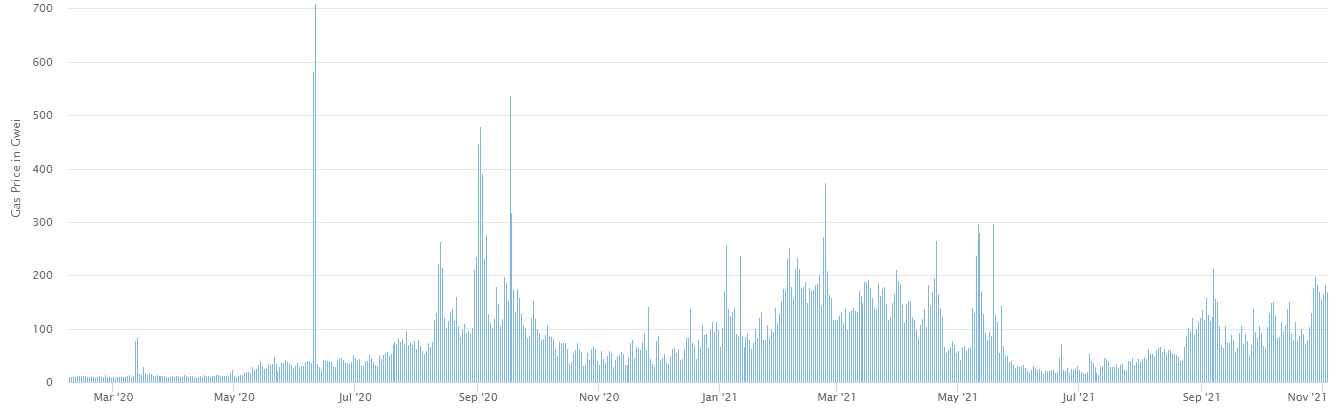

High transaction fees have been a persistent thorn in the side of investors and blockchain projects since at least 2014 when Ethereum Network co-creator Vitalik Buterin stated in reference to Bitcoin, “The ‘Internet of Money’ should not cost $0.05 per transaction. It’s kind of absurd.”

Fast forward to November 2021 and the simple act of approving a token so that it can be transacted on Uniswap can cost as much as $50 worth in Ether (ETH) depending on the time of day.

Even layer-2 solutions, which were billed as the protocols that would help solve the fee issue, have been unable to escape the high-fee curse of congested networks as new users onboard into the cryptocurrency ecosystem by the day.

isnt arbitrum supposed to be cheap lol what a joke pic.twitter.com/v839tZ4nch

— satsdart (@satsdart) November 2, 2021

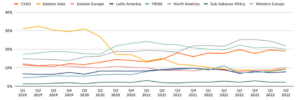

Users migrate to low fee networks

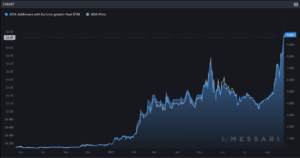

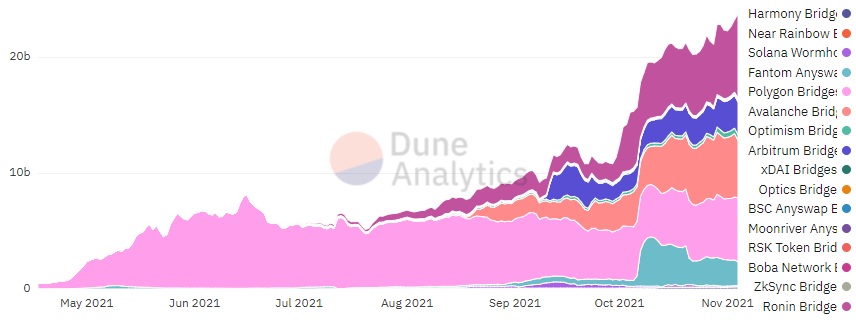

As a result of persistently high Ethereum fees, a growing number of users are bridging assets to lower-cost Ethereum Virtual Machine (EVM) compatible networks. Data from Dune Analytics shows that the total value locked on bridge protocols has been on the uptrend since the beginning of October.

As shown on the chart above, the Ronin bridge has become one of the more popular protocols over the past month thanks in large part to Axie Infinity users migrating assets to the lower fee platform.

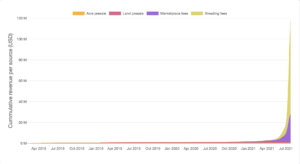

The popularity of Axie Infinity is shown in the following chart from Token Terminal displaying protocol revenue.

Seotud: How to take full advantage of the benefits of DeFi and increase high-interest savings

The third-ranked protocol by revenue is PancakeSwap (CAKE), a high TVL DeFi protocol on the Binance Smart Chain that offers significantly lower transaction fees than those found on Ethereum.

