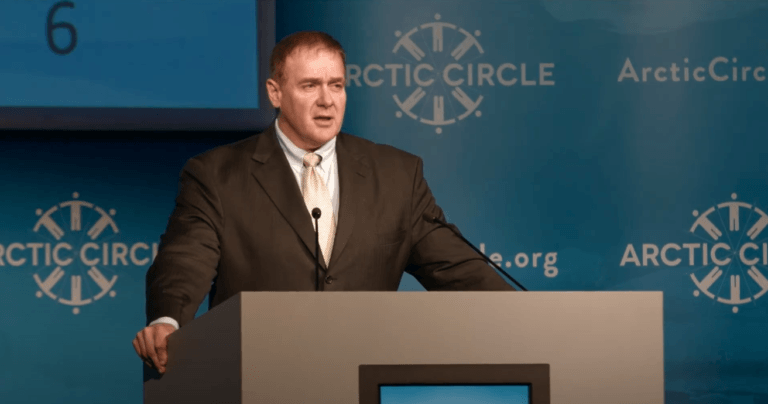

Last week, during an interview, Scott Minerd, Global Chief Investment Officer of Guggenheimi partnerid, the man who said last December that “Bitcoin should be worth about $400,000”, talked about silver, gold, and crypto.

Guggenheimi investeeringud on "Guggenheim Partnersi ülemaailmne varahalduse ja investeerimisnõustamise osakond ning omab rohkem kui 233 miljardi dollari väärtuses varasid fikseeritud tulu, aktsiate ja alternatiivsete strateegiate lõikes." See keskendub "kindlustusseltside, ettevõtete ja riiklike pensionifondide, riiklike investeerimisfondide, sihtkapitalide ja sihtasutuste, varahaldurite ja suure netoväärtusega investorite tulu- ja riskivajadustele".

27. novembril 2020 sai USA SECi jõustumisjärgse muudatuse avalduse kohaselt teatavaks, et üks Guggenheim Investmentsi fikseeritud tulumääraga investeerimisfondidest (“Makrovõimalused”) kaalub Bitcoini investeerimist. Per Financial Timesi andmed, see fond käivitati 30. novembril 2011 ja selle netovara kogumaht oli 4.97 miljardit dollarit (seisuga 31. oktoober 2020).

. SEC esitamine tehtud 27. novembril 2020 on tuntud kui "SEC POS AM” (teise nimega „jõustuv muudatus”). Seda tüüpi esitamine "võimaldab SEC-is registreeritud ettevõttel oma prospekti värskendada või muuta."

Selles avalduses väideti, et fond kaalub krüptovaluutaga kokkupuutumist:

"Cryptocurrencies (also referred to as ‘virtual currencies’ and ‘digital currencies’) are digital assets designed to act as a medium of exchange. The Guggenheim Macro Opportunities Fund may seek investment exposure to bitcoin indirectly through investing up to 10% of its net asset value in Grayscale Bitcoin Trust (“GBTC”), a privately offered investment vehicle that invests in bitcoin."

Then, on 16 December 2020, after the Bitcoin price had finally broken through the $20,000 level on all crypto exchanges to set a new all-time high, Minerd, the Guggenheim CIO, talked about Bitcoin during an intervjuu Bloombergi TV-s.

Intervjuu alustas Guggenheimi juhtivtöötajat, kellelt Bloomberg TV Markets Deski vanemtoimetaja Scartlet Fu küsis Guggenheimi makrofunktsioonide fondi ja selle juhtide otsust investeerida „kuni 10% oma puhasväärtusest halltoonides Bitcoin Trust . ” Eelkõige küsiti temalt, kas Guggenheim oli veel Bitcoini ostma hakanud ja kui palju oli see otsus Fedi erakorralise poliitikaga seotud.

Minerd vastas:

"Vastuseks teisele küsimusele, Scarlett, selgelt Bitcoin ja meie huvi Bitcoini vastu on seotud Fedi poliitika ja vohava rahatrükiga. Mis puutub meie investeerimisfondi, siis teame, et me pole SECiga veel tõhusad. Nii et teate, me veel ootame.

"Muidugi tegime otsuse hakata eraldama Bitcoini suunas siis, kui Bitcoini väärtus oli 10,000 20,000 dollarit. See on veidi keerulisem, kui praegune hind on lähemal 400,000 XNUMX dollarile. Hämmastav, teate, väga lühikese aja jooksul, kui suur eelkasutus meil on olnud, kuid olles seda öelnud, näitab meie põhitöö, et Bitcoini väärtus peaks olema umbes XNUMX XNUMX dollarit. Nii et isegi kui meil oleks täna võimalus seda teha, jälgime turgu ja näeme, kuidas kauplemine sujub, millise hinnangu järgi peame selle lõpuks ostma."

Seejärel selgitas ta, kuidas nad jõudsid Bitcoini väärtuseni 400 XNUMX dollarit:

"See põhineb nappusel ja suhtelisel hindamisel, nagu näiteks kuld protsendina SKTst. Nii et teate, et Bitcoinil on tegelikult palju kulla atribuute ja samal ajal on tehingute osas ebatavaline väärtus."

Seejärel, 11. jaanuaril, varsti pärast seda, kui Bitcoini hind oli Coinbase'is korrigeeritud 32,475 XNUMX dollarile, hoiatas Minerd kauplejaid, et Bitcoin võis tõusta liiga kiiresti ja võib-olla on aeg kasumit teenida.

On February 2, the Guggenheim CIO was interviewed by CNN anchor Julia Chatterley, who asked him what he thinks about Bitcoin.

