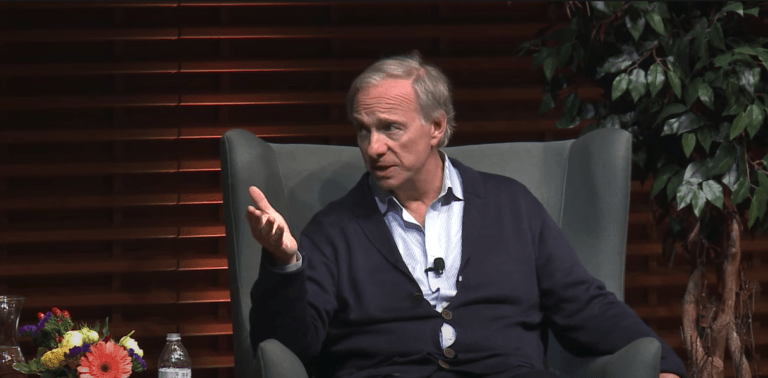

On Thursday (2 February 2023), billionaire investor ray Dalio was interviewed by Andrew Ross Sorkin, co-anchor of CNBC’s Squawk Box. During the interview, Dalio shared his views on crypto in general and Bitcoin in particular.

Dalio is the founder, co-chairman, and co-chief investment officer of Bridgewater Associates. The 73-year American whose nettó érték is estimated to be around $19.1 billion (as of 2 February 2023) created the asset management firm Bridgewater Associates from his New York City apartment just two years after receiving his MBA from Harvard Business School. Bridgewater Associates had $126 billion in assets under management as of June 2022, and its many institutional clients include “pension funds, endowments, foundations, foreign governments, and central banks.”

Earlier today, he had a beszélgetés on CNBC with Sorkin, and they touched on the topic of Bitcoin.

„Szerintem egészen elképesztő volt, hogy 12 éven keresztül sikerült, de úgy gondolom, hogy ennek semmi köze nincsen. Ez egy apró dolog, amely aránytalanul nagy figyelmet kap” – mondta Dalio. „Ez nem lesz hatékony pénz. Ez nem a vagyon hatékony tárolása. Ez nem hatékony csereeszköz.”

Despite his criticisms of Bitcoin, Dalio acknowledges that the current monetary system is in jeopardy due to the excessive printing of money by central banks, including the US, Europe, and Japan. He believes that as the world continues to evolve, people will start to search for a safe store of wealth and that digital currencies could play a role in this evolution.

“I think the question over the next number of years is really what is money, not just as a medium of exchange, but a store hold of wealth,” said Dalio.

Dalio úgy véli, hogy az inflációhoz köthető digitális valuta jobb választás lenne, mint a Bitcoin. „Ha létrehoznál egy érmét, amelyen az áll, hogy rendben van, ez vásárlóerő, amiben tudom, hogy megtakaríthatnám, és be tudnám tenni a pénzemet, és egy bizonyos időn keresztül, és akkor bárhol lebonyolíthatnám, akkor szerintem az jó érme lenne. Nem hiszem, hogy a Bitcoin az” – mondta.

Despite his criticisms, Dalio believes that cryptocurrencies will continue to evolve and that we may see the development of new coins that are more attractive and viable in the future. It will be interesting to see how the world of cryptocurrencies continues to evolve and how investors, including Dalio, will adapt to this rapidly changing landscape.

<!–

-> <!–

->

Dalio had an interjú with Yahoo Finance correspondent Julia La Roche took place on 26 October 2020 at a virtual event called “Yahoo Finance All Markets Summit: Road to Recovery".

Near the end of the interview, Dalio was asked for his take on digital currencies. This is how he replied:

"Digital currencies — let me break them down into two types. There’s the type in which it’s like a Bitcoin type of currency that’ll be an alternative currency in terms of its supply/demand and an alternative storehold of wealth… and then there’s digital currencies — that means they’ll be other types of currencies, let’s say the dollar or the euro or the Chinese Renminbi be that is digitalized.

"I think we’re going to see a lot more of that second type, but I think that there are three main problems of the first type… Theoretically it’s good, but the three basic things are a currency has to be an effective medium of exchange, storehold of wealth, and the governments want to control it.

"So, I today can’t take my bitcoin yet and go buy things easily with it, and as a storehold of wealth, it’s so volatile that its volatility based on speculation is so much greater that it’s not an effective storehold of wealth and which is also one of the reasons it’s a problem to be a transaction vehicle because if a vendor says I’m going to get paid in Bitcoin and they don’t know what that means in terms of their other liabilities — that’s a problem.

"And then thirdly… if it becomes material, governments won’t allow it. I mean, they’ll outlaw it, and they’ll use whatever teeth they have to enforce that. They would say, okay, you can’t transact with Bitcoin, you can’t have Bitcoin. So, then you have to sort of be almost like ‘is it a felony and I’m gonna have to be a felon in order to transact?’

