There’s no denying that Ethereum has interesting qualities as an ecosystem. The amount of activity around the protocol alone is proof of that. However, is it a better currency than Bitcoin? This software engineer with a BA in economics thinks that ETH “is more likely to become a global currency than BTC.” He makes the case in 11 tweets, and we’re here for the discussion.

Adriano Feria makes some good points, but he’s mistaken about a crucial aspect that makes all of his reasoning fall down like a card castle. His thread starts like this:

2/Ether was created to finance the security of the network. It was designed to provide remuneration to miners (ether is used to PAY miners, and issuance is a form of subsidy). It’s sole purpose is to function as a utility token, which is just a form of money that has a very

— Adriano FΞRIA 🦇🔊 (@AdrianoFeria) Július 1, 2021

So far so good. The only issue here is the assertion, “issuance is a form of subsidy.” It is, but that’s the only way ETH is created, which means it’s a lot more than “a form of subsidy” for the miners. It’s inflation, it’s how the sausages are made, it’s magic… and it’s prone to change whenever the developers feel like it should… But that’s neither here nor there, so let’s move on.

Kapcsolódó olvasmányok Why Some Bulls Think Bitcoin Hits $500,000 Over the Coming Years

Tweets one to five are a long-winded explanation of the classic argument: “ETH has more use cases than BTC.” That much is true, and nobody is contesting it. Is that reason enough for The Flippening to happen? It might very well be, but that’s just theory at this point. It hasn’t happened yet, and it’s not close to happening. Does a swiss knife inherently have a bigger market than a screwdriver?

In any case, that has nothing to do with today’s question, is ETH “more likely to become a global currency than BTC? "

To finish the first section of his tweet storm, Mr. Feria asserts that ETH “is NOT a commodity, and never was.” Many people would disagree with this point and argue it to death. We’re not going to do that.

Wait, But, What’s The Flippening?

It’s that mythical and hypothetical time when Ethereum’s market capitalization surpasses that of Bitcoin. If you want a deep dive, Bitcoinist’s got you.

However, that has little to do with today’s question…

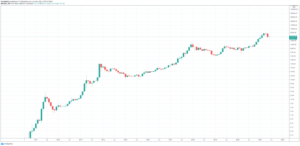

ETH árdiagram a Bitfinex-en | Forrás: ETH / USD on TradingView.com

Is ETH More Likely To Become A Global Currency Than BTC?

As we approach Mr. Feria’s mistake, he says “The market is starting to view ether as a competitor to bitcoin despite the original narrative that these were entirely different types.” He’s not wrong, the market is starting to view it that way. The market is wrong because they’re “entirely different types.” But that’s neither here, nor there…

Mr. Feria asserts a universal truth that everyone should be aware of, that “the value of money is determined” by supply and demand. And then, he makes the mistake:

7/ other asset/good/service: supply and demand. Supply is in part determined by the issuance model, which is unsurprisingly referred to as monetary policy. ETH’s 2.0 monetary policy + EIP-1559 will result in a diminishing total supply while at the same time reducing float due

— Adriano FΞRIA 🦇🔊 (@AdrianoFeria) Július 1, 2021

He thinks that, “ETH’s 2.0 monetary policy + EIP-1559 will result in a diminishing total supply.” That’s simply not true. The “Étereum Improvement Proposal” 1559 promises many things, one of which is less volatile transaction fees by introducing an algorithmic model and base fees. Those base fees will be burned, creating a disinflationary environment.

However, the total supply will keep increasing. The estimated burning is not higher than the daily issuance. Not by a long shot. Right now, the daily issuance is approximately five times higher. And that can change, it’s not set in stone. So, while a little burning certainly is good for the ETH holders, the protocol is far from having “a diminishing total supply. "

Plus, and this is important, Ethereum doesn’t have a hard cap. According to their current monetary policy, they will keep minting ETH forever.

Bitcoin has a 21 million BTC hard cap. That’s the total supply. It’s fixed and known in advance. For this characteristic alone, Bitcoin is more likely to become a global currency.

That doesn’t necessarily mean there’s no place for Ethereum and its vibrant ecosystem. They’re both “teljesen más típusok” of projects with wildly different characteristics, after all.

Is There Anymore To This Currency Thing?

Mr. Feria finished his dissertation by saying that Ethereum’s future Proof-Of-Stake consensus mechanism, mixed with all the exciting developments in their ecosystem creates a “self-reinforcing mechanic for the appreciation of ether.” That might very well be true, and it goes into the “demand” category. However, an increase in ETH demand doesn’t imply a decrease in BTC demand.

So, playing Mr. Feria’s scenario:

In ETH, the demand increases dramatically but the supply is infinite and ever-growing.

In BTC, the demand increases at the current rates and the supply is hard-capped.

Te matekolsz.

10/prices, which is what is needed for it to continue to expand its monetary scope and mature into a global currency.

— Adriano FΞRIA 🦇🔊 (@AdrianoFeria) Július 1, 2021

In any case, everything’s speculation at this point. Feria also thinks that “Accruing value through all these supply/demand dynamics will consequentially increase liquidity and stabilize prices.” Others think that Proof-Of-Stake is a disaster and that the ETH burning to come will increase volatility and act as a permanent “felezés.” Who’s right and who’s wrong? We’ll have to wait and see.

Kapcsolódó olvasmányok 3.6 milliárd dolláros rejtjellopás: a dél-afrikai bank tagadja a csalással vádolt afrikai titkosítást

However, BTC is unmatched as a currency.

Not only by ETH, but by everything under the sun since the dawn of time.

If and only if it can be considered as currency, but, that’s a topic for another time.

Kiemelt kép Markus Spiske on Unsplash - Grafikonok TradingView

- 000

- 11

- 9

- afrikai

- Minden termék

- körül

- Bank

- Billió

- Bitcoin

- Bitfinex

- BTC

- Bulls

- esetek

- változik

- táblázatok

- érkező

- árucikk

- megegyezés

- folytatódik

- létrehozása

- crypto

- Valuta

- Jelenlegi

- Kereslet

- fejlesztők

- Közgazdaságtan

- ökoszisztéma

- mérnök

- Környezet

- ETH

- ETH / USD

- Éter

- Ethereum

- ETHUSD

- Bontsa

- díjak

- finanszíroz

- vezetéknév

- következik

- forma

- csalás

- funkció

- jövő

- Globális

- jó

- itt

- Hogyan

- HTTPS

- kép

- Növelje

- infláció

- IT

- fizetőképesség

- Hosszú

- piacára

- Piac tőkésítés

- matematikai

- millió

- Miners

- vegyes

- modell

- pénz

- mozog

- hálózat

- Más

- Fizet

- Emberek (People)

- politika

- ár

- projektek

- bizonyíték

- Proof-of-Tét

- Az árak

- Olvasás

- biztonság

- készlet

- So

- szoftver

- Software Engineer

- Dél

- vihar

- szubvenció

- kínálat

- Svájci

- lopás

- idő

- jelképes

- tranzakció

- csipog

- Egyetemes

- hasznosság

- Utility Token

- érték

- Megnézem

- Illékonyság

- várjon

- Mi