Institutional investors and long term Bitcoin holders are showing signs of improved bullishness, hitting highs on several important indicators, की रिपोर्ट ARK Invest.

According to a new issue of बिटकॉइन मासिक, an “earnings report” that details on-chain activity, the balance of Bitcoin held on over-the-counter (OTC) desks has hit an all-time high. Nearly 8,000 Bitcoin are sitting on these desks, notching an impressive 60% increase this quarter.

कैथी वुड ARK uses OTC desks as a proxy for institutional activity, suggesting that the numbers reported show institutions and other large capital allocators are focused increasingly on Bitcoin–a bullish sign, they say.

आर्क ने रिपोर्ट में लिखा है, "हमारे विचार में, ओटीसी डेस्क पर बढ़ी हुई शेष राशि से पता चलता है कि संस्थान और अन्य बड़े पूंजी आवंटनकर्ता बिटकॉइन पर तेजी से ध्यान केंद्रित कर रहे हैं।"

Keeping on the institutional trail, the report also touches upon Grayscale’s Bitcoin Trust (जीबीटीसी), one of the few firms that caters to large or accredited investors. It has been on quite the run this year, doubling in value–with its GBTC shares starting the year at $8.65 now बदलना hands at $20.

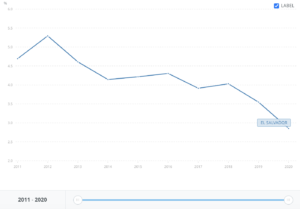

The so-called GBTC “छूट,” which refers to the difference between the price for the shares and the net asset value (NAV) of GBTC’s holdings–has narrowed to -30%, which ARK suggests could be the market’s optimistic sign to the recent ETF filings.

Long-term Bitcoin holders are often considered a sign of strength for the network, a sentiment that ARK said it agrees with. The report notes that nearly 70% of the 19 million circulating आपूर्ति of BTC has not moved in more than a year–an all-time high in both relative as well as absolute terms.

RSI रिपोर्ट also showcases 13 metrics for Bitcoin’s network–ranging from percent supply in profit to miner difficulty. Only two of these metrics (transaction volume and time-weighted turnover) are considered neutral, whereas the rest, says ARK, are flashing bullish.

क्रिप्टो समाचारों के शीर्ष पर रहें, अपने इनबॉक्स में दैनिक अपडेट प्राप्त करें।

- एसईओ संचालित सामग्री और पीआर वितरण। आज ही प्रवर्धित हो जाओ।

- प्लेटोडेटा.नेटवर्क वर्टिकल जेनरेटिव एआई। स्वयं को शक्तिवान बनाएं। यहां पहुंचें।

- प्लेटोआईस्ट्रीम। Web3 इंटेलिजेंस। ज्ञान प्रवर्धित। यहां पहुंचें।

- प्लेटोईएसजी. ऑटोमोटिव/ईवीएस, कार्बन, क्लीनटेक, ऊर्जा, पर्यावरण, सौर, कचरा प्रबंधन। यहां पहुंचें।

- BlockOffsets. पर्यावरणीय ऑफसेट स्वामित्व का आधुनिकीकरण। यहां पहुंचें।

- स्रोत: https://decrypt.co/147570/institutions-are-holding-more-bitcoin-than-ever-before-says-ark-invest