- US core inflation and personal spending softens

- Bond yields pare earlier losses; 10-year yield now only down 1bps to 4.565%

- US near-term inflation expectation drop to lowest levels since 2021

After a disastrous week, month, and quarter as the bond market selloff would not relent, US dollar long positions got closed out after further evidence supported the case that the Fed might be done hiking rates. The latest round of economic data that showed spending and core inflation cooled. The final reading of the University of Michigan confirmed that pricing pressures are easing. The near-term inflation gauge showed prices are expected to rise 3.2% over the next year, while long-term expectations edged higher to 2.8%. Wall Street is welcoming all data that prevents the Fed from overtightening and especially if it allows traders to hold onto soft-landing hopes.

Fed’s favorite inflation gauge

The inflation news was rather positive, Core PCE posted the smallest rise since November 2020. When you combine today’s PCE and consumer data with yesterday’s downward revised personal consumption numbers, one should expect that economic activity will slowdown quicker in the fourth quarter.

Cooling inflation is sending both the dollar and Treasury yields down and providing a less compelling case for the Fed hawks. Given the rising risk that we could see a one- or two-week government shutdown, there is a growing chance that the data-dependent Fed won’t have enough data to seriously consider hiking at the November 1st 会議。

迫るシャットダウン

Congress has less than three days to avoid a government shutdown and if that goes into the middle of next week, traders might not get the latest NFP report. A Biden administration official noted that the Bureau of Labor Statistics could cease all program operations, which is different from what happened with the last shutdown that started December 2018.

If the shutdown lasts beyond next week, the September inflation report could also be in jeopardy. A quick (over the next few days) resolution is becoming less likely and that might make the next Fed meeting an easy hold. Fed swaps are pricing only a 16.6% chance the Fed will raise rates at the November meeting, with traders becoming less convinced that they will move at the December 13th 会議。

The Republicans however might not want to drag this shutdown out as it could support a delayed boost for Q1, which is the start of the pivotal 2024 election cycle. A shutdown of 1-2 weeks could be the way this plays out, but anything longer would be troubling on so many levels. The short-term hit to the economy becomes troubling if the shutdown enters a second week. The longer the shutdown last, the more of a hit the Republicans appear poised to take.

UAW

Negotiations between the United Auto Workers (UAW) union and Big Three automakers are slowly making progress. Today, the UAW announced they will expand the strike against Ford and GM. Yesterday, the UAW said they are targeting a 30% pay raise, which is down from the 46% they were asking for in early September. Automakers have raised their offer to 20% but were not offering much on retirement benefits. The longer this drags, the more both sides lose, so a deal should be reached in the next week or two.

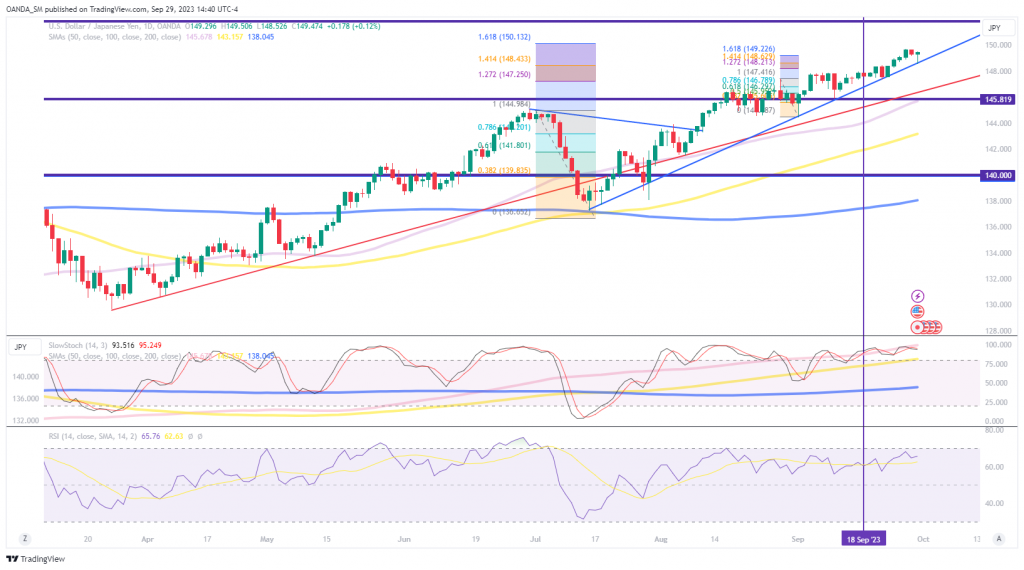

USD / JPY日足チャート

The dollar-yen currency pair didn’t see substantial weakness despite a return to risk aversion at the end of the US session. It looks like this will be a choppy trade going forward as the last key higher lows was breached. It seems 150 will happen in a matter of time, but what everyone wants to know will that be enough to trigger action by Japanese authorities.

