Bitcoin (BTC) and the overall crypto market witnessed one of the most historic crashes on Wednesday, May 19. While the entire crypto market registered a $750 billion intraday dip, Bitcoin saw its valuations tumbling by more than $150 billion in a single day.

At press time, BTC is trading at $38,307 levels with a market cap of $716 and a classic battle between Bitcoin whales and Bitcoin institutional buyers has emerged. The Bitcoin price crash followed after major whale deposits taking place at the exchanges over the last week. These deposits started even before Elon Musk’s tweets which only the fuel to the ignited fire.

Currently looking at the Whale-Dump indicator, CryptoQuant CEO Ki-Young Ju seems to be holding a bearish bias. He kirjutab:

“Whales started depositing $ BTC to exchanges when the price was $50k. Tbh, I was super bullish before Elon’s tweets, and then this shit happened after his tweet. Can’t blame him, but it seems like a butterfly effect. Until this indicator cools off, I’ll keep my bearish bias”.

Ki-Young Ju mentions that the whale dumping indicator has hit a one-year high since the March 2020 market crash. “If this is an orchestrated effort, it will go down again. If not, we may retest the bottom again at least,” he adds.

Bitcoin (BTC) Institutions Continue Buying

As the BTC price tanked all the way to $32,000 on Wednesday, institutional players rushed to Coinbase and other exchanges to make the most of the opportunity. In a FOMO buying taking place on Coinbase, the Bitcoin premium on the exchange surged to above $3000.

Coinbase FOMO buying #biquoin $3000 premium. pic.twitter.com/s5sZWiZ16L

- lahti. (@cryptounfolded) Võib 19 2021

On the other hand, the Bitcoin exchange outflows, probably going to cold wallets, also surged massively. Over $750 million worth of Bitcoins were reported moving out of the exchanges in a flash.

750,000,000 XNUMX XNUMX dollarit väärtuses #biquoin was just moved off of exchanges in the last 10 minutes. Someone bought the dip. pic.twitter.com/uvHVk0i37Q

- Bitcoini 📄 dokumenteerimine (@DocumentingBTC) Võib 19 2021

Industry giants like Michael Saylor and Ark Invest’s Cathie Wood also seemed confident about Bitcoin prospects in the future. Saylor said that all entities under his control still continue holding their $111,000 Bitcoin without selling anything.

Ark Invest’s Cathie Wood said that she’s confident of Bitcoin going to $500,000 in the future. After Wednesday’s plunge, Wood ütles Bloomberg that Bitcoin was on “sale”. Finally, the man behind this entire show, Elon Musk said that Tesla has “Diamond Hands”. Meaning, they continue to hold their Bitcoin purchase strongly.

Teslal on 💎 🙌

- Elon Musk (@elonmusk) Võib 19 2021

Source: https://coingape.com/bitcoin-whales-vs-institutions-shall-win-ultimate-battle/

- '

- &

- 000

- 2020

- absoluutne

- Materjal: BPA ja flataatide vaba plastik

- Laegas

- auto

- avatar

- lahing

- ebaviisakas

- Miljard

- Bitcoin

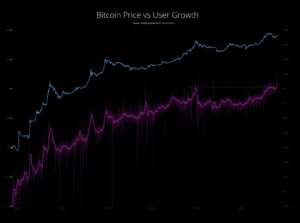

- Bitcoin Hind

- bitcoin vaalad

- blockchain

- Plokkheli tehnoloogia

- Bloomberg

- piir

- BTC

- btc hind

- Bullish

- Ostmine

- tegevjuht

- coinbase

- sisu

- jätkama

- krahh

- krüpto

- Krüptoturg

- cryptocurrencies

- cryptocurrency

- päev

- Ökonoomika

- Elon Musk

- vahetamine

- Vahetused

- Lõpuks

- rahastama

- finants-

- FINTECH

- Tulekahju

- välklamp

- järgima

- FOMO

- tasuta

- Kütus

- tulevik

- Georgia

- hea

- Suur

- hoidma

- HTTPS

- Institutsionaalne

- institutsioonid

- huvi

- investeerimine

- IT

- teadmised

- õppimine

- peamine

- mees

- Märts

- märts 2020

- Turg

- Turupiirkond

- turu uuring

- turud

- mainib

- miljon

- Arvamus

- Võimalus

- Muu

- preemia

- vajutage

- hind

- Hinnakrahh

- ostma

- teadustöö

- Ekraan

- Jaga

- oskused

- Sponsorite

- alustatud

- Tehnoloogia

- Teslal

- aeg

- ülemine

- jälgida

- Kauplemine

- piiksuma

- puperdama

- Uudised

- us

- Valuutavad väärtused

- Rahakotid

- nädal

- WHO

- võitma

- väärt