Down markets can underscore the volatility of fintech companies with pay-as-you-go pricing, but these companies align cost and value for a low barrier to adoption, fast and high rates of expansion, and strong customer retention.

The dominant business model across B2B and B2C fintech companies is pay-as-you-go (PAYG), in which companies earn revenue every time some activity occurs, such as the sale of a good or underwriting of a loan. For instance, SpotOn, Stripe, and Square charge a percentage fee of the payment volume that they process, while E*trade and Interactive Brokers charge a flat fee for each options contract traded. In the not-too-distant future, as nearly minden cég fintech vállalattá válik, most fintech companies will incorporate some degree of PAYG, sometimes referred to as usage-, consumption-, or transaction-based pricing.

PAYG’s defining characteristic is the alignment of cost and value. PAYG companies charge customers for only what they use, which means customers pay for only what they need. In favorable market conditions, this can be a boon, as PAYG companies are set up to quickly capture increases in activity. This alignment is more worrisome in a down market because as soon as customer activity contracts, revenue responds in line. Because PAYG fintech models have more inherent revenue volatility than subscription models, we’ve increasingly found ourselves in conversations with other investors and analysts who suggest that PAYG companies are uncertain, risky, and low quality businesses. We find this view short-sighted and want to lay out why we believe the benefits of aligning cost and value—low barrier to adoption, fast and high rates of expansion, and strong customer retention—help PAYG fintech companies build businesses for the long term.

