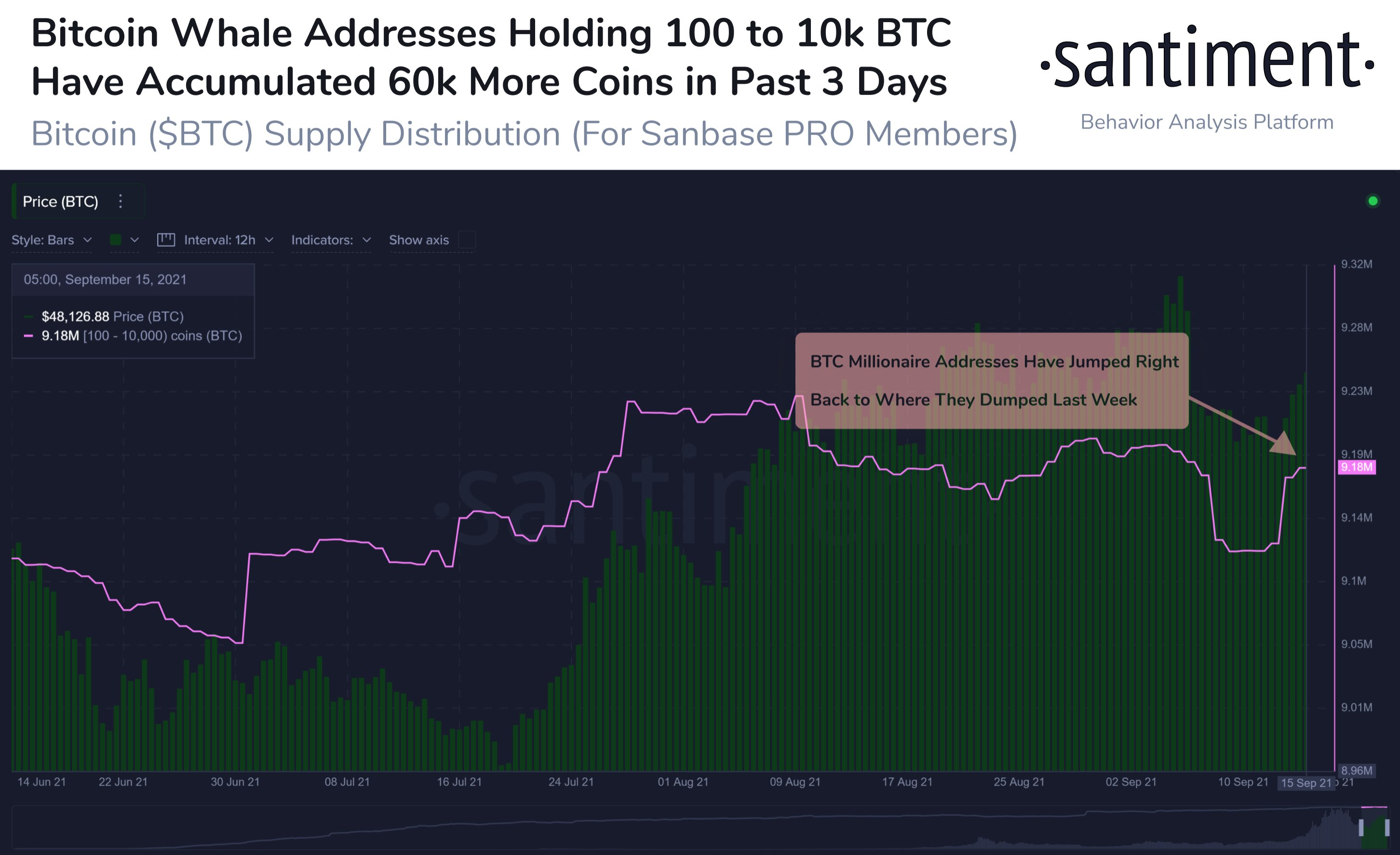

Retail investors need to beware as Bitcoin’s millionaire-tier whale addresses might be playing around with them! As per data from Santiment, Bitcoin’s millionaire-tier whale addresses holding between 100 to 10K Bitcoin dumped their BTC holdings during September 6-7.

As the BTC price tanked nearly 15% under $45,000 followed by retail profit booking, these whales purchased the BTC back again. Over the last three days, these whales have purchased 60K BTC with its price surging by another 5%. This is a classic case of squeezing supplies from the hands of retail investors.

Glassnode co-founders “Yann and Jan” also made similar observations. In the latest update, they نوشت:

چند # بیت کوین holders were shaken out over the last week, realising losses on-chain. Stronger hands stepped in and bought the dip. As $ BTC breaks above $48k, net realised PnL has returned positive, and the market is absorbing those profitable spent coins.

