Data from blockchain analytics firm CryptoQuant has shown that miners are rapidly offloading their Bitcoin holdings, with 14,000 BTC being moved out of wallets belonging to miners in a single 24-hour period.

In the last few weeks, bitcoin miners have offloaded the largest amount of BTC since January 2021 in a phenomenon some are calling “miner capitulation,” in which these miners are selling their coins to cover ongoing expenses.

Miners are struggling over lower bitcoin prices and higher energy costs, which force them to sell their BTC holdings. Citi analyst Joseph Ayoub wrote in a note earlier this month:

“Given rising electricity costs, and bitcoin’s steep price decline, the cost of mining a bitcoin may be higher than its price for some miners.”

اخیر report from Coinbase has revealed that various miners moved from raising capital in equity to raising using debt, in part through loans secured by their own mining equipment. The value of this type of equipment has been dropping, further pressuring miners.

The report details that among the top 28 public mining companies, which represent 20% of Bitcoin’s hashrate, around 13,000 BTC has been sold so far this year, representing 19% of their reserves.

در مجموع، کوین بیس خاطرنشان کرد که تمام ماینرهای بیت کوین حدود 800,000 بیت کوین دارند، به این معنی که دارایی های استخراج کنندگان عمومی 6.8 درصد از کل را تشکیل می دهد. با این وجود، این شرکت تخمین زده است که حتی اگر بیت کوین به 10,000 دلار کاهش یابد، آنها همچنان ذخایری خواهند داشت که حدود 120 روز دوام می آورد و روزانه 16 بیت کوین از ذخایر خود را نقد می کنند.

- بیت کوین

- بلاکچین

- انطباق با بلاک چین

- کنفرانس بلاکچین

- coinbase

- coingenius

- اجماع

- کنفرانس رمزنگاری

- معدنکاری رمز گشایی

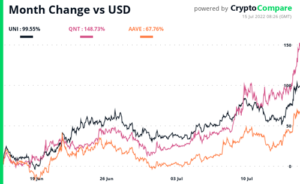

- CryptoCompare

- کریپتو کارنسی (رمز ارزها )

- اخبار رمزنگاری روزانه

- غیر متمرکز

- DEFI

- دارایی های دیجیتال

- ethereum

- فراگیری ماشین

- رمز غیر قابل شستشو

- افلاطون

- افلاطون آی

- هوش داده افلاطون

- پلاتوبلاک چین

- PlatoData

- بازی پلاتو

- چند ضلعی

- اثبات سهام

- W3

- زفیرنت