TARTALOMJEGYZÉK

TARTALOMJEGYZÉK

Faster adoption, faster expansion

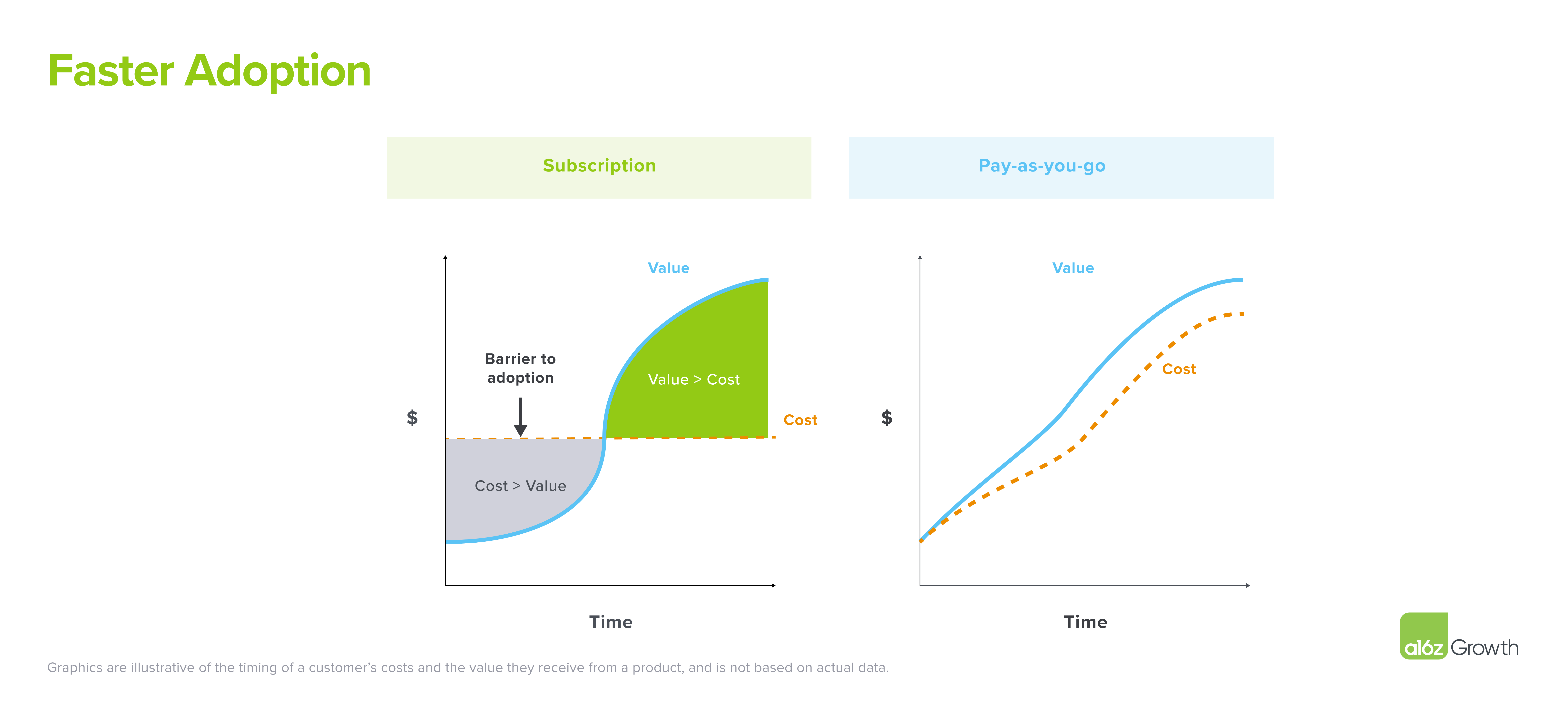

PAYG companies match the timing of spend and value by only charging customers for what they use. By comparison, subscription contracts are typically written to have fixed payment terms over the life of the contract. Cost is agreed upon, and often paid upfront, well before customers have realized any value. Breaking down barriers to adoption allows PAYG businesses to more easily find a foothold in the market. We have even seen PAYG fintech companies accelerate new user growth by removing their subscription tiers for premium features to tap into latent demand that was less willing to pay for subscription. A subset of PAYG companies further lower the barrier to adoption with “invisible” pricing, in which the cost of their service is passed onto a third party, rather than to the customer. For example, AtoB, Jeeves, and Mercury offer their software platforms and corporate cards for free to customers and earn revenue on interchange fees paid by merchants.

