Defi Infrastructure 101 — Overview & Market Landscape

Decentralized Finance (DeFi) is redefining the future of finance. There is a major shift going on in the underlying infrastructure powering financial applications, and it’s changing the way we think about permission and control, transparency, and risks.

DeFi è un settore di mercato in via di sviluppo all'interno dell'intersezione di tecnologie blockchain, risorse digitali e servizi finanziari. Secondo DeFi Pulse, the value of digital assets locked into Defi applications grew 10X from less than $1 billion in 2019 to over $10 billion in 2020, and over $80 billion at its peak thus far in 2021. Yet the DeFi applications and underlying infrastructure are still in its nascent stage of development.

The goal of this report is to provide an introduction of the new emerging area of DeFi infrastructure powering DeFi apps today. While it’s easy to get caught up in the hype and speculation within the space, I’ll focus on the key components of Defi applications, their key differentiation compared to traditional finance, potential risks, and longer-term implications these Defi apps are causing.

Major Structural Commonalities Across DeFi Apps

DeFi apps are financial applications with no central counterparties. In practice, this means there is no institution (e.g. banks) you are interfacing with to access these financial applications; instead users interface directly with the programs (e.g. smart contracts) on top of the protocol itself. For more of a DeFi 101 primer, I highly recommend questa relazione.

Le principali categorie di app DeFi includono scambi decentralizzati, piattaforme di prestito, stablecoin, asset sintetici, assicurazioni, tra gli altri. Sebbene diverse nell'ambito, tutte queste app DeFi condividono una serie importante di punti in comune, tra cui:

- Utilizzo delle blockchain sottostanti come registro principale

- Open source e trasparente per impostazione predefinita

- Interoperabile e programmabile (componibilità)

- Aperto e accessibile a tutti (senza permesso)

Utilizzo delle blockchain sottostanti come Core Ledger

Compared to traditional financial applications which use core banking systems (Fiserv, Jack Henry, FIS, etc.) as the underlying ledgers of record, Defi apps use blockchains as their underlying core ledger.

A few of the most prominent blockchains used to build Defi apps include Ethereum, Solana, and Binance Chain, etc. These underlying blockchains store the ledger state of what is deposited into the DeFi apps, what is stored within the smart contracts, all of the transactions, and withdrawals.

All of the core accounting functions to ensure matching inputs and outputs are handled by the blockchain itself, the Defi apps don’t need to create external systems to reconcile balances, because all of the transactions are queryable across the various block explorers.

Inoltre, rispetto al sistema tradizionale non esiste un processo separato di regolamento e compensazione delle transazioni. L'elaborazione, la compensazione e la liquidazione della transazione avvengono tutte nello stesso momento in cui la transazione viene trasmessa. Sebbene sia consigliabile attendere circa 21 blocchi o più per garantire la finalità sulla blockchain stessa.

Open Source e trasparente per impostazione predefinita

Compared to traditional financial applications which are all closed-source and built on top of proprietary systems, Defi applications are typically entirely open-sourced and built on top of open underlying blockchains.

Ciò causa tre proprietà interessanti:

- componibilità — L'app DeFi stessa può essere biforcuta, remixata e riutilizzata in molte altre applicazioni (maggiori informazioni di seguito).

- Trasparenza — Poiché l'app DeFi è open source, è completamente verificabile sapere esattamente cosa sta facendo lo smart contract in termini di funzioni, autorizzazioni utente e dati utente.

- verificabilità — Poiché la blockchain sottostante è di per sé open source, l'intero flusso di fondi è completamente verificabile, comprese le garanzie nel sistema, il volume degli scambi, i default, ecc.

A differenza del sistema finanziario tradizionale (che è opaco), funziona con un sistema di riserva frazionaria ed è soggetto a shock di mercato - il sistema DeFi è completamente trasparente e eccessivamente garantito - che consente alle aziende DeFi di superare le recessioni in modo molto più efficiente.

Interoperabile e programmabile

Affinché gli sviluppatori possano guadagnare la fiducia degli utenti, la maggior parte delle app DeFi sono completamente open source, inclusi il front-end e gli stessi contratti intelligenti. Inoltre, poiché le app DeFi funzionano tutte su una piattaforma comune (la blockchain sottostante), queste app DeFi sono completamente interoperabili tra loro e possono essere programmate per funzionare con qualsiasi altra app DeFi nell'ecosistema.

Questo è comunemente indicato come il "lego dei soldi" o "componibilità” aspetti della DeFi. Tutte queste app DeFi sono come singoli pezzi lego che possono essere remixati per funzionare con altri pezzi lego per costruire qualcosa di nuovo.

