The New Zealand dollar has bounced back in Wednesday trading, after tumbling 0.98% on Tuesday. NZD/USD is currently trading at 0.7137, up 0.42% on the day.

New Zealand employment shines

The New Zealand dollar managed to recover some of Tuesday’s losses after a better than expected employment report for Q3. Employment change jumped 4.2% y/y, crushing the consensus of around 2.7%. As well, the unemployment rate dropped to a sizzling 3.4%, down from 4.0%, and even the participation rate edged higher. What’s there not to like? The markets were pleased and the New Zealand dollar has recovered about half of its 1% slide on Tuesday.

The kiwi’s tumble wasn’t a result of domestic or external data, but rather a sympathy move with the Australian dollar, which fell 1.20% on Tuesday. This was a result of the RBA abandoning ship and formally removing its yield curve control. The RBA had egg on its face and the markets proceeded to thrash the Aussie.

The strong data will likely increase market expectations of a rate hike from the RBNZ at its policy meeting later this month. The RBNZ released its Financial Stability Report for Q3 on Tuesday, and warned banks about high debt-to-income loans, given the risks of rising interest rates. With a rate hike virtually certain, the question facing the markets is whether the bank will raise rates by 25 or 50 basis points.

All eyes are on the FOMC policy meeting later today. The Fed is widely expected to taper its USD 120 billion QE programme by USD 15 billion. A smaller amount would be considered a dovish move and would weigh on the greenback, while a larger reduction would be aggressive and bullish for the US dollar. As for rate policy, the Fed has said there is no connection between tapering and a rate hike, but that won’t stop the markets from speculating about the timing of a rate raise. There is a significant par between market expectations and the Fed on rate policy, with the markets pricing in a move in 2022, while FOMC members are looking further down the road.

Whatever Fed policy makers decide, we can expect plenty of action in the currency markets after the FOMC decision.

.

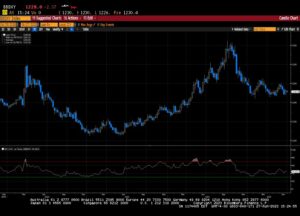

NZD / USD فنی

- NZD/USD با مقاومت 0.7215 و 0.7259 روبرو است

- 0.7129 خط پشتیبانی ضعیفی است. در زیر ، پشتیبانی 0.7087 وجود دارد

این مقاله تنها به منظور اطلاعات عمومی می باشد. این توصیه سرمایه گذاری یا راه حلی برای خرید یا فروش اوراق بهادار نیست. نظرات نویسندگان هستند. نه لزوما شرکت OANDA یا هر یک از شرکت های وابسته، شرکت های تابعه، افسران یا مدیران آن. معاملات اهرمی ریسک بالایی دارد و برای همه مناسب نیست. ممکن است تمام وجوه سپرده شده خود را از دست بدهید.

Source: https://www.marketpulse.com/20211103/nz-dollar-rebounds-sharp-job-data/

- عمل

- نصیحت

- معرفی

- تحلیل

- روانکاو

- دور و بر

- مقاله

- نویسندگان

- بانک

- بانک

- بیلیون

- جعبه

- سرسخت کله شق

- خرید

- تغییر دادن

- Commodities

- ارتباط

- اجماع

- واحد پول

- منحنی

- داده ها

- روز

- دلار

- کاهش یافته است

- استخدام

- چهره

- چهره ها

- نما

- تغذیه

- مالی

- تمرکز

- فارکس

- بودجه

- سوالات عمومی

- زیاد

- HTTPS

- از جمله

- افزایش

- اطلاعات

- علاقه

- نرخ بهره

- سرمایه گذاری

- سرمایه گذاری

- اسرائيل

- IT

- کار

- لاین

- وام

- عمده

- بازار

- بازارها

- اعضا

- حرکت

- نیوزیلند

- آنلاین

- دیدگاه ها

- بسیاری

- سیاست

- پست ها

- قیمت گذاری

- بالا بردن

- محدوده

- نرخ

- بهبود یافتن

- گزارش

- خطر

- اوراق بهادار

- فروش

- ثبات

- پشتیبانی

- تجارت

- بی کاری

- us

- دلار آمریکا

- دلار آمریکا

- وزن کن

- مهاجرت کاری

- بازده