"They outlawed gold, you know, what’s what’s wrong with gold? But gold was a storehold of wealth, and so if I was to say would I prefer bitcoin to gold, no, I wouldn’t prefer Bitcoin to gold. Gold will be the vehicle that central banks and countries use as an alternative to the regular cash because each central bank can print cash but through transactions, through time, when countries dealt with each other, they used gold because they didn’t have to worry about being devalued by some country that’s going to print the gold.

"And so it still is our third largest reserve [asset]. If you take central bank reserves, the largest is the dollar, the second largest is the euro, and the third largest is gold… But I don’t think digital currencies will succeed and in the way people hope they would for those reasons."

- SEO által támogatott tartalom és PR terjesztés. Erősödjön még ma.

- Platoblockchain. Web3 metaverzum intelligencia. Felerősített tudás. Hozzáférés itt.

- Forrás: https://www.cryptoglobe.com/latest/2023/02/billionaire-ray-dalio-wants-to-see-an-inflation-linked-digital-currency-but-says-bitcoin-is-not-it/

- 1

- 2020

- 2022

- 2023

- a

- Rólunk

- megvalósítható

- alkalmazkodni

- hirdetések

- Után

- Minden termék

- alternatív

- elképesztő

- Amerikai

- és a

- Andrew Ross Sorkin

- bárhol

- Apartman

- körül

- vagyontárgy

- Vagyonkezelés

- Eszközök

- figyelem

- vonzó

- Bank

- Banks

- alapján

- alapvető

- mert

- válik

- hogy

- úgy gondolja,

- Jobb

- Billió

- milliárdos

- Bitcoin

- Doboz

- szünet

- üzleti

- Üzleti iskola

- megvesz

- Vásárlás

- hívott

- Készpénz

- központi

- Központi Bank

- Központi Bankok

- változó

- kínai

- Város

- ügyfél részére

- CNBC

- Érme

- érmék

- folytatódik

- tovább

- ellenőrzés

- tudott

- országok

- ország

- készítette

- crypto

- cryptocurrencies

- pénznem

- Valuta

- Jelenlegi

- Fejlesztés

- digitális

- digitális valuták

- digitális pénznem

- Dollár

- ne

- le-

- alatt

- minden

- könnyen

- Hatékony

- becsült

- Euro

- Európa

- esemény

- evolúció

- fejlődik

- csere

- bűntett

- finanszíroz

- Cég

- vezetéknév

- Forbes

- külföldi

- Alapok

- alapító

- ból ből

- alapok

- jövő

- általános

- kap

- Go

- megy

- Arany

- jó

- A kormányok

- nagyobb

- Harvard

- tart

- remény

- Hogyan

- HTML

- HTTPS

- in

- tartalmaz

- Beleértve

- infláció

- szervezeti

- intézményi ügyfelek

- érdekes

- Interjú

- meghallgatott

- beruházás

- befektető

- Befektetők

- IT

- Japán

- Ismer

- táj

- legnagyobb

- kötelezettségek

- összekapcsolt

- Sok

- Fő

- vezetés

- sok

- piacok

- anyag

- eszközök

- közepes

- csereeszköz

- Pénzügyi

- pénz

- több

- Új

- új érmék

- New York

- new york city

- következő

- szám

- október

- Tiszt

- Rendben

- ONE

- opció

- érdekében

- Más

- fizetett

- Bitcoinban fizetve

- különös

- Emberek (People)

- időszak

- Hely

- Plató

- Platón adatintelligencia

- PlatoData

- játszani

- hatalom

- jobban szeret

- Probléma

- problémák

- tesz

- kérdés

- gyorsan

- RAY

- rája dália

- miatt

- fogadó

- szabályos

- kapcsolat

- Tartalék

- tartalékok

- út

- Szerep

- biztonságos

- Mondott

- Megtakarítás

- Iskola

- Képernyő

- képernyők

- Keresés

- Második

- megosztott

- méretek

- So

- néhány

- spekuláció

- kezdet

- Még mindig

- tárolni

- sikerül

- Csúcstalálkozó

- rendszer

- Vesz

- feltételek

- A

- a világ

- azok

- dolog

- dolgok

- Harmadik

- három

- Keresztül

- idő

- nak nek

- Ma

- téma

- érintett

- lebonyolít

- tranzakció

- Tranzakciók

- típusok

- alatt

- us

- használ

- jármű

- eladó

- életképes

- nézetek

- Tényleges

- illó

- Illékonyság

- Vagyon

- Mit

- Mi

- ami

- Wikipedia

- lesz

- világ

- lenne

- Rossz

- jehu

- Yahoo Finance

- év

- te

- zephyrnet