The Oracle of Omaha Warren Buffet once said, “Be fearful when others are greedy and be greedy when others are fearful.” Taking a contrarian position can be frightening, but it often leads to great financial opportunities.

Should you be wary of altcoins?

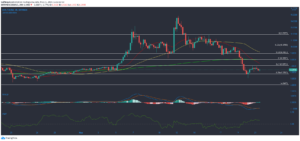

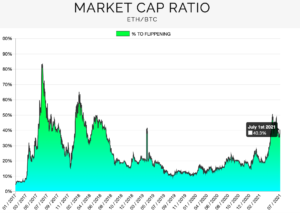

It can be argued that over the past few weeks, the price appreciation recorded by some آلتوین ها has overshadowed بیت کوین own growth. Consider this – Altcoins حساب for about 33% of the total cryptocurrency market. That is up from just 22% at the beginning of August. And yet, the surge in altcoins’ market dominance has some like جی پی مورگان‘s analysts raising red flags.

در اخیر توجه داشته باشید to their clients, JPMorgan analysts cautioned users about the August trading boom. This surge saw spot market trading volumes surpass the $1T mark. The blog اشاره کرد,

“That buying frenzy in stocks also spilled over into “altcoins” in August as investors piled into non-fungible tokens. The افزایش in NFTو DEFI activity has helped not only Ethereum, but also cryptocurrencies that facilitate smart contracts such as Solana, Binance Coin, and Cardano to soar.”

نیازی به گفتن نیست، سولانا, کاردانو saw a huge bump in their price rallies. Especially the former, with Solana up by more than 7,000% year-to-date at press time. Looking into NFTs, OpenSea, one of the largest NFT marketplaces, has seen trading volumes on its platform increase by بیش از٪ 76,000 since the beginning of 2021. In fact, just recently, its trading volume پیشی گرفت $ 4 میلیارد

Along the same lines, here’s an interesting aspect that must be noted. According to the bank,

“… retail investor net flows into U.S stocks hit a record high of almost $16 billion in July and stood at about $13 billion in August. The previous record was $10 billion last June.”

Reddit-inspired day traders certainly بازی a crucial role in moving the market as well, the firm added.

It was in light of the aforementioned “madness” that JPMorgan’s executives opined,

“Cryptocurrency markets [are] looking frothy again”

The note went on to conclude,

«به نظر میرسد که سهم آلتکوینها بر اساس استانداردهای تاریخی نسبتاً افزایش یافته است و به نظر ما بیشتر بازتابی از «شیدایی» سرمایهگذاران خردهفروش است تا بازتابی از روند صعودی ساختاری.

Is there reason to be worried though? While the scale of the hikes did take many by surprise, most would argue that there were good reasons behind the likes of Cardano and Solana hiking. The former, for instance, is closing in on the Alonzo HFC event which involves smart contracts. The latter, while it has been one of August’s strongest-performing cryptos, has also outshone most alts on the fronts of development and social sentiment.

Do fear and greed play a part in the crypto-market?

