Data shows the crypto fates market has noticed more than $400 million in liquidations during the most recent 24 hours as Bitcoin breaks above $23k.

केवल पिछले दिन में क्रिप्टो वायदा में $400 मिलियन से अधिक का परिसमापन हुआ

A “liquidation” happens when misfortunes stack up in a prospects contract and consume a particular level of the underlying edge or guarantee (the specific piece is subject to the subordinates trade) so the trade effectively shuts the position.

Mass liquidations in the crypto market aren’t excessively extraordinary for several reasons. To start with, the unpredictability of most coins (that are not stablecoins) is for the most part high and, surprisingly, hourly variances can be some of the time very significant.

The other explanation is that a lot of influence is really open in many trades. “Leverage” is a credit esteem that any prospects client can get against the edge. Many trades significantly offer figures as high as 100x the underlying position.

While influence can increment benefits by sizes more in the event that the bet resolves, similar applies to misfortunes too. This, joined with the unstable idea of even the greatest coins like Bitcoin, can make ignorant edge exchanging crypto fates very risky.

Related Reading | How The Bitcoin Difficulty Adjustment Has Boosted Miners’ Bottom Line

Now, here is the information for the liquidations happening in the digital money market during the last 24 hours:

The biggest single liquidation somewhat recently estimated more than $2 million in esteem | Source: कॉइनग्लास

As you can see above, nearly $405 million was flushed down during the beyond 24 hours in the crypto fates market. Around $133 million of these liquidations occurred as of now alone.

An occasion where gigantic liquidations, for example, the present happen is known as a “squeeze.” During these occasions, an unexpected cost change makes many agreements close without a moment’s delay, which just enhances this cost swing, and prompts significantly more liquidations.

Related Reading | Gnox (GNOX) Second Presale Sold Out While Bullish Uptrend For Bitcoin (BTC), Tron (TRX) And Binance Token (BNB) Begins

A minimal shy of 100k dealers were engaged with the present liquidation crush and over half of the agreements shut had a place with shorts.

This pattern seems OK as a larger part of the liquidations would have been set off by coins like Bitcoin noticing a sharp expansion in their prices.

BTC मूल्य

रचना के समय, बिटकॉइन की लागत लगभग $ 23.1k है, जो हाल के सात दिनों में 2% अधिक है। पिछले महीने के दौरान, क्रिप्टो ने मूल्य में 11% का अधिग्रहण किया है।

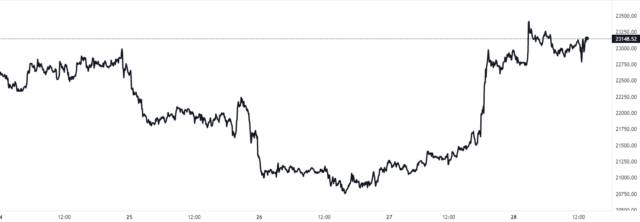

नीचे की रूपरेखा पिछले पांच दिनों में सिक्के की कीमत के पैटर्न को दर्शाती है।

Seems to be the worth of BTC has flooded up over the recent days | Source: TradingView पर बीटीसीयूएसडी

Highlighted picture from Kanchanara on Unsplash.com, graph from TradingView.com

#Crypto #Futures #Market #Sees #400m #Flushed #Bitcoin #Breaks #23k #Bitcoinist.com