The COVER devs recently abandoned the protocol which resulted in halting support and the token crashing 16% moments after so let’s read more in our latest altcoin news today.

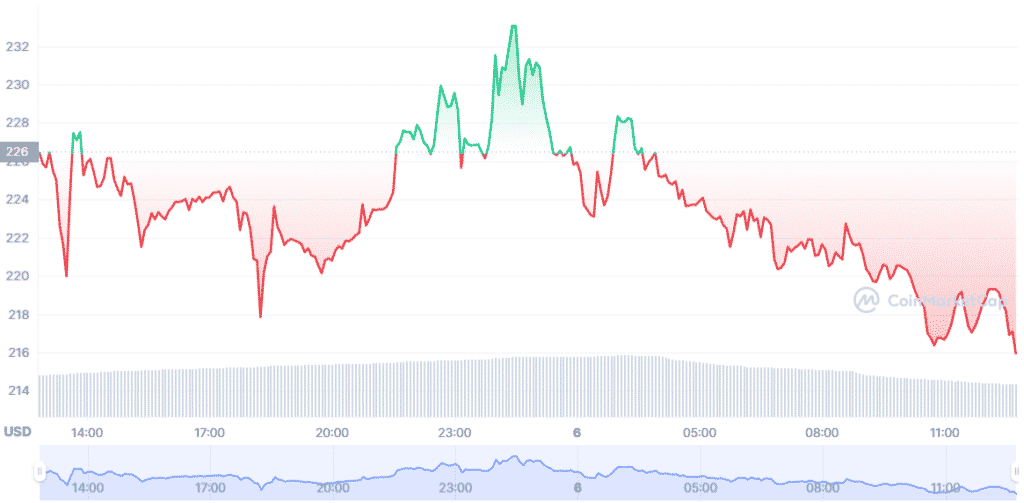

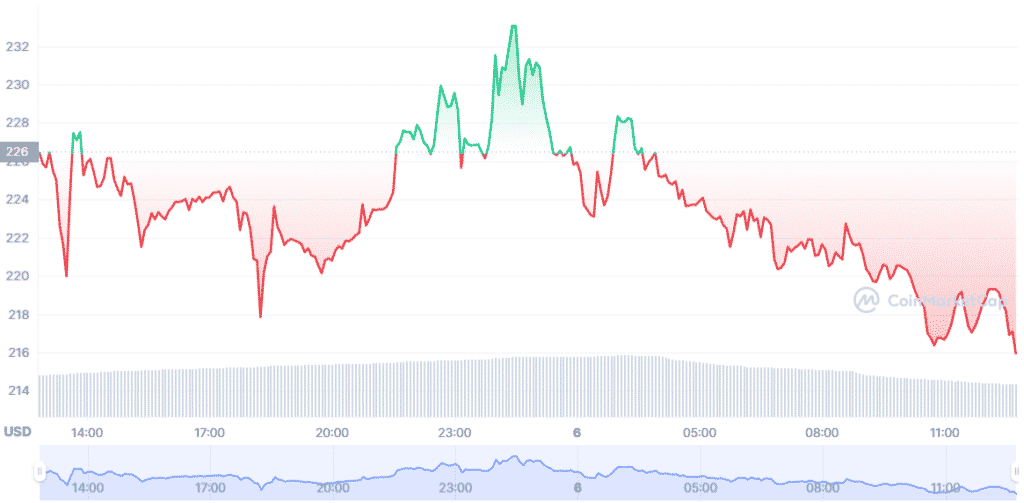

Following the announcement by the core contributor DeFi Ted, the COVER price crashed 16% as the trading volumes soared. Cover Protocol which is DeFi Insurance crypto minted on ETH will no longer receive support and development since the engineers abandoned the project suddenly. The insurance coin’s contributor Defi Ted announced the project will be closing down on Sunday morning. COVER had a market cap of $21 million at the time he made the announcement and in a few hours, the price dropped 16% from $269 to the low of $220.

The 24-hour trading volumes surged from below $4 million to $20 million as COVER holders scrambled to getaway. Defi Ted advised coin holders to withdraw funds from both protocols as they were not able to maintain the UI. At the time of publication, COVER traded against USDT, BUSD, ETH on OKEx, CoinEX, and Gate-io. The DeFi insurance project’s leader wrote:

“The decision to do this did not come easy and is a final decision the remaining team made after reviewing the path forward, after the core developers suddenly left the projects. After discussing with the remaining team and finalizing plans moving forward it made sense that the remaining treasury funds be evenly dispersed to token holders.”

DeFi Ted added that he was disappointed to learn that the Cover devs team was leaving especially given the time spent together building the protocols and following the vision they had. Ironically, the vision they had was DeFi insurance coins which will cover the investors from losses in projects that end in calamity as Cover Protocol did. The Cover Protocol allowed users to stake the coins to put them up as collateral and receive smart contract tokens that will execute claims to insure the holders against losses from hacks, exploits, and rug pulls in ETH Defi projects gone away. The Cover token crashed in March from a highly publicized split with Andre Cronje’s Yearn Finance.

ADVERTISEMENT

The YFI platform is designed for developers to experiment with creating autonomous yield maximizing apps that disburse the users’ funds to the highest yield generating projects in DeFi. After partnering with Cover Protocol, the two projects split up without disclosing why. Many speculated it could have been prompted by the DEC 2020 infinite mining hack which crashed the prices by 80%.

ADVERTISEMENT

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at

Source: https://www.dcforecasts.com/altcoin-news/cover-devs-abandoned-the-protocol-token-crashed-16/

- 2020

- 9

- Altcoin

- announced

- Announcement

- apps

- autonomous

- Building

- BUSD

- claims

- Coin

- CoinMarketCap

- Coins

- contract

- Creating

- crypto

- Crypto News

- DeFi

- developers

- Development

- Devs

- DID

- dropped

- Editorial

- Engineers

- ETH

- experiment

- finance

- Forward

- Free

- funds

- hack

- hacks

- HTTPS

- insurance

- Investors

- IT

- latest

- Lawyers

- LEARN

- March

- Market

- Market Cap

- million

- Mining

- news

- offer

- OKEx

- platform

- policies

- price

- project

- projects

- sense

- set

- smart

- smart contract

- So

- split

- stake

- standards

- support

- time

- token

- Tokens

- Trading

- ui

- us

- USDT

- users

- vision

- Website

- Yield