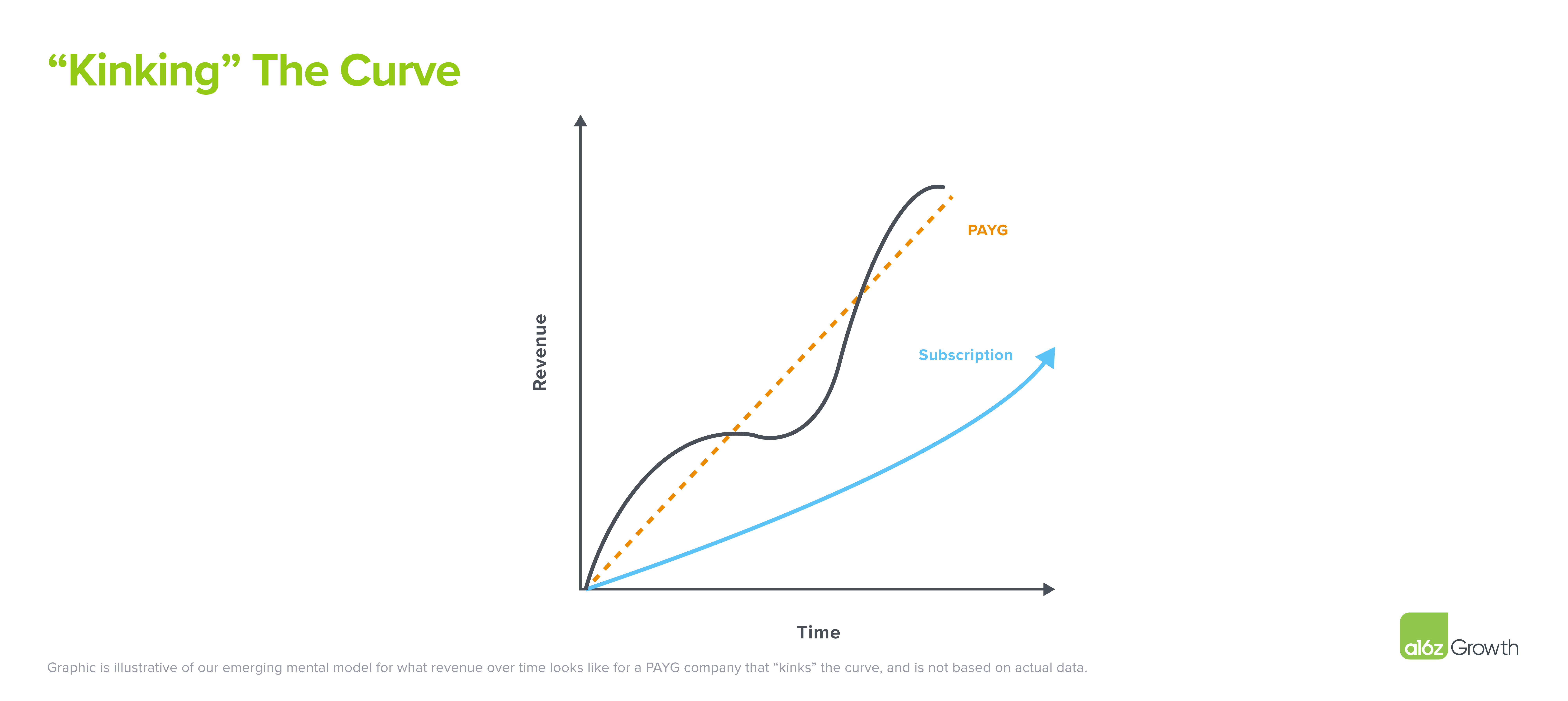

We think at its best PAYG becomes a one-two punch (faster land, faster expand!) that’s able to “kink” the revenue growth curve over time, relative to subscription. Kattintson csipog

Similarly, in PAYG fintech, expansion tangibly means that a customer uses more of the same product. This expansion can happen without any sales interaction, a common point of friction for subscription companies. For example, “net expansion” for Plaid means their customers are connecting more accounts, and for a consumer debit card, net expansion means customers choosing to swipe more often—both entirely frictionless, no-touch processes. PAYG fintech companies can expand at staggering rates within customers. In an analysis of 45+ SMB-focused public- and growth-stage private companies, we found PAYG fintech companies sometimes exceeding 250% net dollar expansion at scale.

When a PAYG fintech company hits product-market fit, faster net expansion can build on top of lower barriers to adoption to create an incredible growth machine. What’s more, PAYG fintech companies can often charge a higher per-unit price than subscription companies can, similar to how buying a single candy bar is more expensive than buying in bulk. In recent years, many of the fastest growing companies passing $25M and $100M revenue scale were PAYG fintech companies (e.g., FTX, Deél). We think at its best PAYG becomes a one-two punch (faster land, faster expand!) that’s able to “kink” the revenue growth curve over time, relative to subscription.

Strong customer retention

When paired with a compelling product, PAYG doesn’t just accelerate adoption, it also unlocks strong customer retention. For example, Stripe’s processing fees are a function of total payments received, so companies know exactly what they are getting in return for their dollars spent. On the other hand, the value of ten seats for an application with a subscription model is harder to quantify. Managers may have to pull separate reports about utilization and weigh qualitative answers about the importance of a tool in a person’s workflow and ultimate productivity to justify renewing their contract. Similarly, when consumers review personal budgets, they’re far less likely to get rid of grocery spend on their debit cards than they are to cut their discretionary subscriptions.

