- Eurozone to release inflation data on Friday

- EUR/USD dips as Germany’s inflation rate falls

L’inflazione tedesca scende al 2.5%

The euro is in negative territory on Thursday. In the North American session, EUR/USD is trading at 1.0800, down 0.35%.

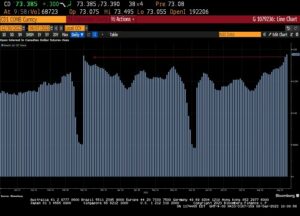

Germany’s inflation rate dropped to 2.5% y/y in February, down from 2.9% in January and lower than the market estimate of 2.6%. This was the lowest level since June 2021, as inflation continues to move closer to the European Central Bank’s target of 2%.

Food and energy prices were the main drivers of the decline, while services inflation was unchanged at 3.4%. Monthly, inflation rose 0.4%, up from 0.2% in February and shy of the market estimate of 0.5%. Core CPI remained steady at 3.4%, its lowest level since July 2022.

The eurozone releases February on Friday, which is also expected to decline. Headline CPI is expected to ease to 2.5%, down from 2.8% in January. Core CPI is projected to decline to 2.9%, compared to 3.3% in January.

If the market estimates are on target, the drop in inflation will put pressure on the ECB to consider lowering interest rates as inflation gets closer to the 2% target. ECB policy makers have been extremely cautious about easing monetary policy too quickly due to fears of inflation resurging, but are well aware that the recipe of high interest rates and a weak eurozone economy could lead to a recession.

In the US, market pricing for Fed rate cuts has been slashed and is currently in line with the Fed projection of three rate cuts this year. In December, the markets priced in as many as six rate cuts but a surprisingly robust US economy and a Fed pushback against rate expectations has pushed a March rate cut off the table, with June or September the likely dates of an initial rate cut.

Tecnico EUR / USD

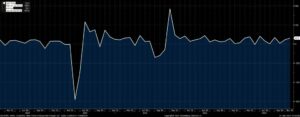

- EUR/USD is testing support at 1.0823 . Below, there is support at 1.0760

- C'è resistenza a 1.0885 e 1.0948

Il contenuto è solo a scopo informativo generale. Non è un consiglio di investimento o una soluzione per acquistare o vendere titoli. Le opinioni sono gli autori; non necessariamente quello di OANDA Business Information & Services, Inc. o di una delle sue affiliate, consociate, funzionari o direttori. Se desideri riprodurre o ridistribuire uno qualsiasi dei contenuti trovati su MarketPulse, un pluripremiato servizio di analisi di forex, materie prime e indici globali e sito di notizie prodotto da OANDA Business Information & Services, Inc., accedi al feed RSS o contattaci all'indirizzo info@marketpulse.com. Visita https://www.marketpulse.com/ per saperne di più sul ritmo dei mercati globali. © 2023 OANDA Business Information & Services Inc.

- Distribuzione di contenuti basati su SEO e PR. Ricevi amplificazione oggi.

- PlatoData.Network Generativo verticale Ai. Potenzia te stesso. Accedi qui.

- PlatoAiStream. Intelligenza Web3. Conoscenza amplificata. Accedi qui.

- PlatoneESG. Carbonio, Tecnologia pulita, Energia, Ambiente, Solare, Gestione dei rifiuti. Accedi qui.

- Platone Salute. Intelligence sulle biotecnologie e sulle sperimentazioni cliniche. Accedi qui.

- Fonte: https://www.marketpulse.com/news-events/central-banks/eur-usd-dips-as-german-inflation-declines-2/kfisher

- :ha

- :È

- :non

- $ SU

- 1

- 2%

- 2012

- 2021

- 2022

- 2023

- 35%

- 400

- 7

- a

- Chi siamo

- sopra

- accesso

- consigli

- affiliati

- contro

- Alpha

- anche

- americano

- an

- .

- analista

- ed

- in qualsiasi

- SONO

- AS

- At

- autore

- gli autori

- premio

- consapevole

- basato

- battere

- stato

- sotto

- Scatola

- ampio

- affari

- ma

- Acquistare

- by

- cauto

- centrale

- più vicino

- COM

- commento

- Materie prime

- rispetto

- Prendere in considerazione

- contatti

- contenuto

- continua

- collaboratore

- Nucleo

- potuto

- Copertine

- CPI

- Attualmente

- taglio

- tagli

- alle lezioni

- dati

- Date

- Dicembre

- Rifiuta

- Cali

- Amministrazione

- giù

- driver

- Cadere

- caduto

- dovuto

- alleviare

- facilitando

- BCE

- economia

- energia

- prezzi dell'energia

- Titoli di capitale

- stima

- stime

- EUR / USD

- Euro

- europeo

- Eurozona

- le aspettative

- previsto

- esperto

- estremamente

- cadute

- paure

- Febbraio

- Federale

- finanziario

- Financial Market

- Trovare

- Focus

- Nel

- forex

- essere trovato

- Venerdì

- da

- fondamentale

- Generale

- Tedesco

- Inflazione tedesca

- si

- globali

- mercati globali

- Avere

- titolo

- Alta

- vivamente

- il suo

- HTTPS

- if

- in

- Inc.

- Compreso

- Indici

- inflazione

- tasso di inflazione

- informazioni

- inizialmente

- interesse

- Tassi di interesse

- investire

- investimento

- Israele

- IT

- SUO

- Gennaio

- jpg

- Luglio

- giugno

- kenneth

- portare

- Livello

- piace

- probabile

- linea

- inferiore

- Abbattimento dei Costi

- minore

- livello più basso

- Principale

- maggiore

- Makers

- molti

- Marzo

- Rappresentanza

- MarketPulse

- Mercati

- max-width

- Monetario

- Politica monetaria

- mensile

- Scopri di più

- cambiano

- necessariamente

- negativo.

- territorio negativo

- notizie

- Nord

- of

- MENO

- ufficiali

- on

- online

- esclusivamente

- Opinioni

- or

- su

- Platone

- Platone Data Intelligence

- PlatoneDati

- per favore

- politica

- Responsabili politici

- Post

- pressione

- Prezzi

- prezzi

- Prodotto

- proiettato

- Proiezione

- pubblicazioni

- pubblicato

- fini

- spinto

- metti

- rapidamente

- gamma

- tasso

- recessione

- ricetta

- rilasciare

- Uscite

- è rimasta

- resistenza all'usura

- robusto

- ROSE

- rss

- Valori

- cerca

- Seeking Alpha

- venda

- Settembre

- servizio

- Servizi

- Sessione

- alcuni

- compartecipazione

- timido

- da

- site

- SIX

- soluzione

- costante

- supporto

- sorprendentemente

- tavolo

- Target

- territorio

- Testing

- di

- che

- I

- la Fed

- Là.

- questo

- quest'anno

- tre

- giovedì

- a

- pure

- Trading

- us

- Economia americana

- v1

- Visita

- Prima

- debole

- WELL

- sono stati

- quale

- while

- volere

- vincente

- con

- Lavora

- sarebbe

- anno

- Tu

- zefiro