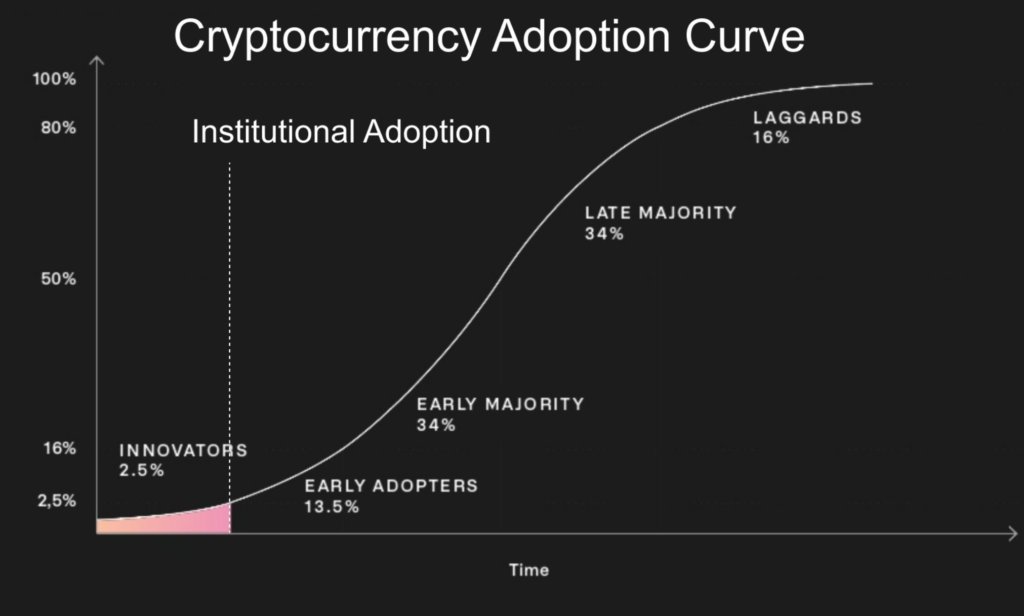

The craze around cryptocurrencies has had many former skeptics announce their change of hearts. Institutions now are openly expressing their interest, not only in بیتکوین، but other altcoins as well. Irrespective of one coin’s specific growth in popularity, however, اتخاذ has also significantly increased in 2021.

The same was the case with respect to blockchain adoption as well, with a Deloitte بررسی last year observing that over 55% of the respondents believe the tech to be critical to the future.

گلدمن ساکس is one of the latest institutions to make such a u-turn, with its recent “then vs now” analysis underlining the evolution of cryptocurrency adoption rates over time.

