- U.S. Senators wrote an open letter to the CEO of Fidelity regarding its bitcoin 401(k) plan.

- Senators condemned the financial institution for offering bitcoin as an optional retirement investment strategy.

- The senators also recognize the struggles of Americans trying to save for retirement but can’t seem to understand traditional finance is the problem.

An avaliku kirja from three U.S. Senators was sent to the CEO of Fidelity Investments to condemn the company’s recent launch of a bitcoin 401(k) retirement plan.

Senators Elizabeth Warren, Richard Durbin and Tina Smith called Fidelity’s decision to offer exposure to bitcoin through retirement accounts “immensely troubling.”

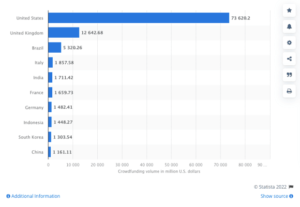

The senators argue that bitcoin is “a volatile, illiquid, and speculative asset” unfit for the retirement accounts of U.S. citizens. The legislators continued to explain some statistics in detailing the small amount of money that is, on the median, held on these retirement accounts –– $33,472.

Warren ja tema kolleegid maalivad seejärel pildi ameeriklastest, kes vajavad pensionile jäämist, kuna nad elavad kauem kui kunagi varem ja tõenäoliselt kestavad oma pensionisäästud kauem.

“This begs the question: when saving for retirement is already a challenge for so many Americans, why would Fidelity allow those who can save to be exposed to an untested, highly volatile asset like Bitcoin?,” reads the letter.

Näib, et kuigi senaatorid suudavad mõista, et töötajate põlvkonnal, kes jõuab järk-järgult kõrgemasse vanusesse kui nende eelkäijad, on selgelt puudu säästudest, puudub neil võime märgata selle tegelikku põhjust. Nagu poliitikas sageli juhtub, vaadatakse status quo säilitamiseks sageli halvasti, kuigi probleemile on lihtne osutada, eemaldumisele selgroo põhjusest – mille üheks osaks on vaieldamatult ka traditsioonilised finantsinfrastruktuurid.

Fidelity is providing the optionality of escape from a doomed system for its customers. Additionally, as the senators pointed out in their letter, Fidelity also caps retirement investment allocations to bitcoin. By doing this, Fidelity is effectively providing the optionality of bitcoin while preventing investors from placing all of their funds in that basket.

Fidelity researched Bitcoin, mõistis selle väärtust ja hakkas pakkuma piiratud riskipositsiooniga toodet, et tagada, et turu lühiajaline kõikumine ei kahjustaks kellegi elatist. Samuti investeeringute juht selged piirjooned that bitcoin is not a short-term bet and that investors should develop long-term investment strategies.

- Bitcoin

- Bitcoin ajakiri

- blockchain

- plokiahela vastavus

- blockchain konverents

- coinbase

- coingenius

- üksmeel

- krüptokonverents

- krüpto mineerimine

- cryptocurrency

- Detsentraliseeritud

- Defi

- Digitaalsed varad

- elizabeth warren

- ethereum

- truudus

- Õigus

- masinõpe

- uudised

- mitte vahetatav märk

- Platon

- plato ai

- Platoni andmete intelligentsus

- PlatoData

- platogaming

- hulknurk

- tõend osaluse kohta

- pensionile

- USA senat

- W3

- sephyrnet