JPMorgan thinks bitcoin is below its ‘fair price’ and now features among the bank’s preferred alternative investments.

Banking giant JPMorgan said in a note Wednesday that bitcoin and cryptocurrencies are now among its preferred “alternative” investments, Markets Insider teatatud.

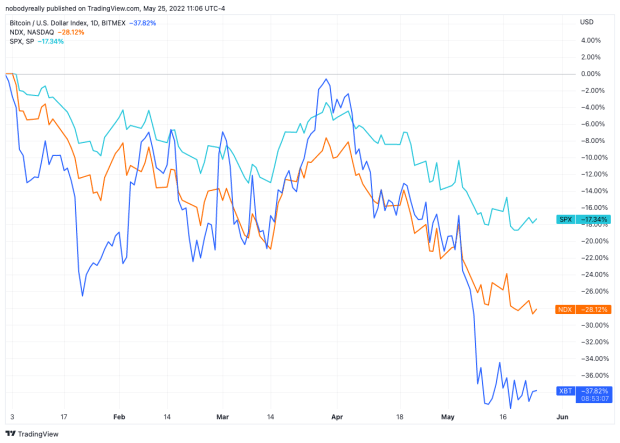

Riskantseks peetud varad, mis often includes bitcoin professionaalsete ja institutsionaalsete investorite meelest, on langenud 2022. aastal keset rangem rahapoliitika ja mitu aastakümmet kõrge inflatsiooninumbrid USA-s ja kogu maailmas.

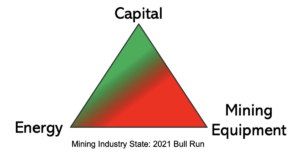

Kuid Bitcoin’s steep sell-off, nagu ka teiste krüptovaluutade oma, on olnud sügavam kui teistes alternatiivsetes investeeringutes, nagu erakapital, erakapital ja kinnisvara, teatas JPMorgan. Seetõttu näeb pank digitaalsete varade klassis rohkem ruumi tagasilöögiks kui muude alternatiivsete varade puhul.

"Seega asendame kinnisvara digitaalsete varadega, mis on meie eelistatud alternatiivne varaklass koos riskifondidega," kirjutasid panga strateegid aruande kohaselt.

JPMorgan’s strategists reportedly said in the note that the bank was sticking to its view that $38,000 was a fair price for bitcoin – about 27.5% higher than its $29,798 price at press time on Wednesday morning. Bitcoin’s discounted valuation is part of the reason why the bank has a more optimistic outlook for the digital currency going forward.

“The past month’s crypto market correction looks more like capitulation relative to last January/February and going forward we see upside for bitcoin and crypto markets more generally,” the note said, per the report.

Despite the greater attractiveness of the sector, JPMorgan reportedly said in the note that it has switched Bitcoin and cryptocurrencies from an “overweight” ranking to a “underweight” one – meaning that the bank is now less keen on the asset class and recommends a lower exposure in an investment portfolio.

- 000

- MEIST

- alternatiiv

- alternatiivsed varad

- vahel

- ümber

- eelis

- vara

- Pank

- alla

- Bitcoin

- klass

- Tulema

- krüpto

- Krüptoturg

- Krüpto turud

- cryptocurrencies

- valuuta

- Võlg

- digitaalne

- Digitaalsed varad

- digitaalse valuuta

- omakapital

- kinnisvara

- õiglane

- FUNKTSIOONID

- edasi

- raha

- üldiselt

- läheb

- suurem

- riskifondid

- rohkem

- HTTPS

- pilt

- Teistes

- hõlmab

- inflatsioon

- Institutsionaalne

- institutsionaalsetele investoritele

- investeering

- Investeeringud

- Investorid

- IT

- JPMorgan

- Likviidsus

- Turg

- turud

- tähendus

- Rahaline

- rohkem

- Muu

- väljavaade

- osa

- portfell

- vajutage

- hind

- era-

- Erakapital

- professionaalne

- väljavaated

- kinnisvara

- soovitab

- aru

- Riskantne

- Ütlesin

- sektor

- näeb

- So

- maailm

- seetõttu

- aeg

- meie

- Hindamine

- vaade

- sõda

- Kolmapäev

- maailm

- aasta