1. June Market Movements

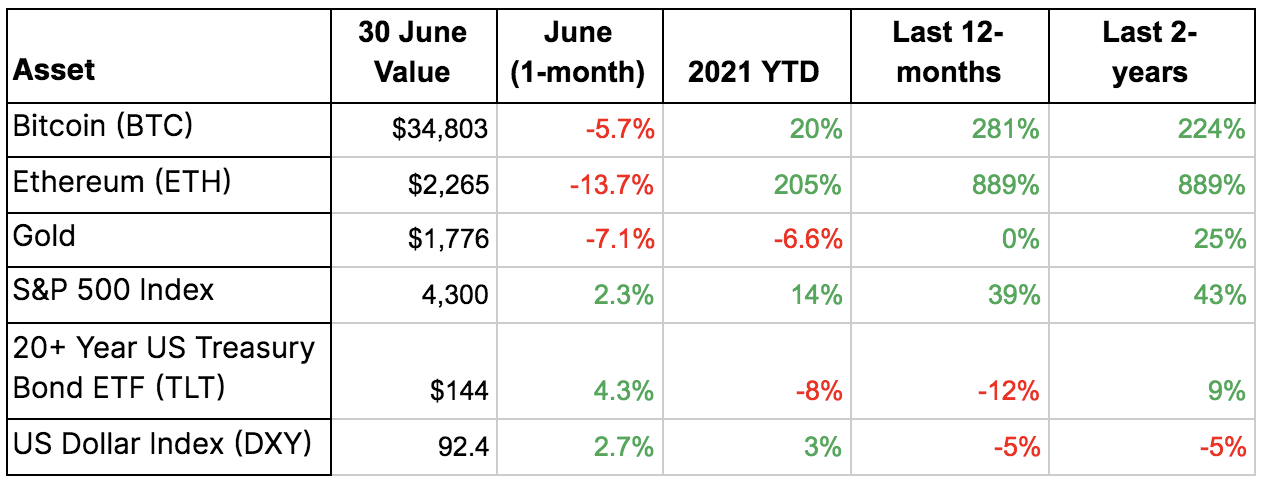

In June Bitcoin (BTC) followed-up May’s major sell-off with a relatively modest decline. Bitcoin finished June -6% for the month. Ethereum fared worse and was down -14%.

However, major cryptoassets are still positive six months into 2021 with bitcoin +20% YTD and Ethereum +205% YTD. And over a 12-month time horizon crypto continues to vastly outperform every other major asset class (BTC +281% and ETH +889%).

1. táblázat: Ár-összehasonlítás: Bitcoin, Ethereum, arany, amerikai részvények, hosszú lejáratú amerikai kincstárjegyek, amerikai dollár (%-os változás)

In traditional markets, gold also saw a major decline -7% while long-dated US treasury bonds rallied +4%. These developments and other data points, such as declining lumber prices, would seem to lend some market support to the view expressed by Fed officials that inflation concerns are “transient”.

However, headline inflation data continues to come in hot. Overall, the jury is still out on whether inflation will abate as quickly as Fed officials have forecasted. For more on the inflation outlook please have a listen to our recent podcast with financial historian Niall Ferguson.

As we go to press in July, the rapidly spreading COVID Delta variant and other factors have sparked selling pressure on stocks in July. Markets are again weighing the possibility of a slower economic recovery as anecdotal examples of vaccinated individuals becoming infected grow more common.

Any recovery slowdown may renew calls for additional monetary and financial stimulus, which was one of the major drivers of bitcoin’s 2020 price rally. Crypto, in contrast with stocks, has also already experienced a major price correction in May-June, down now just over 50% from its all-time high (Figure 1).

Figure 1: BTC market cap to on-chain estimated cost basis (MVRV) is back to a reasonable 1.7x

In short, should the Delta variant force policymakers to apply more stimulus we feel investors will once again look to allocate back into bitcoin.

2. Láncon belüli elemzés

Each month, we dive into on-chain data to explore interesting trends or movements on the Bitcoin network. Overall, on-chain activity dropped in the month of June.

Table 2: June vs May Bitcoin network activity

The average daily fees per transaction continued to drop in the month of June from $15 / transaction to $6 / transaction. But as we saw in May, these reduced fees did not bring on an increase in activity.

Decrease in the estimated hash rate

The estimated hash rate (in EH/s) decreased in June from 161 EH/s to 120 EH/s.

China’s continued crackdown on crypto led to the closure of mining operations. These closures seem to have ultimately led to this month’s decrease in hash rate. However, we’ve already seen mining hubs previously located in China relocated to other areas, including Texas és a Kazahsztán.

3. Amit olvasunk, hallunk és nézünk.

Crypto

A Crypto-n túl

Source: https://medium.com/blockchain/foundations-8932a69510b4?source=rss—-8ac49aa8fe03—4

- 2020

- További

- vagyontárgy

- Bitcoin

- blockchain

- Kötvények

- BTC

- változik

- Kína

- bezárás

- CNBC

- Coindesk

- tovább

- Covidien

- crypto

- dátum

- Delta

- DID

- Dollár

- Csepp

- csökkent

- DX

- Gazdasági

- ETH

- Ethereum

- EV

- Fed

- díjak

- Ábra

- pénzügyi

- Arany

- Nő

- hash

- hash arány

- Magas

- hr

- HTTPS

- ia

- Beleértve

- Növelje

- infláció

- Befektetők

- július

- Led

- Macro

- fontos

- piacára

- Piaci sapka

- piacok

- közepes

- Bányászati

- hónap

- hálózat

- Művelet

- Más

- Outlook

- podcast

- nyomja meg a

- nyomás

- ár

- ár rally

- rally

- Olvasás

- felépülés

- rövid

- SIX

- inger

- készletek

- nyár

- támogatás

- idő

- tranzakció

- Trends

- us

- Amerikai dollár

- Megnézem

- Illékonyság

- youtube