Contrasta questo con il sistema finanziario tradizionale dove;

- Frammentazione dell'infrastruttura — Le app finanziarie tradizionali non sono costruite su un'infrastruttura comune.

- Applicazioni in silos — Le app finanziarie tradizionali sono in genere di proprietà di un istituto bancario. Ad esempio, tutte le "app fintech" di Wells Fargo funzionano insieme ma non tra istituti bancari diversi.

- Sviluppatore poco amichevole — Le app finanziarie tradizionali non sono fatte per altri sviluppatori su cui costruire servizi.

Il sistema finanziario tradizionale ha standard comuni; tuttavia, è estremamente difficile raggiungere il consenso tra i partecipanti al mercato perché le istituzioni finanziarie considerano il loro software come un fossato competitivo invece di utilizzare i prodotti come un fattore di differenziazione.

Uno dei motivi principali per cui abbiamo visto così tanta innovazione nello spazio DeFi è perché i sistemi sono interoperabili, consentendo all'ecosistema degli sviluppatori di avere un'espressione più creativa sui prodotti e sui servizi che creano. Inoltre, gli sviluppatori non devono perdere tempo a reinventare la ruota, ma piuttosto possono basarsi su strutture comuni e concentrarsi sulle cose che rendono speciali i loro prodotti.

Aperto e accessibile a tutti

Con le applicazioni finanziarie tradizionali, i nuovi utenti in genere devono sottoporsi a un lungo processo di onboarding, verifiche del reddito, controlli del credito o persino incontri di persona, solo per poter utilizzare un determinato prodotto finanziario.

A causa di queste regole arbitrarie stabilite dalle istituzioni finanziarie, questi processi di onboarding sono incline al pregiudizio Compreso descrizione del prestito, rifiuto dei servizi bancari di base, apertura di linee di credito senza consenso, addebitare tasse illegali, ecc.

Con le applicazioni DeFi, tutto ciò di cui hai bisogno è un indirizzo di portafoglio per interagire con questi sistemi. Le app DeFi non richiedono la verifica del reddito, non hanno bisogno di controlli del credito e nella maggior parte dei casi non hanno nemmeno bisogno di sapere chi sei al di fuori dell'indirizzo del portafoglio che stai utilizzando.

Questo è comunemente indicato come app DeFi essendo permissionless. Se hai i fondi nel tuo portafoglio per la transazione che vuoi fare, puoi farlo. Non ci sono istituzioni o intermediari per interrompere o negare il servizio. Non importa quale sia il tuo background o da quale paese vieni, le app DeFi non fanno discriminazioni.

Questo è uno degli aspetti più sottovalutati dei prodotti DeFi.

