A report published by Citi analysts has revealed that fears of contagion in the cryptocurrency market have peaked for now as numerous indicators in the space have started easing, at a time in which numerous market makers and brokers are making counterparty exposure disclosures.

As CoinDesk reported, Celsius Network recently filed for Chapter 11 bankruptcy protection, while Lido Finance staked ether ($stETH) token is returning to parity with the price of ether ($ETH), which suggests that liquidity stress may now have passed.

Investors can stake their ETH on Ethereum’s Beacon Chain to earn rewards from staking. The funds are, however, locked until after the Merge occurs. Lido’s stETH provides investors with a token representing staked ETH earning yield that can be used. To redeem stETH, users will have to wait until the Merge is complete and tokens are unlocked.

As many large brokers and market makers in the space have disclosed their exposures, Citi adds, an “acute deleveraging phase” the space underwent has now ended. Moreover, Citi’s report pointed out that stablecoin outflows have been stemmed, while outflows from cryptocurrency exchange-traded funds (ETFs) also stabilized.

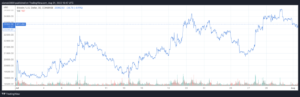

Per the banking giant, exchange and futures leverage is now “benign.” The report adds that volatility in the cryptocurrency space led to a number of “intra-market dislocations,” including a premium on the price of Bitcoin trading on Coinbase versus the price on Binance when paired against USDT disappearing and turning into a discount.

همچنین بخوانید: نحوه انتقال کریپتو از بایننس به کوین بیس: راهنمای گام به گام

همانطور که CryptoGlobe گزارش داد، Coinbase Premium has since turned positive after rising to near the 0.075 mark, marking its second move into positive territory after briefly spiking to 0.217 on June 30, before slipping back into negative territory.

When the premium is positive, it shows buying pressure on the exchange is heating up. That pressure, according to CryptoQuant CEO Ki Young Ju, likely comes from institutional investors in the United States. In mid-June, the CEO noted most U.S. institutional investors are using Coinbase, which meant at the time investor sentiment wasn’t high as the Coinbase price premium was negative.

قابل ذکر است Binance has recently surpassed its Nasdaq-listed rival Coinbase in being the cryptocurrency trading platform with the largest Bitcoin holdings, with Coinbase’s holdings steadily dropping since 2020 and Binance’s steadily rising since launch.

مطابق با آخرین بررسی ارز CryptoCompare طبق گزارش، بایننس با 398 میلیارد دلار معامله در ماه گذشته، جایگاه خود را به عنوان بزرگترین صرافی ارزهای دیجیتال برتر از نظر حجم حفظ کرد. پس از Binance، FTX با 71.6 میلیارد دلار معامله شد و Coinbase با 59.1 میلیارد دلار معامله شد. بایننس در ماه گذشته 24.2 درصد از حجم خود را از دست داد، در حالی که FTX 19.9 درصد و کوین بیس 25.8 درصد از دست دادند.

Citi noted that the Coinbase premium being positive suggests reduced stress in the cryptocurrency market, which the bank said is probably too small and isolated to have spillover effects into the wider financial markets or the economy, although it can affect investor sentiment.

اعتبار تصویر

عکس های ویژه از طریق می Unsplash.

- بیت کوین

- بلاکچین

- انطباق با بلاک چین

- کنفرانس بلاکچین

- coinbase

- coingenius

- اجماع

- کنفرانس رمزنگاری

- معدنکاری رمز گشایی

- کریپتو کارنسی (رمز ارزها )

- cryptoglob به

- غیر متمرکز

- DEFI

- دارایی های دیجیتال

- ethereum

- فراگیری ماشین

- بازارها

- رمز غیر قابل شستشو

- افلاطون

- افلاطون آی

- هوش داده افلاطون

- پلاتوبلاک چین

- PlatoData

- بازی پلاتو

- چند ضلعی

- اثبات سهام

- W3

- زفیرنت