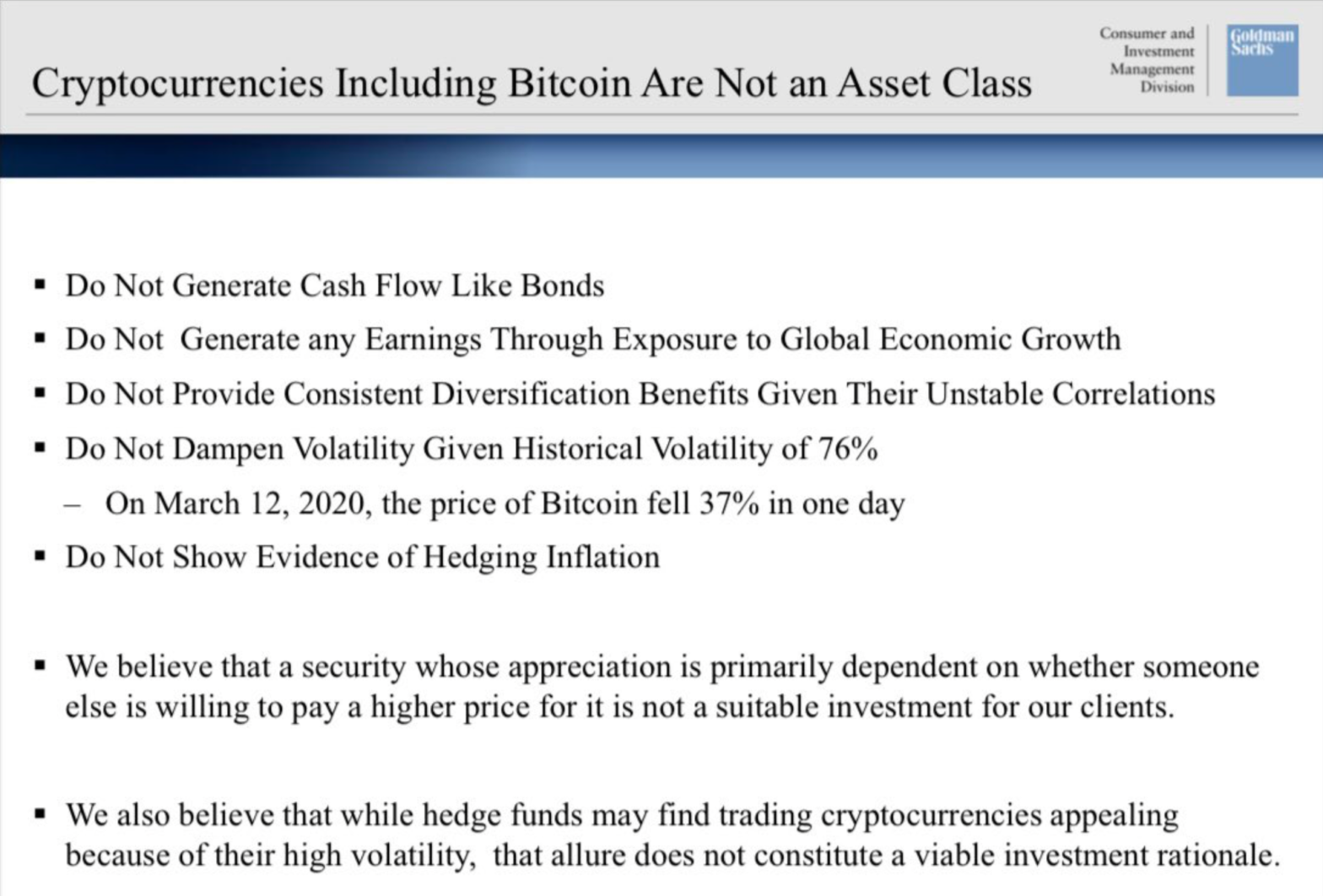

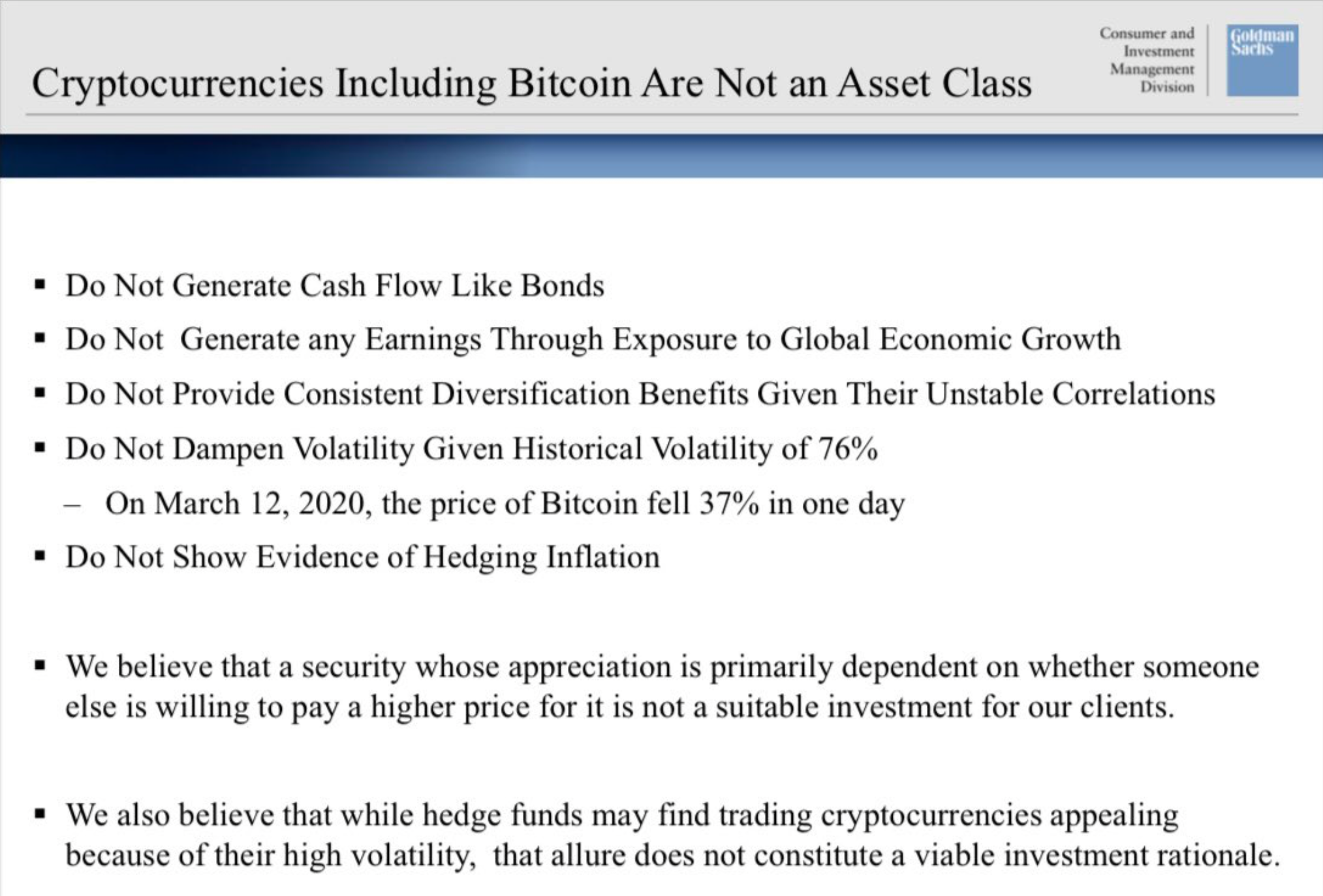

Last year’s report (May 2020)

A report published the previous year was largely bearish about Bitcoin and other crypto-assets. As per the firm’s نمایش به صورت اسلاید, there were various different reasons why Bitcoin could not be considered an asset class, including its association with قاچاق فعالیت.

منبع: گلدمن ساکس

Fast forward to 2021…

در گزارشی با عنوان ‘Crypto: a new asset class?’ the bank studied Bitcoin and the emergence of the larger crypto-market as an asset class, a study exactly contrary to what the firm contended a year ago. الکس کروگر, economist, crypto-trader, and founder of asset management firm Aike Capital shared few screenshots on his social media platform regarding the same.

Crypto، یک طبقه دارایی جدید – گزارشی کاملاً جامع توسط گلدمن. pic.twitter.com/FP2sewJCTx

- الکس کروگر (krugermacro) ممکن است 21، 2021

Needless to say, various experts, including both proponents as well as skeptics, were quick to share their views on the latest report from Goldman Sachs.

مایکل نووگرات, founder and CEO of crypto-investment firm Galaxy Digital Holdings, said,

“The mere fact that a critical mass of credible investors and institutions is now engaging with crypto assets has cemented their position as an official asset class.”

Supporting the same cause was مایکل سوننشن، مدیر عامل شرکت سیاه و سفید, who reiterated,

“Institutional investors now generally appreciate that digital assets are here to stay, with investors increasingly attracted to the finite quality of assets like bitcoin—which is verifiably scarce—as a way to محافظت در برابر تورم and currency debasement, and to diversify their portfolios in the pursuit of higher risk-adjusted returns.”

منبع: توییتر

برعکس، نورلی روبینی, an Economics professor at NYU and popular crypto-skeptic, provided a contrasting viewpoint,

“I disagree with the idea that something with no income, utility, or relationship with economic fundamentals can be considered a store of value or an asset at all.”

