Hotter than expected U.S. inflation pushed bitcoin below $21,000 while the price of ether dipped under $1,600 as crypto tracked traditional financial markets lower.

Bitcoin was trading at $20,888 on Coinbase, down about 5.9% over the past 24 hours, per dátum a tőzsdéről.

Tuesday’s losses followed higher-than-expected inflation számok from the U.S., up 8.3% year-on-year, while headline inflation was up 0.1% month-on-month and core inflation rose 0.6% month-on-month.

Ether’s losses over the past 24 hours are even greater than bitcoin’s, dropping more than 6% to $1,598, per Coinbase dátum.

A higher inflation ábra would most likely result in further selloffs in the equity and crypto market, according to 21.co research associate Adrian Fritz. “Since this would lead to an even more hawkish Fed, that is expected to announce another interest rate hike next week,” he said.

The S&P 500 was down almost 3% at the time of writing, while the Nasdaq composite shed a little over 4%, with markets digesting the the surprise data with just eight days to go to the Fed’s next decision on interest rates.

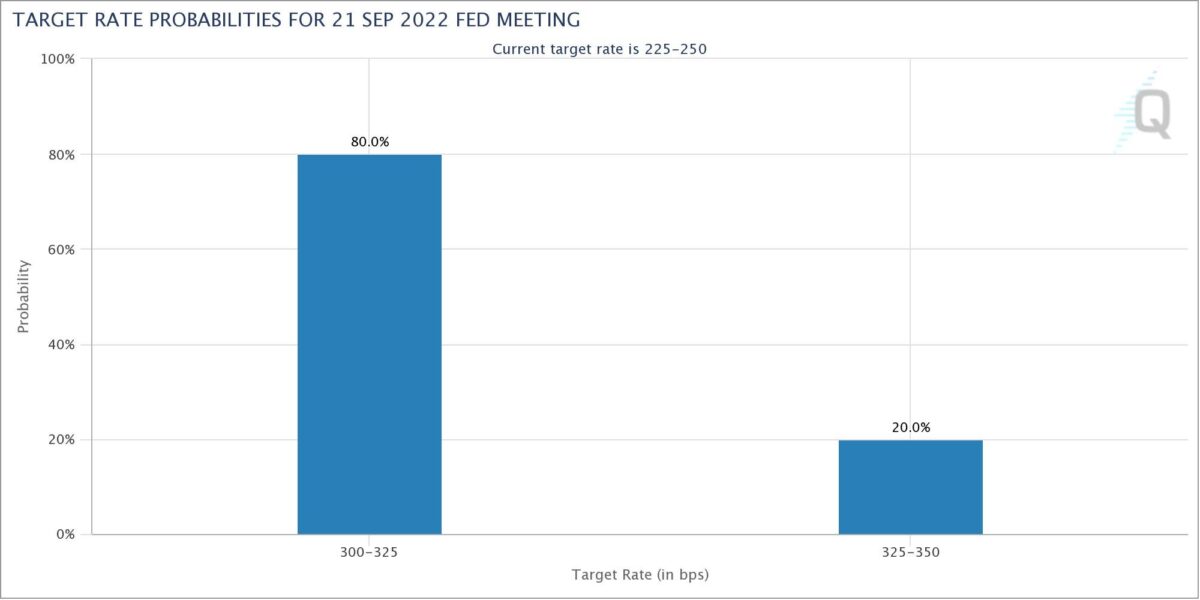

Ahead of the inflation news traders had been factoring in a hike of 75 basis points, however, according to the CME’s FedWatch dashboard the market is now predicting an 20% probability of a 100-basis-point hike at next week’s meeting.

Másutt, a DXY index, which measures the U.S. dollar relative to a basket of other foreign currencies, was back up, gaining 1.3%. FTX’s Sam Bankman-Fried mondott that the dollar dominance and inflation has affected crypto markets this year, and today’s price movements appear to reinforce that assumption.

© 2022 The Block Crypto, Inc. Minden jog fenntartva. Ez a cikk csak tájékoztató jellegű. Nem kínálják, vagy nem szándékoznak felhasználni jogi, adóügyi, befektetési, pénzügyi vagy egyéb tanácsadásként.

- Bitcoin

- blockchain

- blokklánc megfelelőség

- blockchain konferencia

- BTC

- btc ár

- coinbase

- coingenius

- megegyezés

- kriptokonferencia

- kriptikus bányászat

- cryptocurrency

- decentralizált

- Defi

- Digitális eszközök

- Éter

- Ethereum

- FTX

- grafikon

- gépi tanulás

- piacok

- nem helyettesíthető token

- Plató

- plato ai

- Platón adatintelligencia

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- a tét igazolása

- A háztömb

- W3

- zephyrnet