Bitcoin (BTC) saw classic BTC price volatility into the Nov. 7 daily close as a “short squeeze” took the market near $36,000.

Bitcoin hits “key” short squeeze price

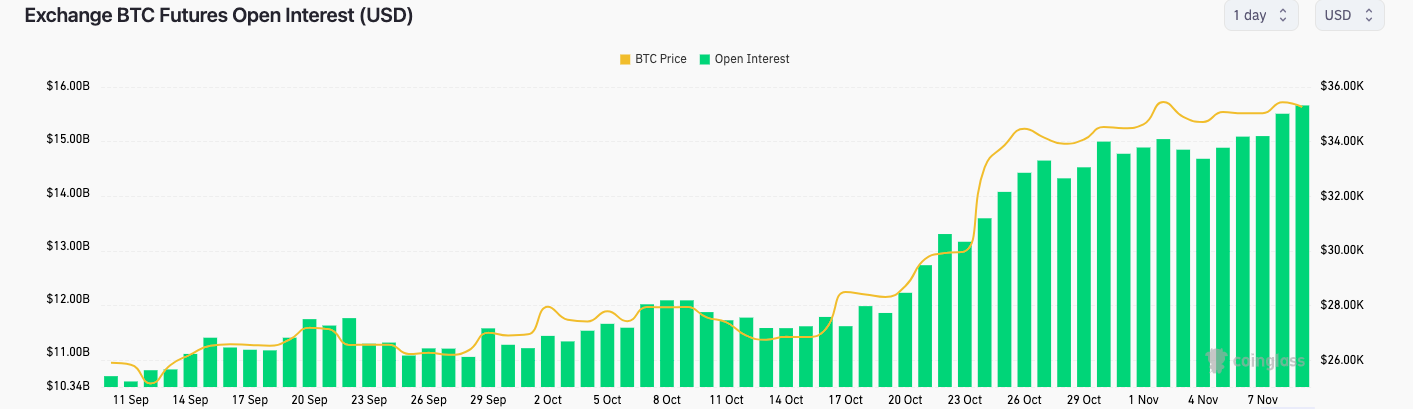

Adatok a Cointelegraph Markets Pro és a TradingView followed BTC/USD as it reacted amid highly elevated open interest (OI) on exchanges.

Korábban a Cointelegraph számolt be a more than $15 billion in OI being apt to spark a fresh round of volatility. Some feared that BTC price downside would result, with the ultimate direction unknown.

In the end, shorts felt the heat as Bitcoin made swift gains to top out at just below $35,900.

Analyzing the situation before the move, popular trader Skew and others predicted the event in advance. Skew argued that momentum would increase quickly should $34,800 return — a sequence of events which then came true.

“Open interest still building up & looking more like shorts have a higher float in the OI build up here. $34,800 ~ key price for a squeeze,” he mondta X előfizető.