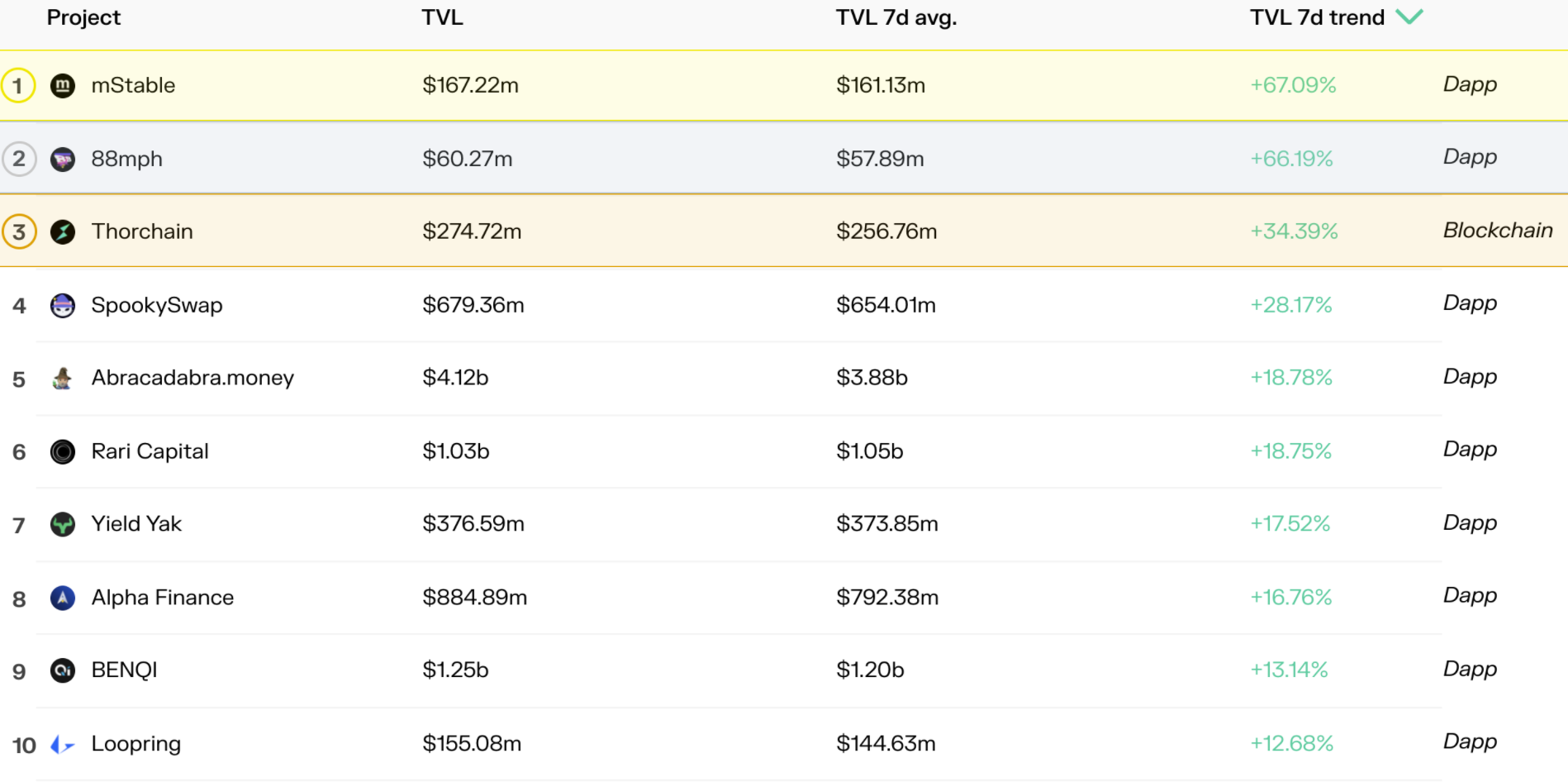

A majority of the top gainers in terms of TVL over the past week are also protocols that are either found on Ethereum competitors or offer multi-chain functionality in side-chain environments.

Avalanche, Abracadabra.money, Yield Yak, Benqi, SpookySwap and Loopring are also multi-chain or Ethereum side-chain compatible networks which have seen a significant bump in TVL in the last 7 day.

Unless something can be done in the near term about the high transaction cost on the Ethereum network, the trend of liquidity being migrated to other blockchains is likely to continue.

Siin avaldatud vaated ja arvamused on ainult autori omad ja ei pruugi kajastada Cointelegraph.com vaateid. Iga investeerimis- ja kauplemisliikumine on seotud riskiga, otsuse tegemisel peaksite ise läbi viima uuringud.

- 7

- ADEelis

- analytics

- vara

- binants

- Bitcoin

- blockchain

- blockchain projektid

- BRIDGE

- Buteriin

- Cointelegraph

- konkurendid

- jätkama

- cryptocurrency

- andmed

- päev

- Defi

- Dune

- ökosüsteemi

- Eeter

- ethereum

- ethereumi võrk

- Tasud

- edasi

- täis

- GAS

- Kasvavad

- siin

- Suur

- HTTPS

- Suurendama

- investeering

- Investorid

- IT

- suur

- Likviidsus

- Enamus

- Tegemine

- raha

- liikuma

- Lähedal

- võrk

- võrgustikud

- pakkuma

- Pakkumised

- Arvamused

- Muu

- inimesele

- Platvormid

- populaarne

- projektid

- protokoll

- teadustöö

- tulu

- Oht

- lihtne

- nutikas

- So

- Lahendused

- LAHENDAGE

- aeg

- sümboolne

- ülemine

- Kauplemine

- tehing

- puperdama

- Lahutage

- Kasutajad

- väärtus

- virtuaalne

- virtuaalne masin

- vitalik

- vitalik buter

- nädal

- väärt

- saak