See on arvamustoimetus autor Julian Liniger, the co-founder and CEO of Relai, a bitcoin-only investment app.

Traditsioonilised pangad on lühiajalised kliendid, kuna nad ei suuda kajastada pakutavate säästukonto intressimäärade inflatsioonilisi muutusi. Peal keskmineUSA-s on need kontod 0.3% – see on nominaalmäär tänapäeva majandusmaastiku kontekstis.

Mõned võivad mäletada, et sulgemise ajal säästsid Ühendkuningriigi leibkonnad lisaraha £ 190 miljardit, kuid nende rahaliste vihmapäevade väärtus on inflatsiooni tõttu kiiresti vähenenud. Inflatsioon on "vaikiv varas" ja selle mõju tähendab, et hoiustajad jälgivad jätkuvalt oma raskelt teenitud säästude väärtuse ammendumist või võivad nad otsida alternatiive, millel on pikaajaline väärtus.

It also could be time to look at alternative investment options and asset classes that are divorced from inflationary fluctuations and are especially resilient to the threat of governmental debasement in times of political or economic turbulence. Bitcoin, when used for long-term saving, is one such alternative, and one that more people will be considering as part of a rounded portfolio designed to beat inflation as well as geopolitical uncertainty.

Investorid kaotavad tavapärastes pankades säästes

Pangandushiiglased segavad igapäevaseid investoreid, kui neil ei õnnestu intressimäärasid tõsta vaatamata sellele, et keskpangad tõstavad baasintresse. Näiteks Inglismaa Pank tõstis baasintressi 1.75. aasta augustis 2022%-ni.

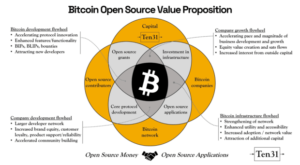

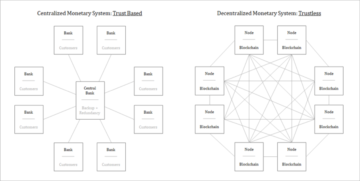

The other problem with savings and investing via traditional banks is that government-issued currency comes with counterparty risk and, on top of that, intrinsically has zero value. Government central banks print based on demand and there’s a risk of value loss due to inflation or becoming worthless when hyperinflation occurs. Bitcoin, on the other hand, has a finite supply and a hard-coded monetary policy, giving the commodity anti-inflationary and store-of-value aspects similar to gold.

Bitcoin has traditionally excelled in zero- or low-interest environments. Since the 1990s, central banks around the world have set low or negative interest rates, and it’s likely that we’ll see a return to this strategy to battle looming recessions.

One substantial lesson shared by investors in these low-interest environments is to forget any wishful thinking that interest rates will increase and to allocate their money accordingly. For this reason, bitcoin is a logical choice as its decentralized and finite properties are practically unaffected by inflation and interest rates set by central banks.

Usaldus traditsioonilise panganduse vastu väheneb

Alates 2008. aasta finantskriisist on pangad muutunud paljude investorite jaoks mõneti võhmaks. ELi üksikisikud usaldavad vähem traditsioonilisi pangaasutusi ja küsitlusi YouGov viitab sellele, et ainult mõned britid usaldavad endiselt traditsioonilisi panku, kusjuures 36% usub, et need asutused tegutsevad nende huvides.

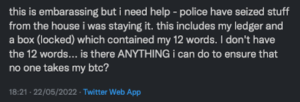

Pole üllatav, üks neljast millennials, Generation X and Generation Z investors turn to cryptocurrency as their asset class of choice. These generations have reduced faith in centralized institutions, like banks, due to continuous economic instability experienced in their lifetime. Moreover, bitcoin allows investors to benefit from self-custody, where only they have possession and control of their assets. This isn’t the case for traditional banks and can leave people feeling a lack of control during economic uncertainty — or worse yet — during a financial crash.

This increasing level of distrust for traditional banking institutions coincides with dwindling confidence in national currencies. Countries like Turkey, Lebanon or Argentina are real-world examples of how inflation can get out of control and how people eventually lose trust in their local currencies. A global, borderless, nationless digital currency, like bitcoin, is becoming more appealing as a vehicle to store wealth.

Bitcoin Saving Accounts Are Designed For The Risk-Averse And Beginners

uurimistöö näitab, et elukallidusest põhjustatud rahaline ebakindlus tähendab, et 46% brittidest on vähendanud või lõpetanud mingisse säästmisvahendisse maksmise. Praegu on meil palju riskikartlikke inimesi, kes hoiduvad investeerimisest või otsivad võimalusi passiivseks säästmiseks.

At Relai, we offer a bitcoin säästuplaan suited to individuals who prefer an automated hands-off approach to saving in bitcoin.

Passively and regularly investing in bitcoin also allows investors to deploy a strategy called “cost averaging.” This is where individuals regularly purchase bitcoin, while ignoring market conditions and volatility. Individuals with little investment capital can potentially accrue significant gains through this strategy in the long run.

The current economic situation across the globe has highlighted the weakness of fiat currencies and the need for alternative long-term store-of-value options like bitcoin. However, before making any investment decision, it’s important to do your own research and weigh whether the choice is right for you.

This is a guest post by Julian Liniger. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

- Pank

- Bitcoin

- Bitcoin ajakiri

- blockchain

- plokiahela vastavus

- blockchain konverents

- coinbase

- coingenius

- üksmeel

- krüptokonverents

- krüpto mineerimine

- cryptocurrency

- kultuur

- Detsentraliseeritud

- Defi

- Digitaalsed varad

- ethereum

- masinõpe

- mitte vahetatav märk

- Arvamus

- Platon

- plato ai

- Platoni andmete intelligentsus

- PlatoData

- platogaming

- hulknurk

- tõend osaluse kohta

- relee

- säästmine

- W3

- sephyrnet