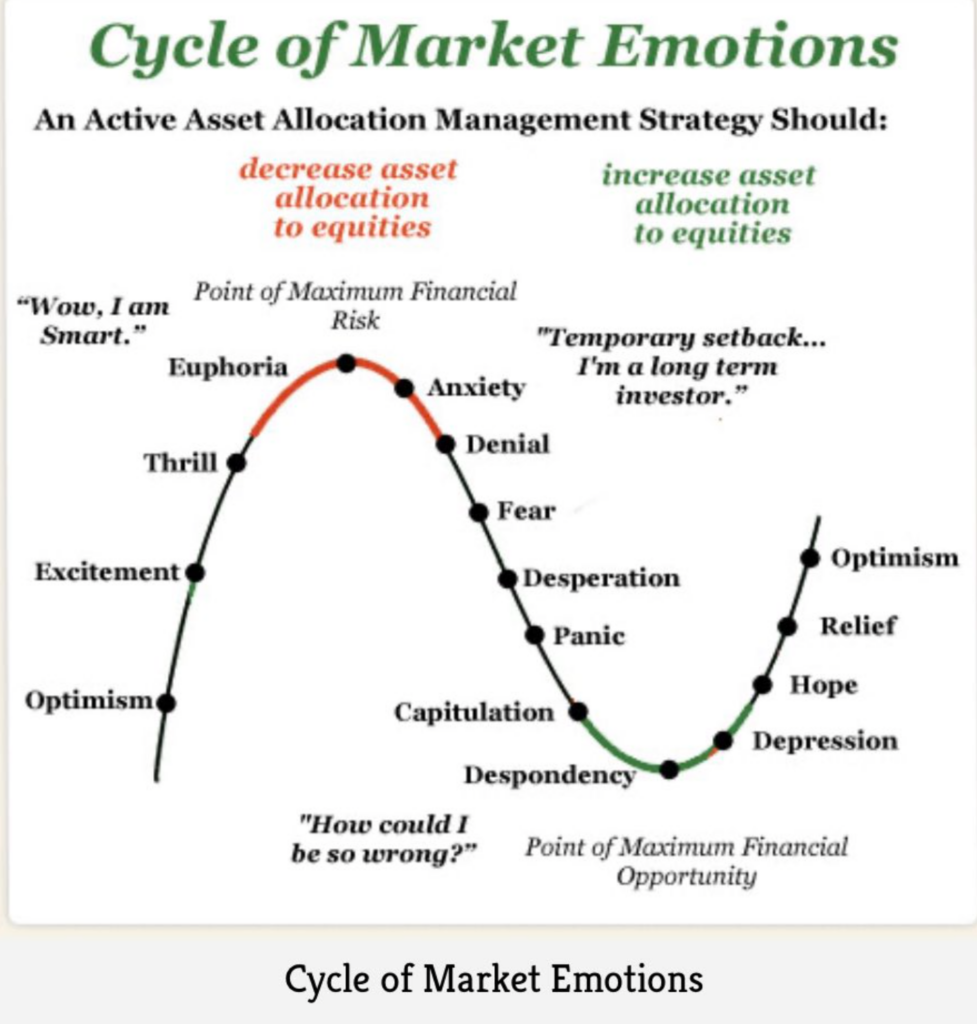

History, perhaps, gives us the best response to the aforementioned question. Each time the crypto-market’s Fear and Greed index has fallen below 20, the market has undergone a reversal. Why? Because sentiments of “despondency” are often seen to be points of “Maximum Financial Opportunity.”

منبع: توییتر

On the contrary, when markets are greedy, most traders are at the “Point of Maximum Financial risk.”

Having said that, will these warnings stop investors and especially traders from making a quick profit from altcoins? Not really.

کجا سرمایه گذاری کنیم؟

مشترک شدن در خبرنامه ما

- 7

- آلتو کین

- اوت

- بانک

- بهترین

- بیلیون

- بنیان

- سکه Binance

- بلاگ

- رونق

- خریداری کردن

- کاردانو

- سکه

- ظرف

- قرارداد

- ارز رمزنگاری

- کریپتو کارنسی (رمز ارزها )

- بازار کریستوگرام

- روز

- پروژه

- DID

- واقعه

- مدیران

- مالی

- شرکت

- خوب

- بزرگ

- رشد

- زیاد

- HTTPS

- بزرگ

- افزایش

- شاخص

- سرمایه گذار

- سرمایه گذاران

- IT

- جی پی مورگان

- جولای

- سبک

- ساخت

- علامت

- بازار

- بازارها

- خالص

- NFT

- NFT

- نشانه های غیر قارچی

- نظر

- فرصت ها

- فرصت

- وحی

- سکو

- فشار

- قیمت

- سود

- دلایل

- پاسخ

- خرده فروشی

- خطر

- مقیاس

- احساس

- اشتراک گذاری

- هوشمند

- قراردادهای هوشمند

- آگاهی

- سولانا

- Spot

- استانداردهای

- سهام

- افزایش

- تعجب

- زمان

- نشانه

- معامله گران

- تجارت

- us

- کاربران

- حجم

- وارن

- وارن بافت