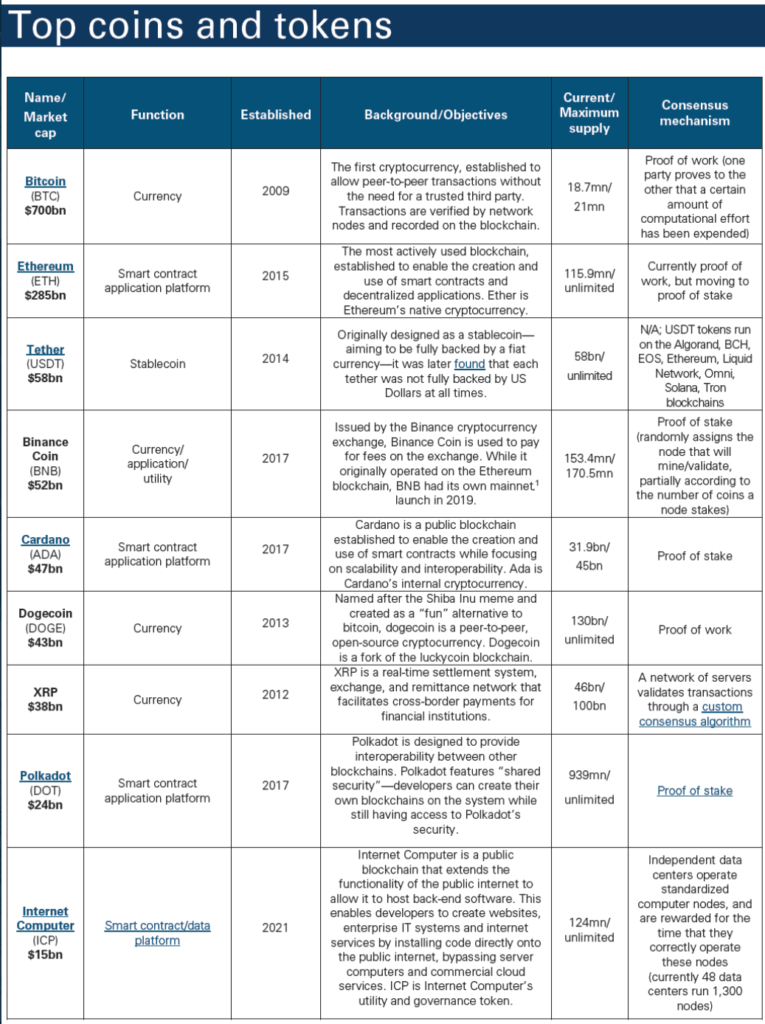

Curiously, the same report also looked at the utility-based functions of cryptocurrencies, apart from Bitcoin. What this suggests is that for many entities in the mainstream like GS, Bitcoin isn’t the only cryptocurrency to catch their eye. The world’s largest cryptocurrency’s institutional adoption and the larger market’s bull run have both contributed to the scope and width of the latest report from Goldman Sachs.

الکس کروگر توییتر| Goldman Sachs Research

Source: https://ambcrypto.com/heres-what-cemented-bitcoins-position-as-an-official-asset-class/

- 2020

- 9

- فعالیت ها

- اتخاذ

- الکس

- معرفی

- آلتو کین

- تحلیل

- دور و بر

- دارایی

- مدیریت دارایی

- دارایی

- بانک

- بی تربیت

- بیت کوین

- بلاکچین

- تصویب بلوکچین

- گاو بازی

- سرمایه

- کشتی

- علت

- مدیر عامل شرکت

- تغییر دادن

- کمک

- عضو سازمانهای سری ومخفی

- رمزنگاری دارایی

- ارز رمزنگاری

- کریپتو کارنسی (رمز ارزها )

- واحد پول

- deloitte

- دیجیتال

- دارایی های دیجیتال

- اقتصادی

- اقتصاد (Economics)

- تکامل

- کارشناسان

- چشم

- شرکت

- به جلو

- موسس

- اصول

- آینده

- کهکشان دیجیتال

- مرد طلایی

- گلدمن ساکس

- رشد

- اینجا کلیک نمایید

- HTTPS

- اندیشه

- از جمله

- درآمد

- سازمانی

- فرزندخواندگی نهادی

- موسسات

- علاقه

- سرمایه گذاران

- آخرین

- ارتباط دادن

- نگاه

- مسیر اصلی

- مدیریت

- رسانه ها

- رسمی

- دیگر

- سکو

- محبوب

- کیفیت

- نرخ

- دلایل

- گزارش

- بازده

- دویدن

- اشتراک گذاری

- به اشتراک گذاشته شده

- آگاهی

- رسانه های اجتماعی

- ماندن

- opbevare

- مهاجرت تحصیلی

- فن آوری

- زمان

- توییتر

- سودمندی

- ارزش

- WHO

- سال