Vágó: Nathaniel Cajuday

The Securities and Exchange Commission (SEC) released an advisory against Sophia Francisco Holding OPC to inform the public of their scheme.

According to the SEC, individuals claiming to represent SOPHIA FRANCISCO HOLDING OPC/FINANCIAL CONSULTANCY SERVICES, SOPHIA-FRANCISCO/SOPHIA FRANCISCO TRADING, headed by SOPHIA MARIA ANDREA RAMIREZ FRANCISCO, are enticing the public to invest their money in said entity.

In a statement, the Commission noted that SOPHIA FRANCISCO HOLDING OPC is offering investments to the public with a minimal amount of ₱500.00 per account. Investors may earn 3% daily for 20 days, or 60% total in 20 days, or earn 25% in just 10 days.

Furthermore, a 5% referral fee is awarded to those who are able to entice others to invest in Sophia Francisco Trading. Interested individuals must register at the website.

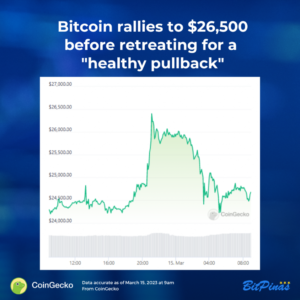

After registering, the investors would be asked to deposit money through various modes of payment that would then be verified within approximately five minutes. A receipt will then be received after verification, and the individual will then be able to trade through the website. Sophia Francisco Holding OPC allegedly earns through Sophia Francisco’s skills in crypto trading by hitting its monthly win rate of 4% daily, 28% weekly, or 112% monthly.

“The transactions stated above are considered securities in the form of “investment contracts” which must be registered with the Commission. The elements are all present as there is an investment of money by the public into the common enterprise known as SOPHIA FRANCISCO HOLDING OPC with the expectation of profits either 3% daily, 60% in 20 days or 25% in 10 days while relying on said entity to manage their trades,” SEC noted.

The records of the Commission show that SOPHIA FRANCISCO HOLDING OPC is registered with the Commission as a One Person Corporation (OPC), while FINANCIAL CONSULTANCY SERVICES SOPHIA-FRANCISCO/SOPHIA FRANCISCO TRADING has been apparently granted a Certificate of Business Name Registration by the Department of Trade and Industry.

On the other hand, SOPHIA FRANCISCO is not registered with the Commission as a corporation or partnership. However, SOPHIA FRANCISCO HOLDING OPC, FINANCIAL CONSULTANCY SERVICES SOPHIA-FRANCISCO and SOPHIA FRANCISCO TRADING FRANCISCO HOLDING OPC are NOT AUTHORIZED to solicit investments from the public since it has not secured prior registration and/or license from the Commission as prescribed under Sections 8 and 28 of the Securities Regulation Code.

Ennélfogva a lakosságnak azt tanácsoljuk, HOGY NE BEFEKTESSEN, ÉS NE SZABÁLJON MEG A BEFEKTETÉST olyan befektetési programba, amelyet bármely egyén vagy személyek csoportja állítólag a nevében vagy nevében kínál fel, és legyen óvatos az olyan személyekkel vagy személyek csoportjával kapcsolatban, akik befektetéseket kérnek. nevében" – tette hozzá a Bizottság.

According to the government body, those who act as salesmen, brokers, dealers, or agents or claim to act as such for SOPHIA FRANCISCO HOLDING OPC in selling or convincing people to invest in the investment scheme being offered by the said entity, including solicitations and recruitment through the internet, may be prosecuted and held criminally liable under Section 28 of the SRC and penalized with a maximum fine of ₱5 million or penalty of 21 years of imprisonment or both pursuant to Section 73 of the SRC.

It also noted that those who invite or recruit others to join or invest in such ventures or offer investment contracts or securities to the public may incur criminal liability, or otherwise be sanctioned or penalized accordingly as held by the Supreme Court in the case of Securities and Exchange Commission vs. Oudine Santos (G.R. No. 195542, 19 March 2014).

“Should anyone have any information on any recruitment or securities solicitation activities being undertaken by persons or groups of persons claiming to represent SOPHIA FRANCISCO HOLDING OPC, they may send their reports to the Enforcement and Investor Protection Department through email at epd@sec.gov.ph, " zárta a SEC.

További információ a Bizottság által más entitásokkal szemben kiadott tanácsokról. Menj: SEC Advisory Archives | BitPinas

Ez a cikk a BitPinas webhelyen jelent meg: A SEC tanácsot adott ki a Sophia Francisco Holding ellen

Jogi nyilatkozat: A BitPinas cikkek és külső tartalma az nem pénzügyi tanácsot. A csapat független, elfogulatlan híreket szolgáltat, hogy információkat nyújtson a Fülöp-szigeteki titkosításhoz és azon túl.

- Bitcoin

- BitPinas

- blockchain

- blokklánc megfelelőség

- blockchain konferencia

- coinbase

- coingenius

- megegyezés

- kriptokonferencia

- kriptikus bányászat

- cryptocurrency

- decentralizált

- Defi

- Digitális eszközök

- Ethereum

- gépi tanulás

- hír

- nem helyettesíthető token

- Plató

- plato ai

- Platón adatintelligencia

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- a tét igazolása

- Szabályozás

- SEC

- SEC tanácsadó

- Sophia Francisco Holding

- W3

- zephyrnet

![[Esemény összefoglalója] Mid-Winter Fireside: Crypto Winter in Three Perspectives [Esemény összefoglalója] Mid-Winter Fireside: Crypto Winter in Three Perspectives PlatoBlockchain Data Intelligence. Függőleges keresés. Ai.](https://platoblockchain.com/wp-content/uploads/2022/08/first-recap-300x157.png)