コンテンツは一般的な情報提供のみを目的としています。 投資アドバイスや証券の売買の解決策ではありません。 意見は著者です。 必ずしも OANDA Business Information & Services, Inc. またはその関連会社、子会社、役員、または取締役のものではありません。 OANDA Business Information & Services, Inc. が提供する、受賞歴のある外国為替、コモディティ、グローバル インデックスの分析およびニュース サイト サービスである MarketPulse で見つかったコンテンツを複製または再配布したい場合は、RSS フィードにアクセスするか、次のアドレスまでご連絡ください。 info@marketpulse.com。 訪問 https://www.marketpulse.com/ 世界市場の動向についてもっと知るために。 © 2023 OANDA Business Information & Services Inc.

- SEO を活用したコンテンツと PR 配信。 今日増幅されます。

- PlatoData.Network 垂直生成 Ai。 自分自身に力を与えましょう。 こちらからアクセスしてください。

- プラトアイストリーム。 Web3 インテリジェンス。 知識増幅。 こちらからアクセスしてください。

- プラトンESG。 カーボン、 クリーンテック、 エネルギー、 環境、 太陽、 廃棄物管理。 こちらからアクセスしてください。

- プラトンヘルス。 バイオテクノロジーと臨床試験のインテリジェンス。 こちらからアクセスしてください。

- 情報源: https://www.marketpulse.com/newsfeed/usd-jpy-cooling-inflation-allows-dollar-rally-to-pause/emoya

- :持っている

- :は

- :not

- :どこ

- 150

- 16

- 2%

- 20

- 2018

- 2020

- 2023

- 2024

- 7

- 700

- a

- 私たちについて

- 上記の.

- アクセス

- 越えて

- Action

- アクティビティ

- 管理

- 利点

- アドバイス

- アフィリエイト

- 後

- に対して

- すべて

- ことができます

- また

- an

- 分析

- アナリスト

- および

- 発表の

- どれか

- 何でも

- 現れる

- です

- AS

- 質問

- 資産

- 関連する

- At

- 著者

- 当局

- 著者

- オート

- 自動車メーカー

- 嫌悪

- 避ける

- 賞

- 銀行

- ベース

- BE

- になる

- になる

- 以下

- 利点

- の間に

- 越えて

- 二人

- バイデン政権

- ビッグ

- ブルームバーグ

- 債券

- 債券市場

- ブースト

- 両言語で

- 両側

- ボックス

- 証券会社

- オフィス

- 労働統計局

- ビジネス

- 焙煎が極度に未発達や過発達のコーヒーにて、クロロゲン酸の味わいへの影響は強くなり、金属を思わせる味わいと乾いたマウスフィールを感じさせます。

- 購入

- by

- キャリア

- 場合

- やめる

- 中央の

- 中央銀行

- 中央銀行の政策

- チャンス

- クラス

- 閉まっている

- CNBC

- COM

- 組み合わせる

- 商品

- 説得力のある

- 確認済み

- 検討

- consumer

- 消費者データ

- 消費

- 接触

- コンテンツ

- 確信

- 基本

- コアインフレ

- 企業

- 企業ニュース

- 可能性

- コース

- カバレッジ

- 暗号通貨

- 通貨

- サイクル

- daily

- データ

- 日

- 取引

- 12月

- 遅延

- 部署

- にもかかわらず

- 異なります

- 取締役

- 悲惨な

- ドル

- 行われ

- ダウン

- 下向きの

- Drop

- 前

- 早い

- イージング

- 簡単に

- 経済

- Economics

- 経済

- ed

- 選挙

- end

- 十分な

- 入ります

- 特に

- イベント

- 誰も

- 証拠

- 詳細

- 期待する

- 期待

- 期待

- 予想される

- 体験

- 専門知識

- お気に入り

- FRBは

- 供給会議

- 少数の

- ファイナル

- ファイナンス

- ファイナンシャル

- もう完成させ、ワークスペースに掲示しましたか?