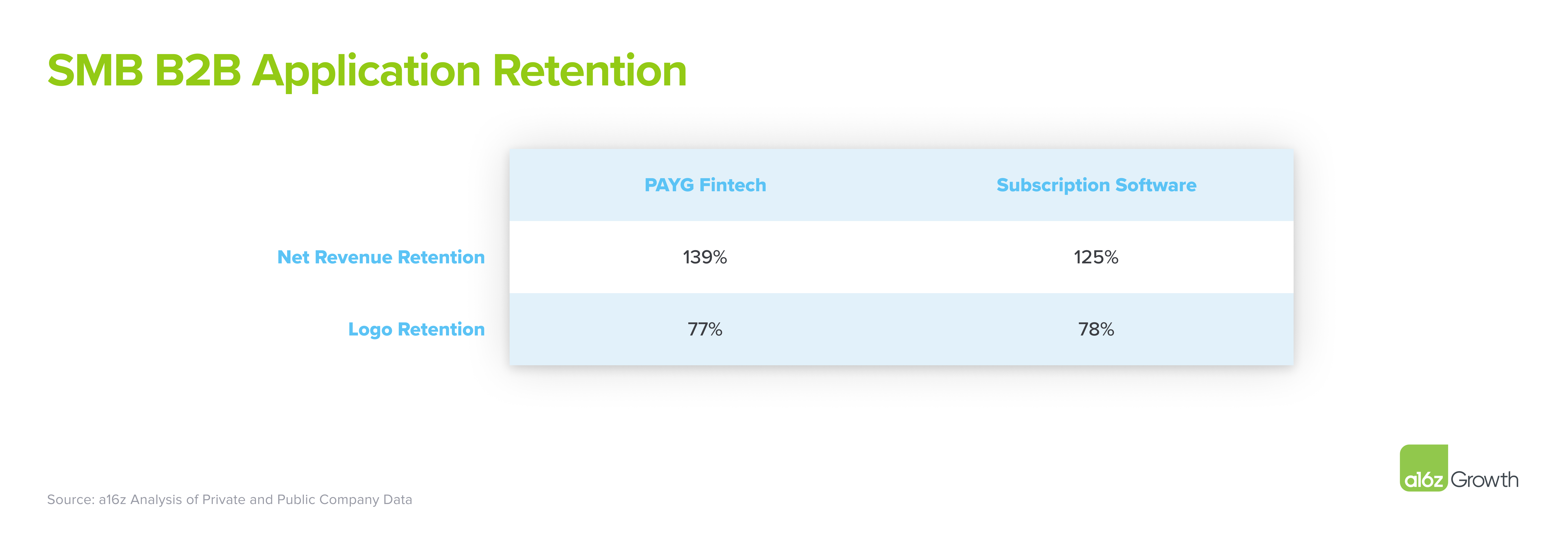

When compared to a subscription model with presumed customer lock-in, PAYG fintech models may actually maintain the same customer logo retention as subscription companies while achieving much higher net retention. In the 45+ SMB-focused public- and growth-stage private companies we analyzed, we found that PAYG fintech companies experience similar customer churn, but see 14 percentage points higher net revenue retention than their subscription software counterparts.

Additionally, PAYG has a shorter revenue feedback loop, so a company can spot and respond more quickly to customer signals. Rather than waiting for quarterly catch ups or the end of a renewal cycle to get product feedback, revenue declines from falling usage tell a company right away when a customer is not happy with their product. This creates more urgency in the company’s response than any amount of qualitative feedback or telemetry data.

Revenue volatility doesn’t mean risky

When a PAYG fintech company experiences high revenue volatility, we often hear investors jump to the conclusion that these companies are risky because no one can predict whether their revenue will go up or down tomorrow. Uncertainty around short-term revenue is expected in PAYG fintech, but volatility alone is a poor measure of the risk that actually matters: how revenue evolves over the long-term. Assessing this requires looking at many qualitative factors, like how core you are to a customer’s operations, or your rate of product innovation, or how you go to market. None of these things can be understood just from looking at a line chart in isolation.