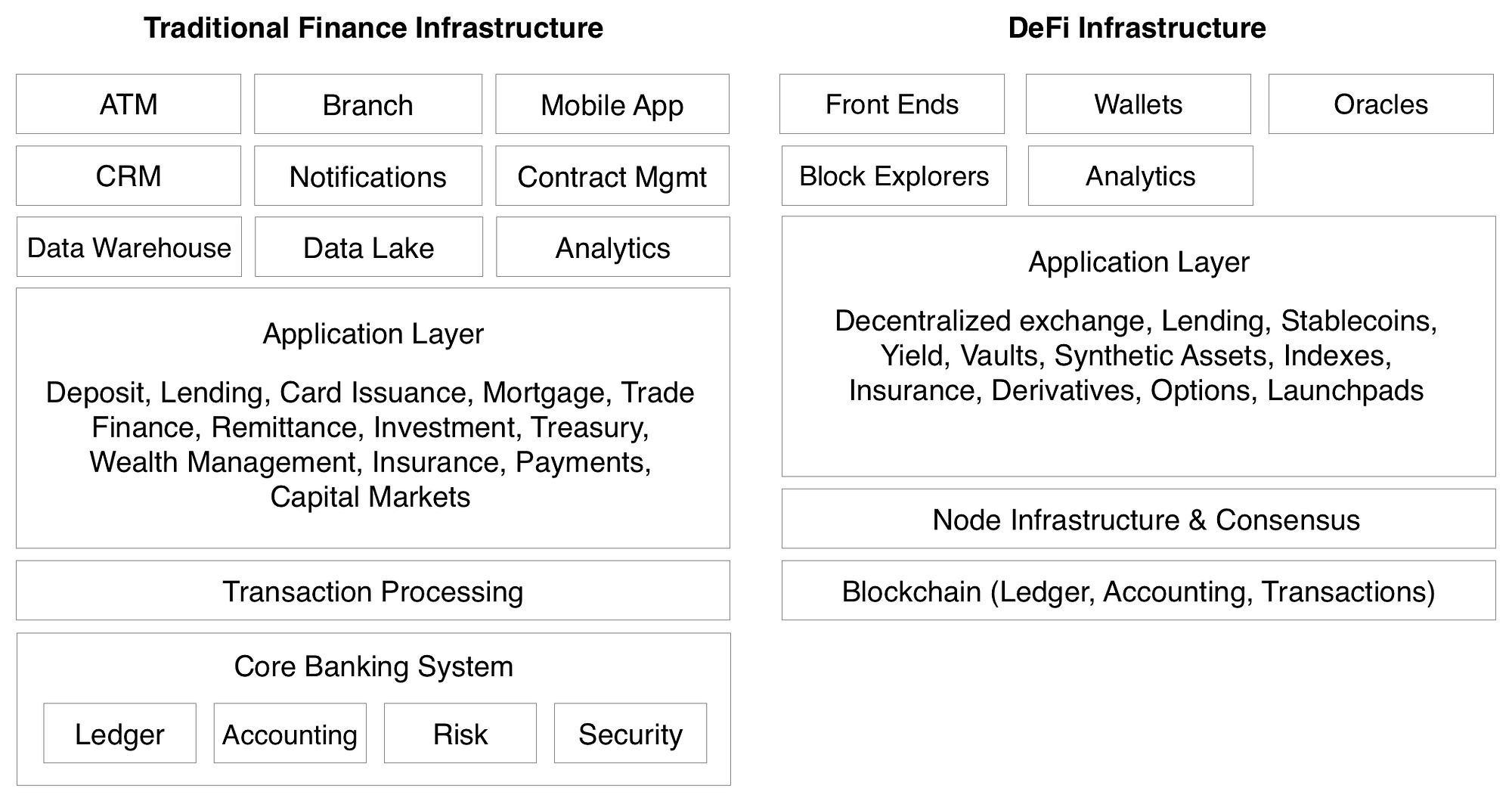

Traditional Fintech Architectures vs. DeFi Architecture

Ecco un diagramma più architettonico sulle principali differenze tecniche tra un'app fintech tradizionale e un'app DeFi (semplificata per brevità):

Here is a more direct comparison chart on some of the key differences between centralized and decentralized financial applications:

DeFi Infrastructure — Market Map

Below is a market map of two different DeFi ecosystems, one built on the Solana ecosystem and the other built on the Ethereum ecosystem.

The reason why I am picking these two ecosystems to focus on is to show the breadth of DeFi apps being built across two different underlying protocols. I also believe Solana is the most interesting new layer one protocol because of its high transaction throughput (50K+ transactions per second), sub second latency & transaction confirmation times, and fast growing ecosystem of developers building DeFi apps on top of the Solana protocol.

While similar in structure, each underlying protocol has its own ecosystem built on top which is largely independent of the other. Below are some of the further explanations of each layer and the tradeoffs between them.

Base Layer (Layer One)

The base layer is the blockchain in which the core ledger itself sits. Ethereum is the most dominant layer one today, and Solana is the most promising new entrant with faster transaction speeds, more throughput, and cheaper transactions.

Node Infrastructure

A never ending amount of data needs to be queried about the underlying ledger (retrieving blocks, finding transactions, syncing data, writing transactions, etc). In the Ethereum ecosystem, a whole industry sprung up to solve this need (Infura, Alchemy, etc.).

Contrast this with Solana where the underlying ledger is fast enough and in sync enough that teams can just query Solana’s RPC nodes directly (this might not last forever though).

Livello due

On Ethereum, there are various layer two solutions primarily used for scaling since Etheruem itself cannot handle all of the transactions on itself. Two of the promising scaling solutions include Matic, Optimism, among others.

On Solana, since there is only one layer to build upon (no layer 2 scaling solution needed) there are no specialized integrations needed and no mismatches with the underlying ledger which is processing settlement.

Order Book Aggregation

Unique to Solana, there is an additional layer occupied by a DeFi project named Siero which provides a CLOB (Central limit order book) that is used by all of the DeFi projects built on top.

When new DeFi projects are built on top of Solana (DEX, AMM, Options, etc.), they can pull orders from Serum and push orders back into Serum, greatly reducing the cold start challenge most new financial applications face.

The best way to think about it is to think of it as “networked liquidity” and an “order management” system which is used by the majority of projects within the Solana ecosystem.

