Orion users will have the option of being paid interest denominated in their deposited stablecoins or a higher interest rate in ORION.

- Additionally, any depositor can earn higher interest for staking ORION. When users stake more ORION, they earn a higher APY, similar to the model used by centralized crypto lenders Celsius and Nexo.

- Different from those CeFi lenders, all net revenue from Orion Money will end up in an ORION staking pool for ORION stakers.

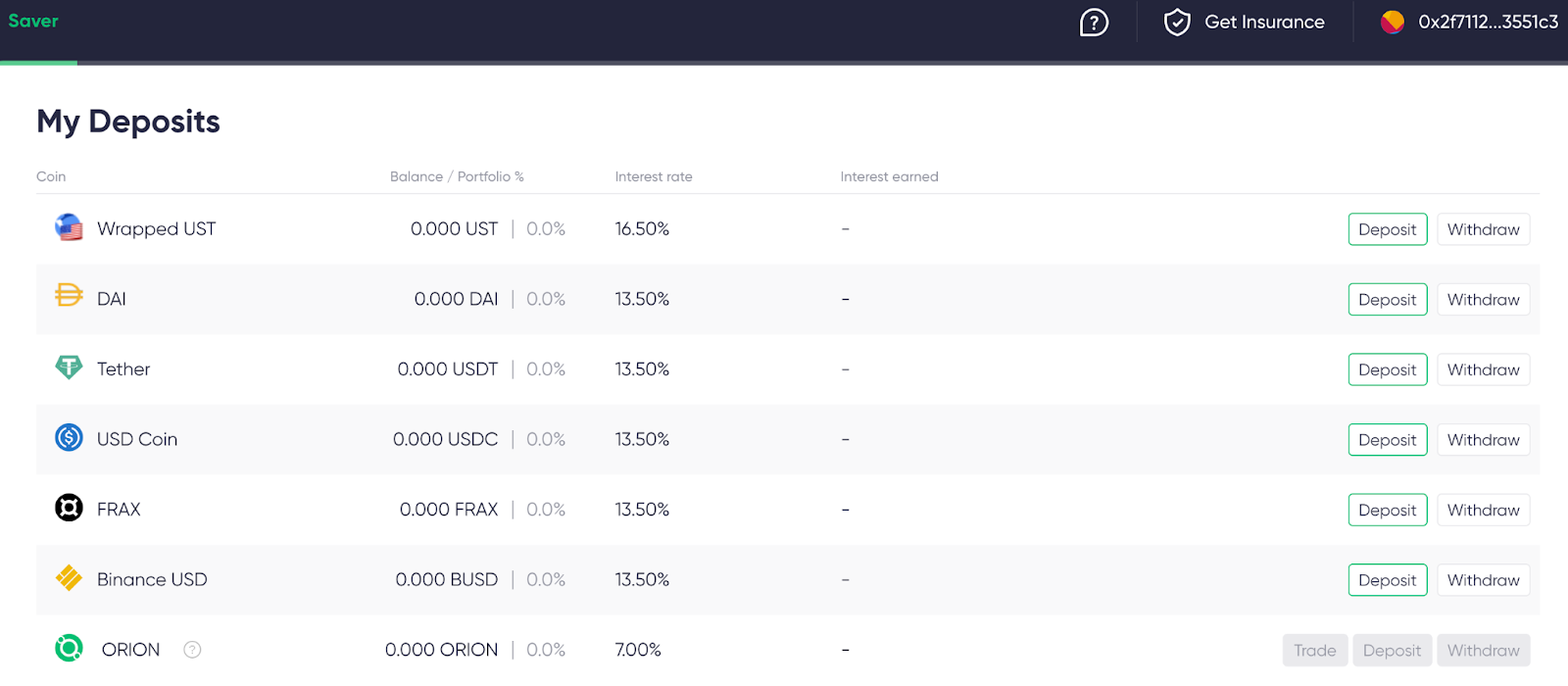

Võimalus: Today, I will share how I can earn 16.5% APY with UST or 13.5% APY with DAI, USDC, USDT, BUSD, or FRAX.

Täitmise aeg: 10 minutit, kui maksate soovitatud FAST gaasihinna või kõrgemat hinda gasnow.org.

Preemiaprogrammi eeldatav pikkus: These pools are only getting started. The rates will actually rise to between 15-25% APY after the ORION token is generated in September, following some future IDO. For now, the rates are fixed at 13.5% for all stablecoins or 16.5% APY for UST.

Gaas + protokollitasud: Ethereumi gaasihindade alusel 30–60 Gwei peaks osalemine maksma 40–90 dollarit.

