September once again proved to be an underwhelming month for the crypto markets. But as the year winds down, historical price analysis suggests that next quarter could generate significantly better returns.

In our latest report Új Negyed, the Kraken Intelligence team examines why the lastest Chinese crypto ban may be a tailwind for BTC over the long run. Additionally, the team analyzes a number of on-chain metrics and trends that indicate demand remains strong and the market is well-positioned to move higher into year-end.

A Bad Month For Bitcoin

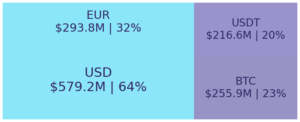

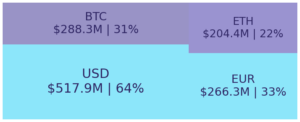

In our last report, we cautioned that September historically generates negative returns. True to its average, Bitcoin snapped a two-month winning streak and finished down 7% in September. Following a golden cross on the 14th, some were surprised to see BTC drop 16% over the next week – pushing BTC back below its 50-day and 200-day moving averages. What followed was a recirculation of China’s crypto ban, which certainly didn’t help. As rough as September was, history tells us that BTC returns 119% on average in the fourth quarter, while its historical median return stands at 58%.

Ethereum Marches On

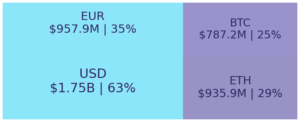

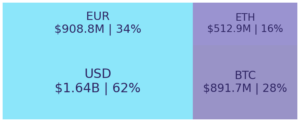

Despite many eyes on BTC, interest in ETH held firm in September. Two months after the London hard fork, the intended effects remain evident and interest continues to gravitate towards the ecosystem. Last month, 405,000 ETH was issued as another 250,000 was burned – reducing issuance by 63%. Additionally, staking in the ETH 2.0 contract rose in popularity as roughly 7.79 million ETH was staked by almost 53k entities (an 8% and 10% increase month-over-month, respectively).

Surveying the Crypto Landscape

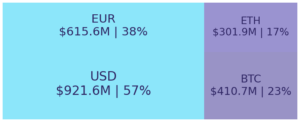

Elsewhere across the crypto industry, interest and demand for other Layer-1 blockchains persisted. Solana investment products saw inflows exceed $60M in September and the chain became the most staked Layer-1 blockchain with 77% of circulating coins staked. NFT activity on the network soared and two Solana-based NFT collections surpassed a market capitalization of $100M – rivaling several of the largest Ethereum-based NFT collections.

Cardano’s anticipated Alonzo hardfork launched with some incorrect assertions about transaction limits and user counts. However, demand for ADA revived after it was announced that Cardano smart contract developers could now utilize Chainlink Oracles to safely transmit off-chain data.

Want to learn more about what went down and what’s ahead? Download the Kraken Intelligence report Új Negyed to understand why crypto could be headed higher in the next few months.

A VIP ügyfelek az elsők, akik megkapják a Kraken Intelligence jelentéseket. Ha szeretne hozzáférni hozzánk hírlevelére vagy akar kezdje el a kereskedelmet, szerezze be azokat az erőforrásokat, amelyekben a kriptobefektetők világszerte megbíznak.

- 000

- 7

- hozzáférés

- ADA

- elemzés

- bejelentés

- Tilalom

- Bitcoin

- blockchain

- Blog

- BTC

- tőkésítés

- Cardano

- Láncszem

- kínai

- érmék

- tovább

- szerződés

- crypto

- Kriptoipar

- Crypto piacok

- dátum

- Kereslet

- fejlesztők

- Csepp

- ökoszisztéma

- ETH

- Et 2.0

- Cég

- vezetéknév

- villa

- Tele

- kemény villa

- történelem

- HTTPS

- Növelje

- ipar

- Intelligencia

- kamat

- beruházás

- Befektetők

- IT

- Kraken

- legutolsó

- TANUL

- London

- Hosszú

- piacára

- Piac tőkésítés

- piacok

- Metrics

- millió

- hónap

- mozog

- hálózat

- NFT

- Más

- ár

- Árelemzés

- Termékek

- jelentést

- Jelentések

- Tudástár

- Visszatér

- futás

- okos

- okos szerződés

- Solana

- kockára

- megmondja

- tranzakció

- Trends

- Bízzon

- us

- hét

- világszerte

- év