It’s time to sort out the damage from the January plunge. And take note of a silver lining.

Terra (Luna), the DeFi sector’s largest asset and second-ranked network, was among the hardest hit, with its price crumbling by half while TVL dropped more than a third over the past month. The combined capitalization of DeFi assets has failed to bounce alongside leading cryptocurrencies this past week.

DeFi assets are at $109B according to MüntGecko, up just 3.3% since a four-month low of $105.3B on Jan. 28. By contrast, Ether is up 24% from its Jan. 24 bottom, while Bitcoin is up nearly 15% since its local low on the same date.

The DeFi market cap is down 37% since its all-time high of $174.7B on Nov. 12. DeFi assets currently represent 6% of the global crypto capitalization.

Tippjuhid

Despite the DeFi market cap remaining down in the doldrums, roughly 70 of the sector’s 100 largest assets are up for the week.

Trader Joe (JOE) + 79%

Synthetix Network Token (SNX) + 30.9%

Lido DAO (LDO) + 25.8%

Orion Protocol (ORN) + 25.1%

Beefy Finance (BiFi) + 24.5%

Suurimad kaotajad

Rebase tokens have continued to take a beating, with OlympusDAO, Wonderland, Redacted Cartel, and KlimaDAO each posting all-time lows in the past seven days.

Imedemaa (TIME) – 57%

Redakteeritud kartell (BTRFLY) – 23.5%

Keep3rV1 (KP3R) – 20.7%

Terra (Luna) – 20.1%

Tribe (TRIBE) – 12.3%

Fantom Gains Marketshare as DeFi TVL Falls

The total value locked in DeFi protocol has also struggled to recover, currently sitting at $195B after slumping to a four-month low of $182.7B on Jan. 25 according to DeFi laama.

Curve is the largest protocol by cross-chain TVL with $17.6B locked across eight network’s followed by Ethereum’s MakerDAO and Convex Finance with $16B and $12.4B respectively. Convex’s TVL is down 40% in the past month, while Curve has shed 27% and MakerDAO 11%.

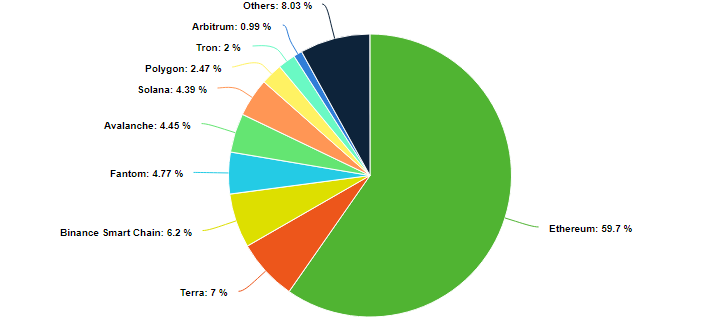

Ethereum represents nearly 60% of TVL, with $116.5B currently locked on the network. Ethereum’s TVL fell to 102.7B on Jan. 23, its lowest level since early August.

The down-trend saw Fantom emerge as the fourth-largest network, with its TVL steadily growing until posting an all-time high of $12.7B on Jan. 25. Fantom now represents $9.3B, ranking behind Terra’s 13.6B and Binance Smart Chain’s $12.1B.

Avalanche and Solana are closely duking it out for fifth with $8.9B and $8.6B respectively.

Kiht 2

The combined TVL of Ethereum’s Layer 2 networks fell to its lowest level since Nov. 1 on Jan. 22, dipping slightly below $5B according to L2 beat.

Arbitrum continues to dominate the L2 sector with $2.9B or 51.5% of TVL, followed by dYdX with $961M or 17.2%, and Optimism with $474M or 8.5%. Rival optimistic rollup network Metis Andromeda ranks fourth with $395M.

NFTs a Silver Lining

NFTs have bucked the selloff, with the floor prices of top-ranked collection Bored Ape Yacht Club up nearly 50% since the start of January. CryptoPunks ranks second with a floor price of 84 ETH or roughly $230,000.

Terraforms By Mathscastles was the week’s top-traded NFT collection, with DappRadar hindamisel the series drove $1.64B worth of volume since Jan. 24.

Meebits ranked second with $1.45B in weekly volume, followed by Dotdotdots with $434M, Audioglyphs with $127B, and BAYC with $108M.

Burn Rate Falls

Ethereum’s network activity has since the ETH has begun to recover, with 84,083 Ether burned in the past seven days at a rate of 8.34 ETH every minute according to Ultraheli raha.

The weekly burn rate has dropped by one-third since posting a rekordiliselt kõrge of 12 ETH per minute three weeks ago.

Unrelenting activity in the NFT markets drove persistently high activity on leading marketplace OpenSea, which represented 18.5% of the week’s total burn. ETH transfers were the second-largest source of burnt Ether with 8.7%, followed by Uniswap v3 with 5.3%, and Tether with 3.1%.

- 000

- 100

- 70

- 84

- Vastavalt

- üle

- tegevus

- vahel

- eelis

- vara

- AUGUST

- binants

- Bitcoin

- Kapitaliseerimine

- klubi

- MüntGecko

- kogumine

- pidev

- Cross-Chain

- krüpto

- cryptocurrencies

- Krüptopunktid

- kõver

- DAO

- Defi

- alla

- langes

- didx

- Varajane

- ETH

- Eeter

- rahastama

- Globaalne

- Kasvavad

- Suur

- HTTPS

- IT

- Jaanuar

- juhtivate

- Tase

- kohalik

- lukus

- MakerDao

- Turg

- Turupiirkond

- turul

- turud

- võrk

- võrgustikud

- NFT

- OpenSea

- hind

- protokoll

- Taastuma

- esindab

- rivaal

- sektor

- Seeria

- Jaga

- Silver

- nutikas

- Solana

- algus

- varu

- Tether

- aeg

- sümboolne

- märgid

- Lahutage

- väärtus

- maht

- nädal

- iga nädal

- väärt