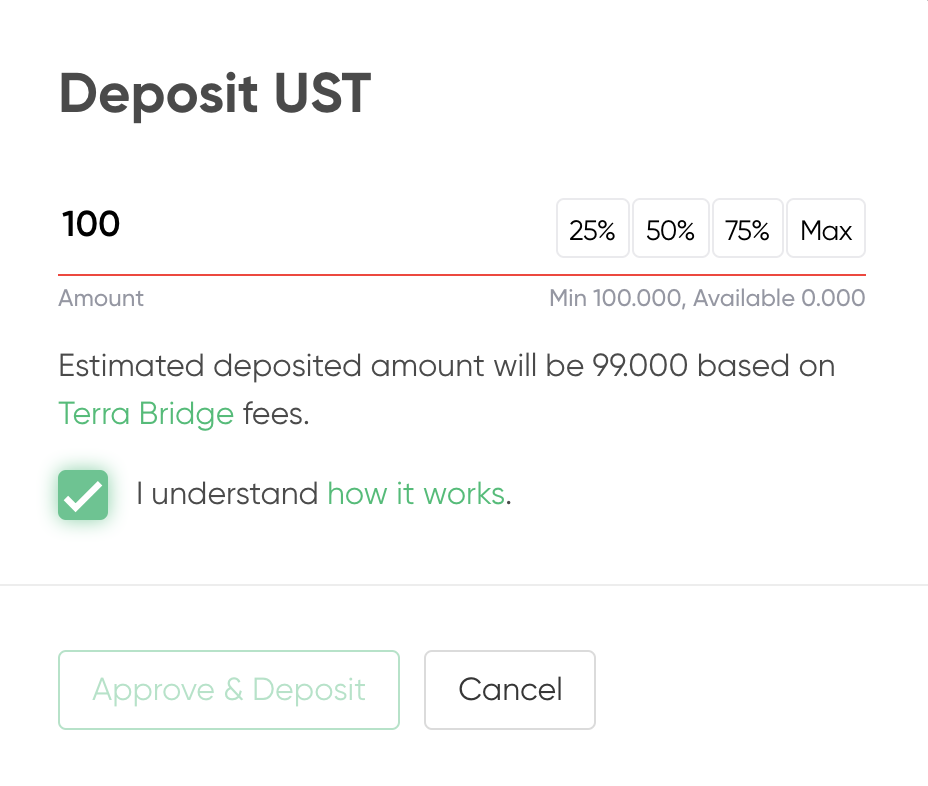

Tasud: Other than the usual Ethereum network fees you pay as gas, it’s worth noting that with Orion, users are paying for a convenience to not have to bridge money to Terra. For this service, Orion takes a cut. For example, I can earn 19.55% APY with the Anchor Rate but I’m earning 16.5% APY with UST on Orion. In the future, after ORION token is generated, these rates will rise to an expected 20-25% APY if I stake ORION and choose to be paid interest in ORION tokens. Also for withdrawing from Orion, be aware it involves a transfer between Terra and Ethereum handled by Terra Bridge (Shuttle) which imposes a fee of maximum of $1 or 0.1% of the total amount.

Riskid: nagu alati, ei ole see finantsnõustamine ja peaksite ise uurima. Selle võimaluse kasutamisel on riskid järgmised.

- Smart contract risk in Orion Money, Anchor, and Curve (if depositing stablecoins other than UST).

- Oracle'i rike

- Likviidsuskriis

- Süsteemne risk DeFi-s

- Seotud varad, nagu stabiilsed mündid, võivad sidumise tühistada

Õpetus:

- Esiteks lähen ma juurde Orion Money app here, connect my Ethereum wallet via MetaMask or WalletConnect, assuming I have one of the six listed stablecoins.

- In order to save gas, if I have multiple types of stablecoins, I might consider swapping them for a single kind of stablecoin ahead of time.

- If I have wrapped UST on Ethereum, I will notably save money on gas since it doesn’t require Orion to swap to UST via Curve before bridging to Terra.

- Btws, ignore the ORION token option at the bottom.

- Next, I choose whichever token to deposit, in my case UST, and click Hoius rohelises.

- Järgin juhiseid Approve & Deposit, which will require 2 transactions on MetaMask.

- I’m done! Now, I can track my Intress teenitud all My Deposits. I could also return here to deposit other stablecoins.

Autori kohta: DeFi isa on DeFi superkasutaja, koolitaja ja investor. Tema ja ta meeskond kell 4RC (Fourth Revolution Capital) investeerib meeskondadesse, kes loovad järgmise suurepärase protokolli või rakenduse DeFi, NFT-de ja Web3 jaoks. Saate tellida tema YouTube'i kanali aadressil defidad.com ja jälgi teda Twitteris.

- &

- nõuanne

- nõuandja

- Materjal: BPA ja flataatide vaba plastik

- Lubades

- app

- taotlus

- vara

- Pank

- blockchain

- BRIDGE

- ehitama

- Ehitus

- BUSD

- kapital

- Celsius

- kiip

- Ühenduste

- leping

- krüpto

- kõver

- DAI

- Defi

- Nõudlus

- ERC20

- ethereum

- ethereumi võrk

- talu

- põllumajandus

- KIIRE

- Tasud

- finants-

- esimene

- järgima

- tulevik

- GAS

- gaasitasud

- suur

- Green

- juhataja

- siin

- Kuidas

- Kuidas

- HTTPS

- mõju

- huvi

- investeering

- investor

- IT

- laenud

- Likviidsus

- Turundus

- MetaMask

- mudel

- raha

- neto

- võrk

- nexo

- NFT-d

- Arvamus

- Arvamused

- Võimalused

- Võimalus

- valik

- et

- Muu

- Maksma

- ujula

- Basseinid

- portfell

- hind

- Programm

- Rates

- teadustöö

- tulu

- Hüved

- Oht

- säästmine

- Jaga

- SIX

- müüdud

- stabiotsiin

- Stabiilkiinid

- kaalul

- Staking

- alustatud

- Strateegia

- toetama

- sihtmärk

- Terra

- aeg

- sümboolne

- märgid

- jälgida

- Tehingud

- USDC

- USDT

- Kasutajad

- rahakott

- Web3

- iga nädal

- töötab

- väärt

- saak

- youtube