On-chain information reveals the Bitcoin funding charge remains to be at a comparatively excessive optimistic worth, suggesting that the crypto would possibly see extra decline within the close to time period.

A Bitcoin finanszírozási ráta pozitív értéket mutatott az elmúlt néhány napban

Ahogy azt a CryptoQuant elemzője azonosította Hozzászólás, the present funding charge means that the value is in a brand new decline proper now.

Azfinanszírozási arány” is an indicator that measures the periodic price that merchants within the Bitcoin futures market should pay one another.

When the worth of this metric is above zero, it means lengthy merchants are presently paying a premium to the brief merchants to maintain their positions. Such values point out {that a} bullish sentiment is extra dominant available in the market in the meanwhile.

Kapcsolódó olvasmányok Láncon belüli adatok: A 10 XNUMX feletti BTC-vel rendelkező Bitcoin bálnák növekedtek

On the opposite hand, detrimental values of the indicator indicate the bulk sentiment is bearish proper now as shorts are paying longs presently.

Now, here’s a chart that reveals the pattern within the Bitcoin funding charges during the last six months:

The worth of the metric appears to have been optimistic up to now week | Source: kriptokvant

As you’ll be able to see within the above graph, each time the Bitcoin funding charge has reached a comparatively excessive optimistic worth throughout the previous couple of months, the value of the crypto has usually noticed a decline not too lengthy after. Similarly, detrimental spikes have resulted within the worth of BTC seeing some uptrend.

Here’s what’s happening right here: excessive optimistic values imply longs are piling up available in the market. So, a major sufficient sudden decline can liquidate quite a lot of these, which might find yourself driving the value additional down, and thus liquidating much more lengthy positions. Such an occasion the place liquidations cascade collectively is named a “présel” (or on this case, an extended squeeze).

Kapcsolódó olvasmányok A Bitcoin NUPL átlagos tulajdonosa visszanyeri nyereségét, de meddig?

A number of days again, when the value of the crypto was above $23k, the funding charge once more made a optimistic peak and the value subsequently went down. However, the present worth of the indicator nonetheless appears to be like to be fairly optimistic, which can imply the decline remains to be ongoing.

BTC ár

Az írás idején Bitcoin ára 22.7 ezer dollár körül mozog, ami 6%-os emelkedést jelent az utolsó hét napon belül. Az előző hónapban a kripto értéke 8%-ot emelkedett.

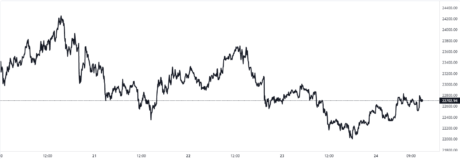

The under chart reveals the pattern within the worth of the coin during the last 5 days.

Looks like the worth of the crypto has been sliding down over the previous couple of days | Source: BTCUSD a TradingView oldalon

Kiemelt kép Brent Jonestól az Unsplash.com-on, diagramok a TradingView.com-tól, a CryptoQuant.com-tól

- Bitcoin

- Bitcoin feltöltés

- blockchain

- blokklánc megfelelőség

- blockchain konferencia

- coinbase

- coingenius

- megegyezés

- kriptokonferencia

- kriptikus bányászat

- cryptocurrency

- decentralizált

- Defi

- Digitális eszközök

- Ethereum

- Friss kriptovaluta hírek

- gépi tanulás

- nem helyettesíthető token

- Plató

- plato ai

- Platón adatintelligencia

- PlatoData

- platogaming

- Poligon

- a tét igazolása

- W3

- zephyrnet