Wells Fargo has joined the race alongside JPMorgan in launching Bitcoin funds. The two big banks have both processed Bitcoin funds with SEC – the Securities and Exchange Commission. They are another pair of renowned banks to broaden their interest in cryptocurrency.

Wells Fargo is an American multinational financial services company in the United States in 1852 by Williams Fargo. The firm is partnering with both FS Investment and the New York Digital Investment Group on the deal.

The NYDIG is a popular financial and technological services company that operates as an investment firm globally. It’s a registered company that offers execution services, asset management, and custody for digital assets.

Kapcsolódó olvasmányok Az Ethereum alapító államai A token alapú decentralizált kormányzás leállítja a DeFi szektor növekedését

Wells Fargo comprises two subsidiaries, the Wells Fargo Advisors Financial Network, and Wells Fargo Clearing Services. The company will receive an unspecified percentage from the sales made via its dual subsidiaries.

JPMorgan Eyes Bankless Future By Launching Bitcoin Funds

JPMorgan will also partner with New York Digital Investment Group (NYDIG) and plans to receive a percentage of sales via subsidiaries. The firm is known as JPMorgan Chase & Co. It’s an American multinational investment bank and financial services holding company.

Wells Fargo and JPMorgan are the latest megabanks in the growing number to slowly embrace cryptocurrency.

JPMorgan had deliberately recommended that investors should consider including Bitcoin assets in their digital portfolio earlier this year. They added that up to 1% of their allocations could attract a reasonable gain in the total risk-adjusted returns.

JPMorgan Chase and Wells Fargo also take precautions by channeling millions of dollars into Bitcoin and crypto towards having a bankless future.

Goldman Sachs, an American multinational investment bank and financial services company, is also part of this move. The company is headquartered in New York City and offers investment management, securities, asset management, and prime brokerage services.

Bank of New York Mellon To Explores Crypto Department

Earlier this month, the BNY Mellon announced their plans to form a new crypto development team. The team will develop a platform known as custody and administration for digital and traditional assets. The Morgan Stanley investment section is also considering whether to stake on Bitcoin.

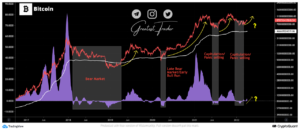

Bitcoin is continuously moving in an upward direction towards a new high | Source: BTCUSD a TradingView.com oldalon

The Bank of New York Mellon Corporation is an American investment banking services holding company. BNY Mellon has its headquarters in New York City, and it originated from a merger in 2007.

Kapcsolódó olvasmányok Jogi szakértő: A Pénzügyminisztérium tervezi a DeFi rögzítését

Until 2020, Banks had no choice in the subject matter. The Office of the Comptroller of the Currency (OCC) didn’t permit banks to include cryptocurrencies in their holdings until past July.

The adjustment and relaxation of this restriction made banks wake up to the option of exploring crypto opportunities.

Kiemelt kép a Pixabay -ből és diagram a TradingView.com webhelyről

- "

- &

- 2020

- tanácsadók

- Amerikai

- bejelentés

- vagyontárgy

- Vagyonkezelés

- Eszközök

- Bank

- Banking

- Banks

- Bitcoin

- ügynöki jutalék

- üldözés

- Város

- jutalék

- vállalat

- crypto

- cryptocurrencies

- cryptocurrency

- Valuta

- Őrizet

- üzlet

- decentralizált

- Defi

- Fejleszt

- Fejlesztés

- digitális

- Digitális eszközök

- dollár

- csere

- pénzügyi

- pénzügyi szolgáltatások

- Cég

- következik

- forma

- alapító

- FS

- alapok

- jövő

- kormányzás

- Csoport

- Növekvő

- Magas

- HTTPS

- kép

- Beleértve

- kamat

- beruházás

- Befektetők

- IT

- JPMorgan

- jpmorgan üldözés

- július

- legutolsó

- vezetés

- Morgan Stanley

- mozog

- hálózat

- New York

- new york city

- Ajánlatok

- Lehetőségek

- opció

- partner

- emelvény

- Népszerű

- portfolió

- Fő bróker

- Futam

- Olvasás

- Visszatér

- értékesítés

- SEC

- Értékpapír

- Értékpapír- és Tőzsdebizottság

- Szolgáltatások

- tét

- Stanley

- Államok

- Pénzügyminisztérium

- Egyesült

- Egyesült Államok

- Wells Fargo

- XML

- év