Lahtiütlus: Järgneva analüüsi tulemused on kirjaniku ainukesed arvamused ja neid ei tohiks võtta investeerimisnõustamisena

Very few buy opportunities have been presented in the Dogecoin market. Trading at a 73% discount from its May all-time high, DOGE has been picked apart by short-sellers who have capitalized on weakening meetrika on all fronts.

Over the next week, the major support line of $0.160 would be under tremendous pressure to fuel a rally. If sellers continue their relentless assault, another 50% plummet to February levels would be possible.

At the time of writing, DOGE was trading at $0.201, down by 3.4% over the last 24 hours.

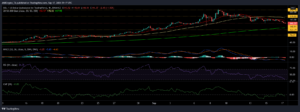

Dogecoini päevakaart

Dogecoin’s daily chart offered a buffet of bearish signals. Firstly, the candles traded below their daily 20, 50, and 200 Simple Moving Average lines. Not only do such readings attract short-selling, but also dissuade buyers from taking up long positions.

Secondly, a death cross was just around the corner, one which exposed the market to another major sell-off. Moreover, retail traders have sought different options rather than testing their luck with Dogecoin. Data from Santiment highlighted that its trading volume has remained in the $1-$2 billion range lately, as opposed to the $5-$7 billion range seen during rallies.

Now, keeping these factors aside, the Visible Profile suggested that DOGE was still trading within its developing value range of $0.455 and $0.17. As long as DOGE maintains above the lower end of this range, a complete blowout can be avoided.

A minor rally seemed possible as investors mop up DOGE at the $0.16-support. However, a close below $0.16 would open the floodgates for an extended fall. The next immediate support lay at $0.087. This meant that DOGE would decline by another 43% before buyers can respond.

Põhjendus

Of late, Dogecoin has been trending lower after a descending triangle breakdown. A Sarnasusi to $0.232 can be expected to transpire into further losses towards $0.16. Naturally, DOGE’s indicators flashed alarm bells. The RSI was close to the overbought zone and suggested some more weakness before a reversal.

The Awesome Oscillator and MACD also maintained movement below their respective half-lines due to market weakness.

Järeldus

Apart from a few scalping opportunities, short-selling seemed to be the most viable trading strategy in the Dogecoin market.

Although shorting at DOGE’s press time level would not be a bad call, a safer bet can be placed once DOGE closes below $0.16-$0.17.

Kuhu investeerida?

Telli meie uudiskiri

Source: https://ambcrypto.com/this-is-the-safest-strategy-for-dogecoin-traders/

- 7

- Materjal: BPA ja flataatide vaba plastik

- analüüs

- ümber

- ebaviisakas

- Miljard

- ostma

- helistama

- Konteiner

- jätkama

- andmed

- Allahindlus

- Dogecoin

- Kütus

- Suur

- Esiletõstetud

- HTTPS

- investeering

- Investorid

- pidamine

- Tase

- joon

- Pikk

- peamine

- Turg

- avatud

- Arvamused

- Võimalused

- Valikud

- vajutage

- surve

- profiil

- ralli

- valik

- jaemüük

- Scalping

- Sellers

- Lühikeseks müük

- Pikkus

- lihtne

- Strateegia

- toetama

- Testimine

- aeg

- Ettevõtjad

- Kauplemine

- trendid

- väärtus

- maht

- nädal

- WHO

- jooksul

- kirjanik

- kirjutamine