On Wednesday, the lending arm of Genesis Global Capital joined the list of firms caught in FTX fallout as it leállította az ügyfélkivonásokat. In a call with customers, Genesis Interim CEO Derar Islim connected the firm’s decision to FTX’s collapse.

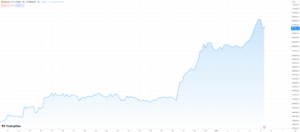

Bitcoin (BTC) közelmúltban 16,600 24 dollár körül forgott, ami alig változott az elmúlt 16,000 órában. A piaci kapitalizáció szerint legnagyobb kriptovaluta kilencedik egymást követő napon mozgott legutóbbi 19,000 XNUMX dolláros támogatása fölött. A BTC a korábbi XNUMX XNUMX dolláros támogatottsága alá esett, amikor Sam Bankman Fried FTX birodalmának első szálai elkezdtek kibontakozni. (A Genesis tulajdonosa, a Digital Currency Group (DCG) a CoinDesk anyavállalata is.)

Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in a Thursday email that markets have already “priced in” the latest news.

“It might take another downfall of a major crypto company or a de-risking movement on Wall Street to take bitcoin below its recent low,” he wrote.

Last week’s slower-than-expected U.S. Consumer Price Index (CPI) inflation date for October also “partially softened the fall” in the BTC market, Serhii Zhdanov, CEO of cryptocurrency exchange EXMO told CoinDesk, although a quick recovery of the market is “not foreseen for the nearest future.”

A CoinDesk piaci index recently dropped 0.6%. Ether (ETH) was down 0.3% to $1,210 at the time of publication.

Likviditási válság

FTX-Alameda’s fallout has spurred a larger drop in crypto liquidity over the past week than in any previous market drawdown, according to a report by crypto data firm Kaiko. Many market makers must operate with “delta-neutral strategies,” according to Eliézer Ndinga, director of research at crypto investment products firm 21.co.

“They have to go long on specific products but also possibly go short to make sure that they can hedge against a specific downside,” Ndinga told CoinDesk in an interview.

Genesis’ had $8.4 billion in loan originations and $2.8 million in total active loans at the end of the third quarter, according to its .

“This is bigger than many people think,” Ndinga said, adding:“I think the best-case scenario for players like Genesis would be to define fresh capital or more of the highest bidders to help the company to operate better.”

“We’re going to hear more about the effects on these players in the space,” he said.

- hangya pénzügyi

- Bitcoin

- blockchain

- blockchain konferencia fintech

- harangjáték fintech

- coinbase

- coingenius

- kripto konferencia fintech

- FINTECH

- fintech alkalmazás

- fintech innováció

- Fintech hírek

- Nyílt tenger

- PayPal

- paytech

- fizetési mód

- Plató

- plato ai

- Platón adatintelligencia

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- csík

- tencent fintech

- Xero

- zephyrnet