- 固定の

- 固定収入

- フォーブス

- フォード

- 外国為替

- 外国為替取引

- フォワード

- 発見

- 第4

- キツネ

- フォックスビジネス

- から

- さらに

- FX

- ゲージ

- 地政学的

- 取得する

- 与えられた

- グローバル

- グローバル市場

- GM

- ゴエス

- 行く

- だ

- 政府・公共機関

- 成長

- ゲスト

- 起こる

- が起こった

- 持ってる

- he

- より高い

- 彼の

- ヒット

- 保持している

- 期待している

- しかしながら

- HTTPS

- if

- in

- (株)

- 含めて

- 所得

- 索引

- インフレ

- 情報

- に

- 投資

- IT

- ITS

- 日本語

- ジャーナル

- JPG

- キー

- 知っている

- 労働

- 姓

- 最新の

- 主要な

- less

- レベル

- ある

- ような

- 可能性が高い

- ライブ

- 長い

- 長期的

- より長いです

- LOOKS

- 失う

- 損失

- 最低

- 安値

- 主要な

- make

- 作成

- 多くの

- 市場

- 市場分析

- 市場の反応

- MarketPulse

- マーケット

- マーケットウォッチ

- 問題

- 最大幅

- ご相談

- ミシガン州

- 真ん中

- かもしれない

- 月

- 他には?

- 最も

- MSN

- ずっと

- 必ずしも

- ネットワーク

- 新作

- ニューヨーク

- ニューヨーク·タイムズ紙

- ニュース

- 次の

- 来週

- NFP

- 注意

- 11月

- 今

- 番号

- of

- 提供

- 提供すること

- 役員

- 公式

- on

- ONE

- の

- 〜に

- 業務執行統括

- 意見

- or

- でる

- が

- ペア

- 特定の

- 一時停止

- 支払う

- PCE

- 個人的な

- 極めて重要な

- プラトン

- プラトンデータインテリジェンス

- プラトデータ

- 演劇

- お願いします

- 態勢を整えた

- ポリシー

- ポジション

- 正の

- 掲示

- 圧力

- を防止

- 価格、またオプションについて

- 価格設定

- 生産された

- 作成

- 演奏曲目

- 進捗

- 提供

- 提供

- 出版物

- 目的

- Q1

- 四半期

- クイック

- より速い

- 上げる

- 隆起した

- ラリー

- 範囲

- 価格表

- むしろ

- 達した

- 反応

- リーディング

- 最近

- レギュラー

- 定期的に

- 名高い

- レポート

- 共和党

- 研究

- 解像度

- 退職

- return

- ロイター通信社

- 上昇

- 上昇

- リスク

- 円形

- RSS

- ラトガース大学

- 前記

- 二番

- 有価証券

- と思われる

- 売る

- 売り払う

- 送信

- シニア

- 9月

- 真剣に

- サービス

- サービス

- セッション

- いくつかの

- シェアリング

- 短期

- すべき

- 示されました

- shutdown

- 側面

- から

- ウェブサイト

- 空

- 速度を落とす

- ゆっくり

- So

- ソフトランディング

- 溶液

- ソリューション

- 一部

- 支出

- start

- 開始

- 統計

- ストック

- ストリート

- ストライキ

- かなりの

- そのような

- サポート

- サポート

- スワップ

- 取る

- ターゲット

- チーム

- テレビ

- より

- それ

- 連邦機関

- ニューヨークタイムズ

- アプリ環境に合わせて

- そこ。

- 彼ら

- この

- 三

- 時間

- <font style="vertical-align: inherit;">回数</font>

- 〜へ

- 今日

- 今日の

- トレード

- トレーダー

- トレーディング

- 財務省

- 財務省利回り

- トリガー

- 困った

- 信頼されている

- tv

- 2

- 組合

- ユナイテッド

- 大学

- us

- 米ドル

- USD / JPY

- v1

- ビュー

- 訪問

- 壁

- ウォール街

- ウォールストリートジャーナル

- 欲しいです

- 望んでいる

- ました

- 仕方..

- we

- 弱点

- 週間

- ウィークス

- 歓迎する

- した

- この試験は

- いつ

- which

- while

- ワイド

- 広い範囲

- 意志

- 勝利

- 働いていました

- 労働者

- 世界の

- でしょう

- 年

- 昨日

- 産出

- 収量

- ヨーク

- You

- ゼファーネット