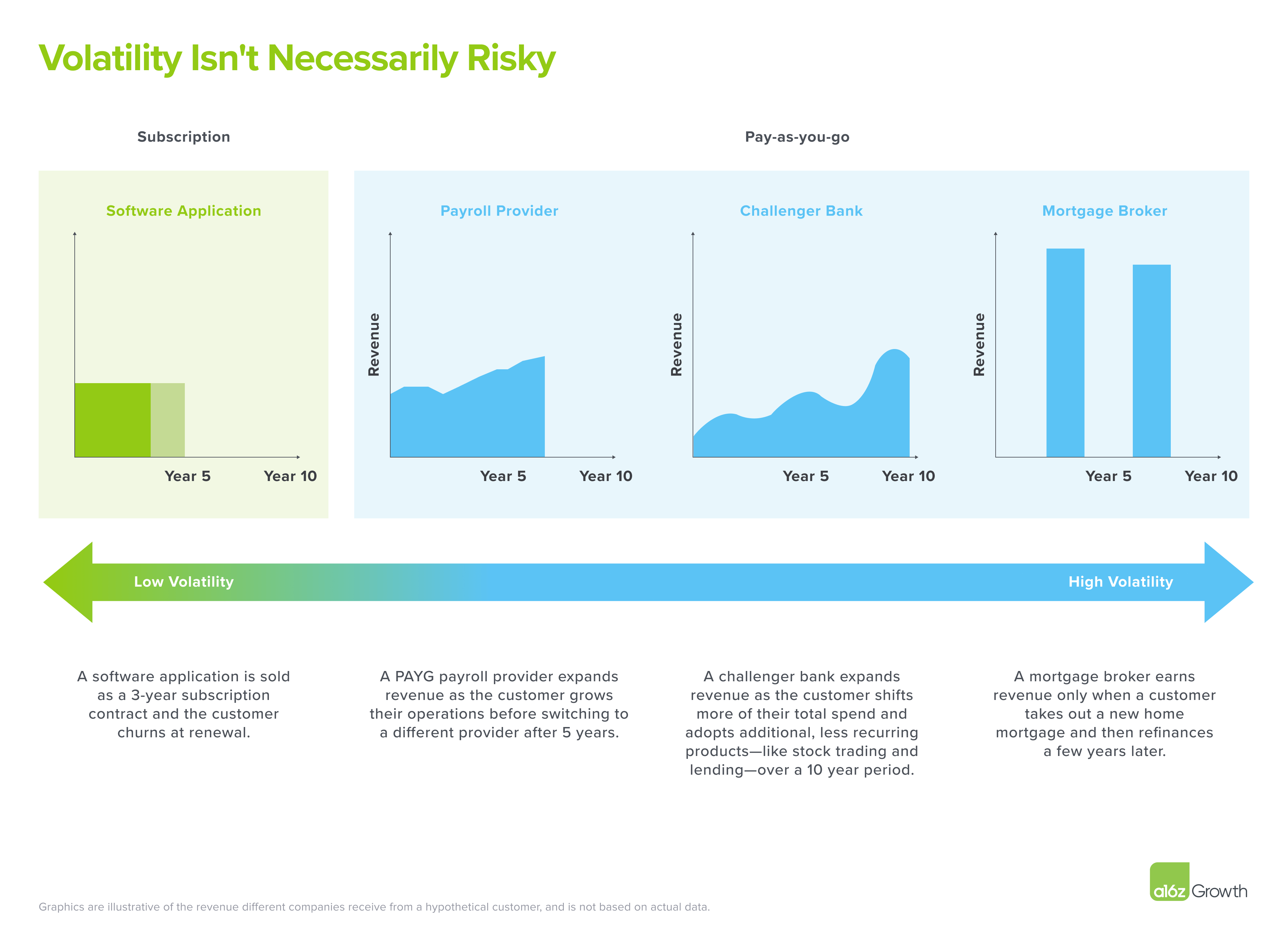

In PAYG fintech, revenue may oscillate more along the way, but entrepreneurs should focus on maximizing revenue over a long time horizon. To illustrate this, let’s consider a hypothetical example of the revenue earned from a customer by four different companies.

While the software application company has the lowest volatility, all three PAYG companies capture more revenue over a ten-year period, despite the absence of a multi-year contract. For the PAYG companies, the smoothness of revenue depends on how recurring or episodic the customer need you’re solving is. A payroll provider processes payments multiple times per month, for instance, while a mortgage broker may only process a loan for a customer once a decade. Regardless of the volatility, the persistence of the need these businesses solve and how well they solve it determines long-term revenue. What matters is the area under the curve, not the smoothness of the line.

