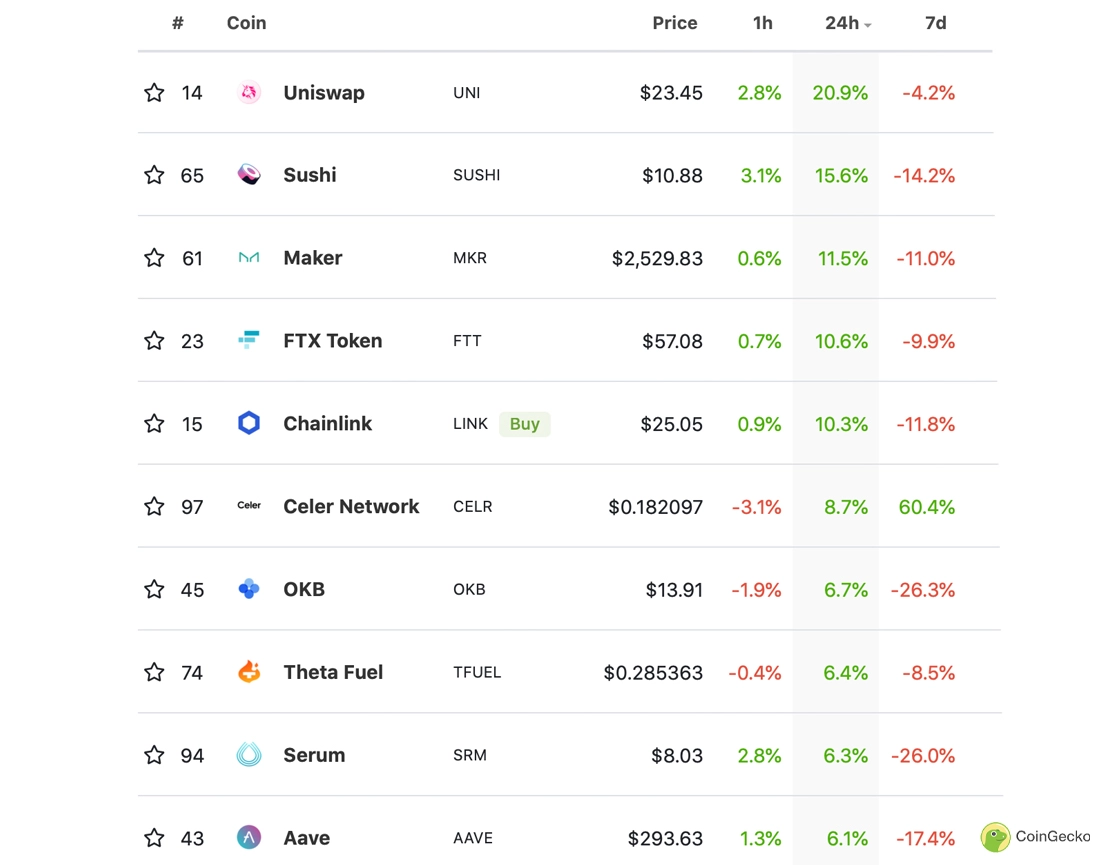

Uniswap ($UNI), the largest decentralized exchanged (Dex) saw its native token price surge over 35% in the last 24-hours. $UNI rose from a daily low of $17.77 to a daily high of $25.98 as the trading volume for the token saw a 500% rise. Over the past couple of days, Defi tokens have skyrocketed making double-digit gains at a time when the majority of the crypto market is still recovering from the correction on Friday caused by China’s yet another crypto ban.

Many attribute the surge in چالش token value and volume to China’s latest crypto crackdown guidelines as well. Chinese journalist Colin Wu claimed that the recent crackdown by the Chinese government would push native crypto traders towards Defi that would lead to a surge in Metmask wallet volumes and Dex protocols such as dYdX. The prophecy came true soon after as wxya registered a higher trading volume than Coinbase.

تعداد زیادی از کاربران چینی به دنیای DeFi سرازیر خواهند شد و تعداد کاربران MetaMask و dYdX به شدت افزایش خواهد یافت. همه جوامع چینی در حال بحث در مورد چگونگی یادگیری defi هستند.

- وو بلاکچین (WuBlockchain @) سپتامبر 26، 2021

Even when the majority of the crypto market is in a consolidation phase, major Defi protocols registered double-digit gains including Ethereum ($ETH) on which most of the Defi protocols work. The surge in Defi volume might not be entirely coming from China but the ban on the centralized exchange would surely give Defi a boost.

ممنوعیت رمزنگاری چین می تواند راهی را برای پذیرش دفی ایجاد کند

The crypto crackdown in China was not the first of its kind and probably not the last one either and has been the case, crypto traders always find a way to trade despite all the restrictions. In 2017 when China banned all crypto exchanges in the country, traders started using VPNs to register on foreign exchanges. Now that major foreign crypto exchanges such as Huobi and Binance have announced the خاتمه دادن of services, Chinese traders might turn to Defi for relief.

Defi can help Chinese traders to trade without having to register using KYC or come under the government authority radars due to the decentralized nature. This could in turn help the already popular Defi market become more mainstream. The total value locked in Defi protocols is nearing $200 billion, currently at $177.2 billion and it has risen by 7% over the past week. Market pundits expect the Defi TVL to continue to grow further with the Chinese interest.

- 77

- 98

- معرفی

- اعلام کرد

- بان کی مون

- بیلیون

- بنیان

- بلاکچین

- ایجاد می شود

- چین

- چینی

- آینده

- جوامع

- تثبیت

- محتوا

- ادامه دادن

- زن و شوهر

- عضو سازمانهای سری ومخفی

- مبادلات رمزنگاری

- رمزنگاری بازار

- معامله گران رمزنگاری

- ارز رمزنگاری

- غیر متمرکز

- DEFI

- دگزامتازون

- Ddx

- ethereum

- تبادل

- مبادلات

- مالی

- نام خانوادگی

- جمعه

- دولت

- شدن

- دستورالعمل ها

- زیاد

- نگه داشتن

- چگونه

- چگونه

- HTTPS

- Huobi

- از جمله

- افزایش

- علاقه

- سرمایه گذاری

- IT

- روزنامه نگار

- KYC

- بزرگ

- آخرین

- رهبری

- یاد گرفتن

- مسیر اصلی

- عمده

- اکثریت

- ساخت

- بازار

- تحقیقات بازار

- MetaMask

- نظر

- محبوب

- قیمت

- افزایش قیمت

- تسکین

- تحقیق

- خدمات

- اشتراک گذاری

- آغاز شده

- افزایش

- زمان

- رمز

- نشانه

- تجارت

- معامله گران

- تجارت

- لغو کردن

- کاربران

- ارزش

- حجم

- VPN ها

- کیف پول

- هفته

- واتساپ

- مهاجرت کاری

- جهان

- wu