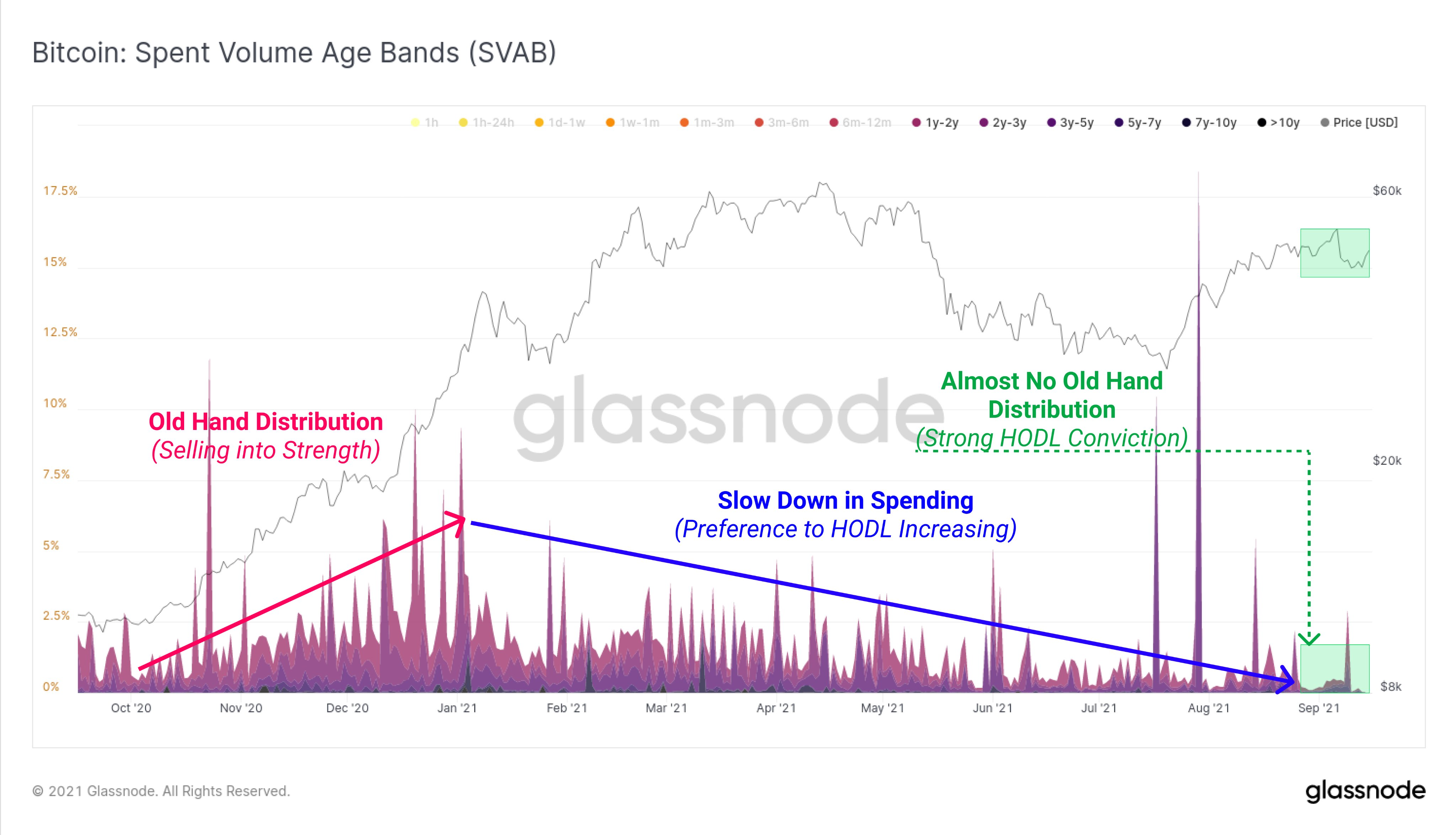

However, despite Bitcoin showing volatility in September, old hands remain confident and continue holding. These are typically investors holding Bitcoins for more than one year. As per the Spent Volume Age Bands (SVAB), bitcoin holding has dropped to a multi-year low. This shows strong conviction among old hands to HODL.

مقررات رمزنگاری باید با نهنگ ها شروع شود

Amid the regulatory crackdown on crypto recently, regulators have been going hard after several crypto projects in the market. However, Forbes analyst Oliver Renick notes that the regulators should rather target the crypto VIP aka the whales who control larger power in price manipulations. He می نویسد::

It follows that the people who pose a threat are those with the most ability to move the markets. Those people are whales, investment vehicle providers, fund managers, token creators. The crypto VIP.

It makes sense to begin regulation by imposing trading rules and disclosure requirements akin to the constraints of these groups in traditional markets, to crypto owners who meet some certain market-cap threshold in any given asset.

This would certainly be a herculean task for the regulators since it would mean larger transparency of the wallets. Let us know your views on whether if the regulators should go after the whales.

مشترک شدن در خبرنامه ما رایگان

Source: https://coingape.com/as-btc-surges-past-48000-are-bitcoin-whales-playing-pump-and-dump/

- 000

- 100

- آگهی

- معرفی

- در میان

- روانکاو

- دور و بر

- دارایی

- بیت کوین

- نهنگ های بیت کوین

- BTC

- قیمت btc

- بنیانگذاران

- سکه

- محتوا

- ادامه دادن

- عضو سازمانهای سری ومخفی

- ارز رمزنگاری

- داده ها

- کاهش یافته است

- مالی

- فوربس

- صندوق

- HODL

- نگه داشتن

- HTTPS

- سرمایه گذاری

- سرمایه گذاری

- سرمایه گذاران

- IT

- آخرین

- بازار

- تحقیقات بازار

- بازارها

- حرکت

- خالص

- عضویت در خبرنامه

- نظر

- صاحبان

- مردم

- قدرت

- قیمت

- سود

- پروژه ها

- پمپ و تخلیه

- تنظیم

- مقررات

- رگولاتور

- مورد نیاز

- تحقیق

- خرده فروشی

- سرمایه گذاران خرده فروشی

- قوانین

- حس

- اشتراک گذاری

- هدف

- رمز

- تجارت

- شفافیت

- بروزرسانی

- us

- وسیله نقلیه

- نوسانات

- حجم

- کیف پول

- هفته

- واتساپ

- WHO

- سال