Minerd vastas:

"We’ve been looking at Bitcoin for almost 10 years and the size of the market just wasn’t big enough to justify institutional money. As the total market cap of Bitcoin got bigger, around $10,000, it started to look very interesting and my view is we get a lot of fundamental research and if you consider the supply of Bitcoin relative let’s say to the supply of gold in the world and what the total value of gold is, if Bitcoin were to go to those kinds of numbers, you’d be talking about four hundred to six hundred thousand dollars per Bitcoin.

"Now, I’m not saying we’ll ultimately get there, but that’s an indication of what might be a measure of fair value. Tthat gives you a lot of room to run, but then when you consider that within a course of a month, we went from $20,000 to $40,000 on Bitcoin, that smacks of short-term speculation… now the air’s coming out of that speculative run, and so the money is migrating into other places…

"I don’t really see the institutional support today, which is just coming online from the likes of people like BlackRock and Guggenheim and other large institutional investors being big enough to support the valuation at its current levels… Bitcoin has had a lot of times where it’s had setbacks of 50% from its highs. I wouldn’t be surprised to see that happen again…

"I think that cryptocurrency has come into the realm of respectability and will continue to become more and more important in the global economy."

On April 7, Minerd was again interviewed by CNN’s Julia Chatterley, who wanted to know what would happen to the crypto space if there was a pullback in the price of Bitcoin.

Minerd vastas:

"When I made the $400,000 statement, I’m looking at it over a period of time 10 to 20 year. Of course, the market took off. I first started looking at buying Bitcoin at $10,000. Today, I don’t know where we are anymore. It’s become so rich so fast, maybe around $50,000, but it clearly has gotten caught up in the speculative bubble that GameStop got into and a number of these other stocks.

"I think when we get a risk-off moment, we could be seeing Bitcoin pullback to somewhere between $20,000 and $30,000, but I think for long-term investors that’ll be a great entry point."

On May 19, however, Minerd appeared to be much more bearish on crypto in general.

Well, on May 25, the Guggenheim CIO was intervjueeritud by CNBC’s “Worldwide Exchange“, where he shared his latest thoughts on Bitcoin, gold, and silver.

Vastavalt aru by Kitco News published on May 26, this is what he had to say:

"As money leaves crypto and people are still looking for inflation hedges, gold and silver are going to be much better places to go."

Minerd expects gold to reach as high as $10K per ounce in the long term:

"This is ultimately is in the cards. Silver traditionally lags. It is the poor man’s gold, and it’s the one that will have the largest move on a percentage basis. It is the high-beta version of gold."

As for his long-term outlook on crypto, although he thinks that Bitcoin and Ethereum will remain popular, he thinks the ultimate winner might be a crypto project that we have not seen yet:

"AOL was the winner. Yahoo was the winner. Then Google and other players came along. We are going to find out that some new crypto comes long, which can overcome some of the issues we are facing right now with the cost of mining, all the carbon production. And it will be a superior form of crypto, and that will become the dominant crypto."

LAHTIÜTLEMINE

Autori või selles artiklis mainitud inimeste avaldatud seisukohad ja arvamused on üksnes informatiivsed ning need ei kujuta endast finants-, investeerimis- ega muud nõuannet. Krüptokassettidesse investeerimine või nendega kauplemine kätkeb endas rahalise kahju ohtu.

- 000

- 11

- 2020

- 7

- kuulutused

- nõuanne

- nõuandev

- Materjal: BPA ja flataatide vaba plastik

- Aprill

- ümber

- artikkel

- eelis

- varahaldus

- vara

- auto

- ebaviisakas

- Miljard

- Bitcoin

- Bitcoin Hind

- BlackRock

- Bloomberg

- ostma

- Ostmine

- süsinik

- püütud

- juht

- CIO

- lähemale

- CNBC

- CNN

- coinbase

- tulevad

- Ettevõtted

- ettevõte

- sisu

- jätkama

- krüpto

- Krüptovahetused

- cryptocurrency

- valuutade

- Praegune

- Nõudlus

- digitaalne

- Digitaalsed varad

- dollarit

- majandus

- toimetaja

- Tõhus

- omakapital

- ethereum

- vahetamine

- Vahetused

- ootab

- ees

- õiglane

- KIIRE

- Toidetud

- Lõpuks

- finants-

- esimene

- vorm

- fond

- raha

- SKP

- Üldine

- Globaalne

- Maailma majandus

- Kuldne

- Halltoonid

- suur

- Suur

- Kuidas

- HTTPS

- tulu

- inflatsioon

- Institutsionaalne

- institutsionaalsetele investoritele

- kindlustus

- huvi

- Intervjuu

- investeerimine

- investeering

- Investorid

- küsimustes

- IT

- suur

- hiljemalt

- Tase

- Pikk

- Makro

- mees

- juhtimine

- Turg

- Turupiirkond

- turud

- mõõtma

- keskmine

- Kaevandamine

- raha

- liikuma

- Lähedal

- neto

- uudised

- numbrid

- Ohvitser

- Internetis

- Arvamused

- Muu

- väljavaade

- pension

- Inimesed

- poliitika

- vaene

- populaarne

- PoS

- hind

- Produktsioon

- projekt

- avalik

- teadustöö

- Oht

- jooks

- SEC

- komplekt

- Tagasilöögid

- jagatud

- Aktsiad

- Lühike

- Silver

- SIX

- SUURUS

- So

- Ruum

- algus

- alustatud

- väljavõte

- varud

- varustama

- toetama

- rääkimine

- sihtmärk

- Tehniline

- aeg

- Ettevõtjad

- Kauplemine

- Tehingud

- Usalda

- tv

- meie

- Värskendused

- Hindamine

- väärtus

- sõiduk

- vaade

- Haavatav

- Jõukus

- nädal

- WHO

- jooksul

- Töö

- maailm

- väärt

- Yahoo

- aasta

- aastat

- youtube