7. október 2021. / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

The US FDIC is looking into whether stablecoin deposits would be választható for its insurance coverage.

-

CoinSwitch Kuber, India’s largest cryptocurrency exchange, emelt $260 million at a valuation of $1.9 billion in a round led by a16z and Coinbase Ventures.

-

Az Egyesült Államok Igazságügyi Minisztériuma bejelentés a cryptocurrency enforcement team to strengthen the regulator’s ability to fight crypto-related crimes.

-

Based on a paper közzétett yesterday, the Federal Reserve believes that digital currencies could “reduce reliance on the US dollar.”

-

metamaszk hozzáadott crypto custodians BitGo, Qredo, and Cactus Custody to meet compliance requirements for its institutional arm.

-

The International Organization of Securities Commissions (IOSCO) and the Bank for International Settlements (BIS) think stablecoins should be regulated under the ugyanazok a szabályokas traditional payments.

-

The price floor for CryptoToadz, an Ethereum-based NFT, has felkelt from .18 ETH to approximately 12 ETH in less than a month.

-

a16z released an vázlat for how regulators should handle crypto regulation.

-

MoneyGram, a cross-border payments company, bejelentés partnerships with USDC and Stellar.

-

A bogár was found in Rocket Pool, an ETH 2.0 staking platform, that could have affected millions of dollars in ETH staked across multiple protocols.

Mit mémelsz?

Mi az a Poppin?

Alright, Bitcoin is poppin’. Yesterday, the coin crossed the threshold of $55,000, increasing roughly 9% between Tuesday and Wednesday afternoon. At the time of writing, 6:14 PM ET, Bitcoin’s market cap was sitting above $1 trillion — a number not seen since May 10th.

It appears that rumors swirling around the approval of a bitcoin futures ETF could be pushing the BTC price up. SEC Chair Gary Gensler is most likely the source of such talk, twice mondásthat he would “look forward to staff’s review of such filings.” Eric Balchunas, the senior ETF analyst at Bloomberg, estimates a 75% chance that a BTC futures ETF is approved in October.

Backing up Balchunas’s bold prediction, CoinDesk reports that BTC-based futures contracts on the Chicago Mercantile Exchange are trading at a 12.8% -os prémium to the spot price — marking the largest premium since mid-April. CoinDesk points out that many analysts consider CME sentiment to be swayed by institutions, who prefer to trade assets through regulated exchanges.

Mike Bucella, a general partner at Block Tower, believes the premium suggests that institutions could be “front-running” the news of a futures-based BTC ETF being approved.

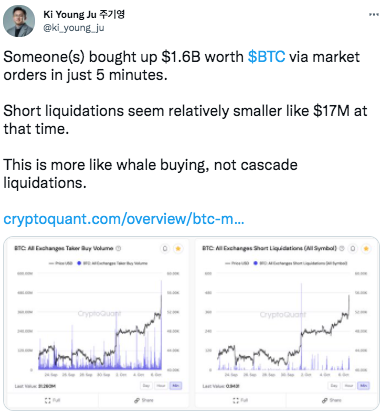

In addition to speculation surrounding the approval of a bitcoin ETF, Bitcoin’s price also got a bump from a billion-dollar spot purchase yesterday, as noted by Ki Young Ju, the CEO of CryptoQuant. Based on Ju’s reading of the data, it appears that a whale purchased $1.6 billion of spot bitcoin in just under five minutes.

To round out a bullish day for Bitcoin, the CEO of the $27 billion family office of billionaire George Soros confirmed that the fund invests in Bitcoin. The CEO, Dawn Fitzpatrick, mondta Bloomberg, “From our perspective again, we own some coins, not a lot, and the coins themselves are less interesting than the use cases of DeFi and things like that.”

Fitzpatrick went on to add that cryptocurrencies have made it mainstream. “I’m not sure bitcoin is only viewed as an inflation hedge. Here I think it’s crossed the chasm to mainstream. Cryptocurrencies now have a market cap of over $2 trillion. There’s 200 million users around the world, so I think this has gone mainstream,” Fitzpatrick added.