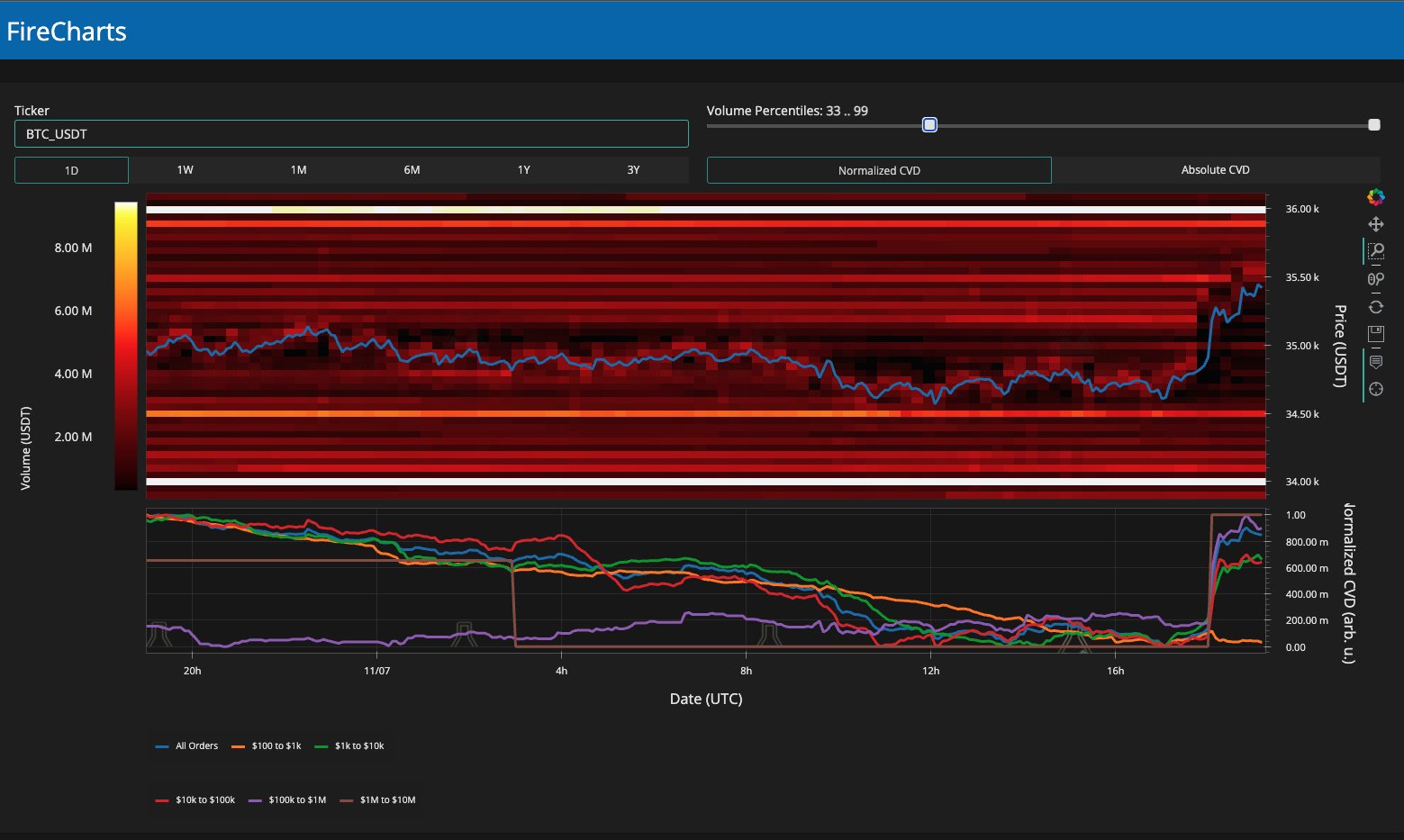

Yup there was a significant rise in OI overnight- it seems to be more of the same- shorts aping into passive bids here at the local lows.

We have a big rise in OI, perp takers net selling, funding decreasing, and limit bids being filled. A recipe for a nice squeeze up. https://t.co/IgwSR5dIo9 pic.twitter.com/F82fmNnw7F

- CrediBULL Crypto (@CredibleCrypto) November 7, 2023

On-chain monitoring resource Material Indiators repeated a previous assertion that $36,000 would stay out of reach this week.

“You can never say, ‘Never’ in this game, but based on the latest Trend Precognition signals, I’d be very surprised to see BTC move above $36k before the Weekly candle close,” part of a post-move X post olvas, referring to one of its proprietary trading indicators.

Fellow trader Daan Crypto Trades meanwhile eyed what he described as “an interesting shift” in derivatives composition.

Traders on largest exchange Binance were positioning themselves bearish compared to exchange Bybit, he neves, but a “long squeeze” was far from certain.

“Bybit perpetuals have consistently traded higher than Binance. There’s been a clear long interest on Bybit while Binance has been more short orientated during this range,” he summarized.

An accompanying chart compared the two exchanges’ BTC/USDT perpetual swap pairs, showing Binance trading lower after the short squeeze.

“Will be very interesting to see how this resolves,” he concluded.

“One thing is clear and that’s that Bybit traders are more bullish than Binance traders.”

Major BTC futures OI flush still to appear

Financial commentator Tedtalksmacro showed the impact of the squeeze on Binance, where short open interest disappeared.

Kapcsolódó: Rendkívül magas – A Bitcoin Ordinals új 5 hónapos csúcsra küldi a BTC tranzakciós díjakat

BTC shorts obliterated.

All of the OI built up earlier today ~$350MM USD, wiped in minutes. https://t.co/E8Ev1lsBWe pic.twitter.com/tHU25fTUt0

— tedtalksmacro (@tedtalksmacro) November 7, 2023

BTC/USD traded at $35,300 at the time of writing on Nov. 8, with OI still beyond $15 billion, per data from on-chain monitoring resource CoinGlass.

