A spokesperson for the IMF has said that El Salvador’s decision to make bitcoin legal tender raises several issues that will require careful analysis.

صندوق بین المللی پول در بیانیه ای گفت on June 10 that it foresees a number of “macroeconomic, financial and legal issues” with El Salvador’s decision to make bitcoin legal tender. IMF spokesperson Gerry Rice, during a press briefing, said that the IMF would follow the developments closely and continue consultations with authorities.

The IMF will also speak to Bukele to discuss the law, and the country is reportedly seeking a program that is worth nearly $1 billion. The country’s decision to recognize bitcoin as legal tender set off a string of discussions in both the crypto and traditional finance worlds.

IMF foresees bitcoin legalization issues

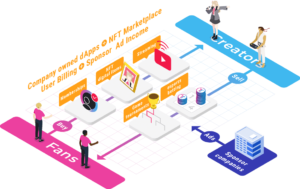

El Salvador’s President Nayib Bukele announced the decision last week, and quickly sent the law to Congress for ratification. بیت کوین will not be taxed for capital gains, and the country will also attract entrepreneurs by handing them permanent residency. Citizens will also be able to pay taxes in the asset.

Bukele has said that making bitcoin legal tender will have a range of benefits for citizens, including fostering financial inclusion and improving remittances. Bukele has gone on to state that merchants cannot refuse payments in bitcoin,

"اگر شما به مک دونالد یا هر چیز دیگری بروید ، آنها نمی توانند بگویند که ما بیت کوین شما را نمی گیریم ، آنها مجبورند که آن را طبق قانون بگیرند زیرا این یک پیشنهاد قانونی است."

The country will also use geothermal energy from volcanoes to power bitcoin mining facilities. This comes as the talking point of bitcoin’s power consumption takes center stage.

This is the first of its kind in the world, and it has rightly stirred other countries into thinking about the ramifications. The IMF has not offered more details on what the issues might be, but time will tell how other countries respond to this development.

Insiders in the crypto community, meanwhile, تماس گرفته اند the IMF “a tool of monetary imperialism.” Max Keiser had even harsher words for the IMF.

What impact will El Salvador’s decision have?

It’s hard to say how much of an impact El Salvador’s decision will have. On the one hand, it could act as a catalyst for other countries doing the same. On the other hand, some governments could point to it as criticism if the experiment fails to meet expectations or meets trouble.

At the moment, countries are flocking towards the idea of central bank digital currencies (CBDC), perhaps partly inspired by this development. Governments will obviously want to retain as much sovereignty as possible, but stopping bitcoin is virtually impossible.

What we can expect is greater regulation, one that imposes strict limitations on what can and can’t be done. The latter half of 2021 should see several such حوادث as countries like the U.S. increasingly discussing آئین نامه.

سلب مسئولیت

تمام اطلاعات موجود در وب سایت ما با حسن نیت و فقط برای اهداف عمومی منتشر می شود. هر اقدامی که خواننده نسبت به اطلاعات موجود در وب سایت ما انجام می دهد ، کاملاً به خطر خود آنها است.

Source: https://beincrypto.com/imf-el-salvador-bitcoin-macroeconomic-financial-legal-issues/

- عمل

- فعال

- معرفی

- تحلیل

- اعلام کرد

- دارایی

- بانک

- بیلیون

- بیت کوین

- بلاکچین

- بلومبرگ

- جلسه توجیهی

- سرمایه

- CBDC

- بانک مرکزی

- ارزهای دیجیتال بانک مرکزی

- انجمن

- کنگره

- مصرف

- ادامه دادن

- کشور

- عضو سازمانهای سری ومخفی

- ارز

- پروژه

- دیجیتال

- ارزهای دیجیتال

- انرژی

- کارآفرینان

- تجربه

- سرمایه گذاری

- مالی

- شمول مالی

- نام خانوادگی

- به دنبال

- صندوق

- سوالات عمومی

- خوب

- دولت ها

- چگونه

- HTTPS

- اندیشه

- صندوق بین المللی پول

- تأثیر

- از جمله

- گنجاندن

- اطلاعات

- بین المللی

- صندوق بین المللی پول

- مسائل

- IT

- قانون

- قانونی

- مسائل حقوقی

- ساخت

- حداکثر کایزر

- بازرگانان

- حرکت

- دیگر

- پرداخت

- مبلغ پرداختی

- قدرت

- رئيس جمهور

- فشار

- برنامه

- افزایش

- محدوده

- خواننده

- تنظیم

- مقررات

- حوالهها

- خطر

- تنظیم

- سخنگوی

- صحنه

- دولت

- سخنگو

- عوارض

- تفکر

- زمان

- مالی سنتی

- سایت اینترنتی

- هفته

- WHO

- جهان

- با ارزش