PAYG companies can be particularly hard hit in a downturn, and the short-term pain can be intense across layoffs, low morale, and more difficult fundraisings. A down cycle may also test the resolve of employees and investors, but this does not mean that important and high-quality businesses are not being built. We continue to believe in PAYG fintech companies and the opportunity for long-term growth ahead.

***

Az itt kifejtett nézetek az AH Capital Management, LLC („a16z”) egyes alkalmazottainak nézetei, és nem az a16z vagy leányvállalatai nézetei. Az itt található bizonyos információk harmadik féltől származnak, többek között az a16z által kezelt alapok portfólióvállalataitól. Noha megbízhatónak vélt forrásokból származnak, az a16z nem ellenőrizte önállóan ezeket az információkat, és nem nyilatkozik az információk tartós pontosságáról vagy adott helyzetre való megfelelőségéről. Ezenkívül ez a tartalom harmadik féltől származó hirdetéseket is tartalmazhat; az a16z nem vizsgálta át az ilyen hirdetéseket, és nem támogatja az abban található reklámtartalmat.

Ez a tartalom csak tájékoztatási célokat szolgál, és nem támaszkodhat rá jogi, üzleti, befektetési vagy adótanácsadásként. Ezekkel a kérdésekkel kapcsolatban konzultáljon saját tanácsadójával. Bármely értékpapírra vagy digitális eszközre történő hivatkozások csak illusztrációs célt szolgálnak, és nem minősülnek befektetési ajánlásnak vagy ajánlatnak befektetési tanácsadási szolgáltatások nyújtására. Ezen túlmenően ez a tartalom nem befektetőknek vagy leendő befektetőknek szól, és nem is szánható felhasználásra, és semmilyen körülmények között nem támaszkodhat rá az a16z által kezelt alapokba történő befektetésről szóló döntés meghozatalakor. (A16z alapba történő befektetésre vonatkozó ajánlatot csak az ilyen alap zártkörű kibocsátási memoranduma, jegyzési szerződése és egyéb vonatkozó dokumentációja tesz, és azokat teljes egészében el kell olvasni.) Minden említett, hivatkozott befektetés vagy portfóliótársaság, ill. A leírtak nem reprezentatívak az a16z által kezelt járművekbe történő összes befektetésre, és nem garantálható, hogy a befektetések nyereségesek lesznek, vagy a jövőben végrehajtott egyéb beruházások hasonló tulajdonságokkal vagy eredménnyel járnak. Az Andreessen Horowitz által kezelt alapok befektetéseinek listája (kivéve azokat a befektetéseket, amelyek esetében a kibocsátó nem adott engedélyt az a16z számára a nyilvánosságra hozatalra, valamint a nyilvánosan forgalmazott digitális eszközökbe történő be nem jelentett befektetéseket) a https://a16z.com/investments oldalon érhető el. /.

A benne található diagramok és grafikonok kizárólag tájékoztató jellegűek, és nem szabad rájuk hagyatkozni befektetési döntések meghozatalakor. A múltbeli teljesítmény nem jelzi a jövőbeli eredményeket. A tartalom csak a feltüntetett dátum szerint beszél. Az ezekben az anyagokban megfogalmazott előrejelzések, becslések, előrejelzések, célok, kilátások és/vagy vélemények előzetes értesítés nélkül változhatnak, és mások véleményétől eltérhetnek vagy ellentétesek lehetnek. További fontos információkért látogasson el a https://a16z.com/disclosures oldalra.

- Andreessen Horowitz

- Bitcoin

- blockchain

- blokklánc megfelelőség

- blockchain konferencia

- coinbase

- coingenius

- megegyezés

- kriptokonferencia

- kriptikus bányászat

- cryptocurrency

- decentralizált

- Defi

- Digitális eszközök

- Ethereum

- FINTECH

- gépi tanulás

- nem helyettesíthető token

- Plató

- plato ai

- Platón adatintelligencia

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- árazás

- a tét igazolása

- W3

- zephyrnet