13. szeptember 2022. / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Bitcoin ugrott above the $22,000 mark, outperforming ETH prior to the Merge.

- Az ETHPoW csapata mondott the fork will be deployed within 24 hours of the Merge.

- Stone Ridge, a multi-billion dollar asset manager iktatott to liquidate its bitcoin strategy fund with the SEC.

- Nikhil Wahi, brother of ex-Coinbase manager Ishan Wahi, könyörgött guilty to insider trading.

- Crypto exchange Huobi will kivezetésének seven privacy coins from its platform amid regulatory concerns.

- Heather Morgan, also known as “Razzlekhan,” is kér the judge to grant her access to crypto wallets.

- Argentina’s tax agency elkapott three clandestine crypto mining sites.

- Two Algorand executives are toló Helium to move to the Algorand network rather than Solana.

- A Blockchain Egyesület indított a new PAC to back pro-crypto candidates.

Ma a kriptográfiai elfogadásban…

- A CME Csoport bejelentés éter opciók elindítását tervezi.

- The Polygon network was választott for Starbucks web3 ‘odyssey’.

A $$$ sarok…

- A NEAR Alapítvány indított a $100 million venture capital fund and lab for web3.

- Goldsky, a crypto data infrastructure platform, zárt 20 millió dolláros vetőmag kör.

- NEAR-based wallet Sender emelt $4.5 million in a round led by Pantera Capital.

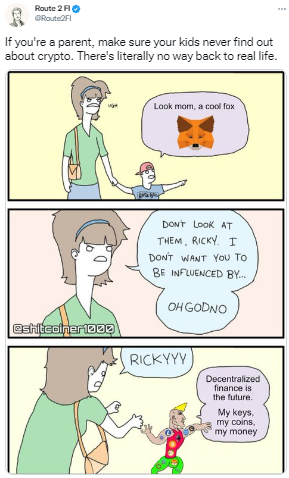

Mit mémelsz?

Mi az a Poppin?

Yesterday, the Wall Street Journal jelentett that Fidelity Investments is considering offering bitcoin to retail customers.

Fidelity is one of the world’s largest asset managers and handles over 34 million retail accounts on its brokerage platform.

The financial giant has been a supporter of Bitcoin for some years now. In 2018, it launched a bitcoin-trading business for hedge funds and institutional investors. In addition, earlier this year, the firm allowed companies to incorporate up to 20% of BTC into their 401(k) retirement plans.

The company hasn’t confirmed the plans with its clients yet. However, at the Salt conference, Galaxy Holdings Ltd.’s CEO Mike Novogratz mondott, “A bird told me that Fidelity, a little bird in my ear, is going to shift their retail customers into crypto soon enough.”

Fidelity’s move, though unconfirmed, follows BlackRock’s partnerség with Coinbase to offer crypto trading to its institutional customers. It looks like big players are still interested in the industry despite the negative sentiment in the markets.

The news was taken very positively on social media, with many celebrating the potential mass adoption that this move could trigger. And, even though it is unclear if the Fidelity news was the catalyst, the price of BTC rose almost 3% yesterday, reaching a high of $22,439.

Ajánlott olvasmányok

- Chainalysis on the Merge impact

- Madison Mariani on blokklánc rétegek

- Ishan B tovább tokenomika

On The Pod…

Kevin Zhou, cofounder of Galois Capital, and Evgeny Gaevoy, founder and CEO of Wintermute, discuss how to trade the Ethereum Proof of Work fork, what the market is telling about the Merge, and whether the Merge affects Bitcoin. Show highlights:

- what will happen at the time of the Merge according to Kevin and whether there’s uncertainty

- when the ETH Proof of Work chain will emerge and how that affects trading opportunities

- the mistakes of the ETHPoW team, like repealing EIP-1559

- what percentage of ETH market cap ETHPoW will accrue

- what the first few blocks of ETHPoW will be like

- what the strategies are to earn the ETHPoW airdrop and what the on-chain activity looks like

- whether there is an “up-only” monoculture in Ethereum

- what stETH is, how it should be priced and what the futures market indicates

- where the value of a chain comes from and the likelihood of ETHPoW failing catastrophically

- how to protect from replay attacks

- the price action of ETH after the Merge

- how ETH becoming deflationary affects Bitcoin’s narrative as digital gold

- how the ESG-friendly image of Proof of Stake could affect the narratives of ETH and BTC

Könyvfrissítés

Könyvem, A kriptopártiak: idealizmus, kapzsiság, hazugság és az első nagy kriptovaluta-őrület kialakulása, ami az Ethereumról és a 2017-es ICO-mániáról szól, már elérhető!

Itt vásárolhatod meg: http://bit.ly/cryptopians

- Bitcoin

- blockchain

- blokklánc megfelelőség

- blockchain konferencia

- coinbase

- coingenius

- megegyezés

- kriptokonferencia

- kriptikus bányászat

- cryptocurrency

- decentralizált

- Defi

- Digitális eszközök

- Ethereum

- gépi tanulás

- hírlevelek

- nem helyettesíthető token

- Plató

- plato ai

- Platón adatintelligencia

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- a tét igazolása

- korlátozás nélküli

- W3

- zephyrnet