Polaris Ventures, a charity created by former FTX and Alameda chief of staff Ruairi Donnelly, reportedly wants to access roughly $150 million earned from insider trading on the bankrupt exchange’s tokens.

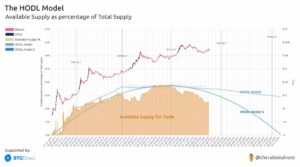

According to a Feb. 14 Wall Street Journal report, Donnelly ricevuto roughly $562,000 in salary during his time at FTX, which was converted into FTX Tokens (FTT) at a rate not yet available to the public — $0.05. The former executive reportedly ‘donated’ the tokens to Polaris Ventures, selling them in 2019 and 2020 after public trading opened at price of $1 and making millions.

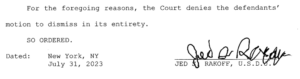

FTX filed for Chapter 11 bankruptcy in November 2022, at which time many wallets and funds tied to the exchange were seized by authorities or otherwise frozen for legal proceedings. Donnelly reportedly seeks to cash out the $150 million amid public scrutiny on FTX and Alameda and their former CEOs.

Donnely’s legal team reportedly said the charity’s FTT tokens “were not FTX’s funds” and seemingly not subject to claims from other parties. Debtors for the exchange said on Dec. 19 they would “make arrangements for the return” of funds donated to charities or political campaigns and suggested legal action to obtain payments with interest should any group refuse.

Condivido il comunicato stampa dei debitori FTX appena emesso: https://t.co/NdXQlUTM6r

— FTX (@FTX_ufficiale) 5 Febbraio 2023

Correlato: Chi ha restituito donazioni o contributi da FTX tra i rischi reputazionali dell'azienda?

Amid FTX’s bankruptcy proceedings in the United States, some regulators have announced investigations into charitable organizations. The Charity Commission for England and Wales said in January that it had ha avviato un'indagine into Effective Ventures due to FTX being a “significant funder” of the group.

- Distribuzione di contenuti basati su SEO e PR. Ricevi amplificazione oggi.

- Platoblockchain. Web3 Metaverse Intelligence. Conoscenza amplificata. Accedi qui.

- Fonte: https://cointelegraph.com/news/charity-tied-to-former-ftx-exec-made-150m-from-insider-trading-report

- 000

- 11

- 2019

- 2020

- 2022

- a

- accesso

- Action

- Dopo shavasana, sedersi in silenzio; saluti;

- Alameda

- Tra

- ed

- ha annunciato

- Autorità

- disponibile

- fallito

- Fallimento

- procedure fallimentari

- essendo

- Contanti

- Incassare

- CEO

- Capitolo

- Capitolo 11

- Capitolo 11 Fallimento

- Charities

- Beneficenza

- capo

- Cointelegraph

- commissione

- contributi

- convertito

- creato

- debitori

- Donazioni

- durante

- guadagnato

- Efficace

- Inghilterra

- exchange

- esecutivo

- Ex

- da

- congelati

- FTT

- Token FTT

- FTX

- Token FTX

- fondi

- Gruppo

- HTTPS

- in

- Insider

- insider trading

- interesse

- Indagini

- Rilasciato

- IT

- Gennaio

- rivista

- Legale

- Azione legale

- azioni legali

- squadra legale

- fatto

- Fare

- molti

- milione

- milioni

- Novembre

- ottenere

- ha aperto

- organizzazioni

- Altro

- altrimenti

- parti

- pagamenti

- Platone

- Platone Data Intelligence

- PlatoneDati

- politico

- stampa

- Comunicati Stampa

- prezzo

- procedimento

- la percezione

- tasso

- Regolatori

- rilasciare

- rapporto

- rischi

- approssimativamente

- Suddetto

- stipendio

- cerca

- sequestrati

- Vendita

- dovrebbero

- alcuni

- STAFF

- stati

- strada

- soggetto

- team

- I

- loro

- Legato

- tempo

- a

- Tokens

- Trading

- Unito

- Stati Uniti

- Ventures

- Wall Street

- Wall Street Journal

- Portafogli

- quale

- sarebbe

- WSJ

- zefiro