One of the more innovative examples of combining a CLOB (Serum) and an AMM is Raydium (very similar to Uniswap v3). The combining of these systems allows for passive LPs with active market making using Serum.

DeFi Toolset

There are a set of common tools needed to operate most of these DeFi apps, either from the perspective of developers or end users. These services don’t have direct traditional finance analogies but they include:

- Portafogli — The main interface people use to store assets & interface with DeFi apps.

- Oracoli — On-chain data feeds DeFi apps use to reference prices and execute transactions against (example: liquidations).

- Block Explorers & Analytics — Tools like Block Explorers were created to allow people to query the blockchain ledger itself directly. These are used most often when verifying transactions.

- Stablecoins — The two main assets used in DeFi ecosystems include the underlying native protocol token (ETH or SOL) and ideally on-chain stablecoins (USDC, Dai, or Pai).

- Front-Ends — A new emerging layer which creates easy to use front-end applications to interact with multiple DeFi projects at once, or to simplify transactions. This includes both Zapper.fi within the Ethereum Ecosystem or Step Finance within the Solana ecosystem.

App DeFi

The DeFi apps themselves are composed of all of the core financial applications which can be used directly, or embedded into other various apps within the crypto ecosystem.

Potential Missing Pieces of DeFi Infrastructure

When comparing and contrasting DeFi infrastructure with traditional financial infrastructure, there were a few pieces that don’t exist yet in the decentralized world that could be interesting to explore.

A few to highlight below:

- Applicazioni consumer — In the traditional financial world, consumers typically act with consumer apps (ex. Robinhood, Chime, Transferwise) not the underlying protocols themselves. The front-ends of the DeFi space could be greatly improved and intermediate much more of the total consumer experience. In general, the UI/UX of most DeFi apps are still very difficult to use from a consumer perspective.

- CRM — The DeFi space doesn’t really have a concept of customer relationship management nor typically collects any amount of consumer data. While great from a privacy perspective, there is great value in understanding the customer better.

- Notifiche — Notifications or alerts don’t really exist at all in the DeFi space at all. On a more broader level there aren’t any great methods to communicate with users either.

- Analisi del prodotto — There are tools to measure blockchain activity, but not to measure engagement within DeFi applications.

- Sicurezza - DeFi products do typically conduct security audits; however, none of the security audits guarantee the most common protections consumers are accustomed to in the traditional financial world. On top of this, the demand for security auditors outstrips the supply, so it’s a big bottleneck.

- Transaction Rollbacks — In traditional finance, if you make a mistake, a financial institution can initiate a rollback of the transaction. This does not yet exist in DeFi.

- Custodia — Right now, most DeFi projects need to be interacted with from an individual wallet perspective. None of the custodians allow you to interact with DeFi apps.

- Piattaforme per sviluppatori — Most of the developers in the crypto space are building right on top of the layer one protocol itself. There are no concepts of developer platforms or middleware just yet.

- Embeddable Wallets — Wallets are seen as these external services, there aren’t any offerings of white-label wallets to embed these directly into the DeFi apps themselves. There are several initiatives such as Torus, but these are still in its infancy.

- Identità — One of the biggest complaints from the traditional finance world about DeFi is the pseudonymity of users. Ideally there needs to be a way to keep out the bad actors while persevering consumer privacy.

Future of Financial Applications

After meeting hundreds of founders and seeing progress teams are making, one thing is very clear — the pace of innovation in DeFi is 10x faster vs. that of traditional fintech apps.

In traditional finance:

- The underlying ledgers are not open source nor developer friendly.

- There are a whole host of “banking as a service” applications just to wrap underlying partner banks in developer friendly platforms.

- Fintech apps are very challenging regulatory wise and typically take years of development before releasing a single product.

Contrast that to DeFi where:

- Everything is open source including the ledger itself.

- All of the transactions are public.

- Everything is built from the perspective of developers building applications on top of protocols.

- New DeFi apps are built and released in weeks, not years.

We at Race Capital believe that DeFi developers will forever change how the finance world works. We are incredibly bullish about the DeFi infrastructure stack and community.

If you are building the horizontal infrastructure layers of the new open source financial stack including: trading, lending, borrowing, and/or any horizontal tools all new DeFi projects will rely upon in the future, we want to chat with you. Send me a message > chris@race.capital

Grazie!

A big thank you to Bartosz Lipinski, Kas Vardhanabhuti, George Harrap, Dylan Macalinao, Anmol Singh, Edith Yeung, and Kim McCann for helping to review and provide feedback on this post.

Disclaimer: I’m a proud seed investor in Laboratori Solana.