Ajánlott olvasmányok

-

Pantera Capital dropped its October investor letter:

-

Arcane Research on the state of the Lightning Network (Twitter thread + report):

-

Puru Goyal, a chemical engineer, on Bitcoin’s energy usage:

On The Pod…

How does the SEC determine if a token is a security? Why is DeFi particularly hard to regulate? What will regulators do about stablecoins? On Unchained, Greg Xethalis, chief compliance officer at Multicoin Capital, and Collins Belton, founding partner at Brookwood P.C., dive into crypto regulation, discussing securities laws, DeFi regulation, and why the US should be promoting stablecoins rather than trying to shut them down. Highlights:

-

why the SEC and CFTC have not announced bigger crypto enforcement news at the end of their fiscal years

-

why the SEC is going after DINO (decentralized in name only) companies

-

what the Howey and Reves tests are and how the SEC uses them to determine whether an asset is a security or not

-

why Collins and Greg think the SEC has recently begun been applying Reves more often

-

why they think centralized crypto lending products should not be considered securities under the Howey test

-

whether new legislation needs to be written for cryptocurrency-based products

-

what makes Collins think the SEC is being “disingenuous” regarding the SEC registration process for crypto companies, like Coinbase

-

how regulators will end up handling DeFi and why both Greg and Collins are long-term optimistic

-

how the US government has a “great history” of respecting privacy and encryption

-

why regulatory pressure is likely to build up around centralized crypto exchanges and what we can learn from the EtherDelta case

-

why Collins thinks most cryptocurrency companies should be regulated

-

why the SEC is the best motivator for forcing protocols to fully decentralize

-

how smart contracts could theoretically be used to standardize SEC Commissioner Hester Peirce’s Safe Harbor proposal

-

how blockchain data makes cryptocurrency companies more transparent and easier to regulate than centralized entities

-

what Collins and Greg think will happen with stablecoin regulation going forward

-

why the US should be pushing to make dollar-pegged stablecoins more prominent

Könyvfrissítés

Könyvem, A kriptopártiak: idealizmus, kapzsiság, hazugság és az első nagy kriptovaluta-őrület kialakulása, már előrendelhető.

A könyv, amely az Ethereumról és a 2017-es ICO-mániáról szól, január 18-án jelenik meg. Rendeld meg még ma!

Itt vásárolhatod meg: http://bit.ly/cryptopians

Source: https://unchainedpodcast.com/bitcoins-market-cap-reaches-heights-not-seen-in-149-days/

- 000

- 420

- 7

- 9

- Minden termék

- elemző

- bejelentés

- ARM

- körül

- vagyontárgy

- Eszközök

- Bank

- BEST

- Billió

- bis

- Bitcoin

- Bitcoin ETF

- Bitcoin határidős

- BitGo

- blockchain

- Bloomberg

- BTC

- btc ár

- épít

- Bullish

- tőke

- esetek

- vezérigazgató

- CFTC

- kémiai

- Chicago

- Chicago Mercantile Exchange

- fő

- CM kiterjesztés

- Érme

- coinbase

- Coinbase Ventures

- Coindesk

- érmék

- Companies

- vállalat

- teljesítés

- szerződések

- Crimes

- határokon átnyúló

- crypto

- Kriptocsere

- cryptocurrencies

- cryptocurrency

- Kriptovaluta tőzsde

- pénznem

- Őrizet

- dátum

- nap

- decentralizált

- Defi

- Igazságügyi Minisztérium

- digitális

- digitális valuták

- Dollár

- dollár

- csökkent

- energia

- mérnök

- becslések

- ETF

- ETH

- Et 2.0

- Ethereum

- csere

- Feltételek

- család

- bizalom

- Szövetségi

- Federal Reserve

- vezetéknév

- Előre

- alap

- Futures

- általános

- György

- Kormány

- Kezelés

- itt

- Hogyan

- HTTPS

- ICO

- infláció

- szervezeti

- intézmények

- biztosítás

- Nemzetközi

- befektető

- IT

- Igazság

- törvények

- TANUL

- Led

- Jogalkotás

- hitelezési

- villám

- Villámhálózat

- főáram

- Gyártás

- piacára

- Piaci sapka

- mém

- millió

- hálózat

- Új jogszabály

- hír

- NFT

- Tiszt

- szervezet

- Papír

- partner

- partnerségek

- kifizetések

- perspektíva

- emelvény

- medence

- előrejelzés

- prémium

- nyomás

- ár

- magánélet

- Termékek

- Vásárlás

- Olvasás

- Bejegyzés

- Szabályozás

- Szabályozók

- szabályozók

- bizalom

- jelentést

- Jelentések

- követelmények

- kutatás

- Reuters

- Kritika

- Pletykák

- biztonságos

- SEC

- SEC biztos

- Értékpapír

- Értékpapírtörvények

- biztonság

- érzés

- okos

- Intelligens szerződések

- So

- Spot

- stablecoin

- Stablecoins

- kockára

- Állami

- Csillag

- tesztek

- The Source

- a világ

- idő

- jelképes

- kereskedelem

- Kereskedés

- us

- Amerikai dollár

- minket kormány

- USDC

- Felhasználók

- Értékelés

- Ventures

- WHO

- világ

- írás

- X

- youtube