Ez a cikk nem tartalmaz befektetési tanácsokat és javaslatokat. Minden befektetési és kereskedési lépés kockázattal jár, és az olvasóknak a saját döntésük meghozatalakor saját kutatásokat kell végezniük.

- SEO által támogatott tartalom és PR terjesztés. Erősödjön még ma.

- PlatoData.Network Vertical Generative Ai. Erősítse meg magát. Hozzáférés itt.

- PlatoAiStream. Web3 Intelligence. Felerősített tudás. Hozzáférés itt.

- PlatoESG. Carbon, CleanTech, Energia, Környezet, Nap, Hulladékgazdálkodás. Hozzáférés itt.

- PlatoHealth. Biotechnológiai és klinikai vizsgálatok intelligencia. Hozzáférés itt.

- Forrás: https://cointelegraph.com/news/bitcoin-short-squeeze-btc-price-35-9-k-oi

- :van

- :is

- :nem

- :ahol

- $ UP

- 000

- 7

- 8

- 9

- a

- felett

- előre

- tanács

- Után

- Között

- és a

- APT

- VANNAK

- érvelt

- cikkben

- AS

- At

- alapján

- BE

- esetlen

- óta

- előtt

- hogy

- lent

- Túl

- Nagy

- Billió

- binance

- Bitcoin

- könyv

- BTC

- btc ár

- BTC / USD

- épít

- Épület

- épült

- Bullish

- de

- bybit

- jött

- TUD

- bizonyos

- Táblázatos

- klasszikus

- világos

- közel

- Cointelegraph

- kommentátor

- képest

- összetétel

- megkötött

- Magatartás

- következetesen

- tartalmaz

- crypto

- napi

- dátum

- döntés

- Származékok

- leírt

- irány

- nem

- hátránya

- alatt

- Korábban

- emelkedett

- végén

- esemény

- események

- Minden

- csere

- Feltételek

- messze

- díjak

- hiba

- megtöltött

- Úszó

- követ

- A

- friss

- ból ből

- finanszírozás

- Futures

- Nyereség

- játék

- Legyen

- he

- itt

- Magas

- <p></p>

- nagyon

- Találat

- Hogyan

- HTTPS

- i

- Hatás

- in

- Növelje

- mutatók

- kamat

- érdekes

- bele

- beruházás

- IT

- ITS

- éppen

- Kulcs

- legnagyobb

- legutolsó

- mint

- LIMIT

- helyi

- Hosszú

- keres

- alacsonyabb

- Louis

- készült

- Gyártás

- piacára

- piacok

- anyag

- Közben

- Perc

- Lendület

- ellenőrzés

- több

- mozog

- Közel

- háló

- soha

- Új

- szép

- november

- of

- on

- Láncon

- ONE

- nyitva

- nyitott érdeklődés

- or

- érdekében

- Egyéb

- ki

- saját

- párok

- rész

- passzív

- mert

- Örökös

- Örökkévalók

- Plató

- Platón adatintelligencia

- PlatoData

- Népszerű

- helymeghatározás

- állás

- jósolt

- előző

- ár

- szabadalmazott

- gyorsan

- hatótávolság

- el

- olvasók

- recept

- ajánlások

- megismételt

- Számolt

- kutatás

- forrás

- eredményez

- visszatérés

- Emelkedik

- Kockázat

- körül

- s

- látta

- azt mondják

- lát

- Úgy tűnik,

- Eladási

- küld

- küld

- Sorozat

- rövid

- rövid préselés

- rövidnadrág

- kellene

- kimutatta,

- jelek

- jelentős

- helyzet

- ferdeség

- néhány

- forrás

- Szikra

- Présel

- tartózkodás

- Még mindig

- előfizetőknek

- meglepődött

- csere

- csereügyletekkel

- SWIFT

- szedők

- mint

- hogy

- A

- A Hetilap

- azok

- maguk

- akkor

- Ott.

- dolog

- ezt

- ezen a héten

- idő

- nak nek

- Ma

- vett

- felső

- forgalmazott

- kereskedő

- Kereskedők

- szakmák

- Kereskedés

- TradingView

- tranzakció

- tranzakciós díjak

- tendencia

- igaz

- kettő

- végső

- ismeretlen

- USAdollár

- nagyon

- Illékonyság

- vs

- volt

- hét

- heti

- voltak

- Mit

- amikor

- ami

- míg

- val vel

- lenne

- írás

- X

- zephyrnet