Az Áru Futures Trading Commission chief has declared unlicensed decentralized finance (Defi) platforms illegal after searching for the term on Google.

Commissioner Dan M. Berkovitz of the U.S. CFTC made the comments during a June 8 keynote titled “Climate Change and Decentralized Finance: New Challenges for the CFTC.”

elhelyezés Defi in the same category as climate change emphasizes how serious policymakers are taking what they clearly perceive as a major threat to their own financial system.

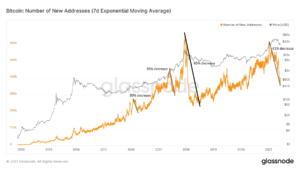

A beszéd, Berkovitz referred to the DeFi boom over the past year that has resulted in billions of dollars flowing into various protocols,

"Tekintettel az ágazat robbanásszerű növekedésére, a szövetségi szabályozóknak meg kell ismerniük ezt az új technológiát és annak lehetséges felhasználásait, és fel kell készülniük arra, hogy megvédjék a lakosságot a visszaélésekkel szemben."

DeFi defies ancient laws

Berkovitz defined DeFi after looking up the topic on Google and Wikipedia, labeling it as “an umbrella term for a variety of financial applications in cryptocurrency or blockchain geared toward disrupting financial intermediaries.”

He argued that intermediaries such as banks, exchanges, asset managers, and payment clearing facilities have developed over the past two or three hundred years. For this reason, according to Berkovitz, they can provide financial services, reliable information, custody, prevent money laundering, and be held accountable if something goes wrong.

“In a pure ‘peer-to-peer’ DeFi system, none of these benefits or protections exist,” he stated before adding:

"Nemcsak azt gondolom, hogy a derivatív eszközök engedély nélküli DeFi-piaca rossz ötlet, és azt sem látom, hogy a CEA szerint miként legálisak."

The Commodity Exchange Act is a federal act passed in 1936 acting as the backbone for financial regulators such as the CFTC, which hit Coinbase with a $6.5 million fine in March. Berkovitz added that the CEA requires futures contracts to be traded on a designated contract market (DCM) licensed and regulated by the CFTC.

“DeFi markets, platforms, or websites are not registered as DCMs or SEFs [swap execution facility]. The CEA does not contain any exception from registration for digital currencies, blockchains, or ‘smart contracts.’”

Unlicensed derivatives cannot compete

He appeared to have more of a bone to pick with the derivatives side of DeFi rather than simple automated market makers,

“Apart from the legality issue, in my view it is untenable to allow an unregulated, unlicensed derivatives market to compete, side-by-side, with a fully regulated and licensed derivatives market.”

Berkovitz concluded that the CFTC, which investigated Binance in March, needs to focus more attention on this “growing area of concern” and address regulatory violations appropriately.

“We should not permit DeFi to become an unregulated shadow financial market in direct competition with regulated market,”

A felelősség megtagadása

A weboldalunkon található összes információt jóhiszeműen és csak általános tájékoztatás céljából tesszük közzé. Bármely cselekedet, amelyet az olvasó megtesz a weboldalunkon található információkra, szigorúan saját felelősségére történik.

Source: https://beincrypto.com/cftc-commissioner-calls-for-crackdown-on-illegal-defi/

- Akció

- Minden termék

- alkalmazások

- TERÜLET

- vagyontárgy

- Automatizált

- Banks

- binance

- blockchain

- bumm

- CFTC

- változik

- fő

- Klímaváltozás

- coinbase

- Hozzászólások

- jutalék

- árucikk

- verseny

- szerződés

- szerződések

- crypto

- Kriptoipar

- cryptocurrency

- pénznem

- Őrizet

- cyber

- kiberbiztonság

- decentralizált

- Decentralizált pénzügy

- Defi

- Származékok

- digitális

- digitális valuták

- dollár

- csere

- Feltételek

- Objektum

- Szövetségi

- finanszíroz

- pénzügyi

- pénzügyi szolgáltatások

- végén

- Összpontosít

- Futures

- általános

- jó

- Növekedés

- Hogyan

- HTTPS

- ötlet

- Illegális

- ipar

- információ

- IT

- címkézés

- legutolsó

- Jogi

- fontos

- piacára

- piacok

- millió

- pénz

- Pénzmosás

- fizetés

- Platformok

- védelme

- nyilvános

- Olvasó

- Bejegyzés

- Szabályozók

- Kockázat

- biztonság

- Szolgáltatások

- árnyék

- Egyszerű

- rendszer

- Technológia

- Kereskedés

- nekünk

- Megnézem

- weboldal

- honlapok

- Wikipedia

- év

- év